E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Icahn, Corvex Mulling Bid to Further Shake Up Permian Pure-Play Energen

Permian Basin pure-play Energy Corp. is facing another battle for control as hedge fund Corvex Management, long critical of management and now holding two board seats, has teamed with activist investor Carl Icahn to get involved in a strategic review underway.

In a Securities and Exchange Commission (SEC) Form 13D filing on Monday, Corvex chief Keith Meister, who worked for Icahn for seven years, said he is working with Icahn entities to potentially buy out the Birmingham, AL-based independent.

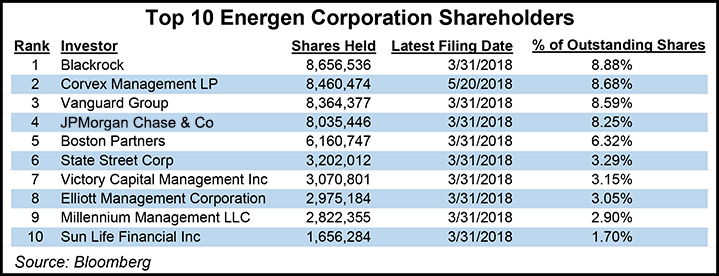

Corvex already owns 8.5 million shares, or around 8.7% of the company. In early March, Energen management agreed, following Meister’s prodding, to undertake a strategic review and add two Corvex members to the board.

“On March 7, 2018, the issuer indicated via press release that its board would promptly conduct an in-depth review, assisted by its financial advisers (J.P. Morgan and Tudor, Pickering, Holt & Co.), of the issuer’s business plan, competitive positioning and potential strategic alternatives,” the SEC filing said.

“The reporting persons believe the issuer’s securities are undervalued and may, subject to due diligence, have interest in joining with other parties to acquire the issuer as part of the strategic initiatives process or otherwise.”

Corvex intends to review its investments “on a continuing basis,” and may “take such actions with respect to their investments in the issuer as they deep appropriate,” which could include direct discussions regarding more changes to the board or buying more shares to effect changes.

Corvex also has sold two million shares to Icahn entities for $64.84/share, and granted an option to buy another two million shares until Nov. 18 for $67.37 each. Corvex and Icahn entities now collectively own about 10% of Energen’s outstanding shares.

Energen works exclusively in West Texas and southeastern New Mexico. During the first quarter, total production was 92.9 million boe/d, which surpassed the guidance midpoint by 4% on better-than-expected well performance.

Reserves at the end of March included an estimated 577,489 MMcf of natural gas, 257 million bbl of oil and 90.78 million bbl of natural gas liquids. The company during 1Q2018 produced 33,528 MMcf of gas, 16.95 million bbl of oil and 5.26 million bbl of liquids.

Most of Energen’s wells are drilled using its proprietary Generation 3 technology, allowing the operator to drill in multi-zone patterns and complete wells in batches at original reservoir pressure.

At mid-year 2017, Energen had identified 4,116 net engineered, unrisked, potential drilling locations in the Delaware and Midland sub-basins of the Permian with an estimated 2.5 billion boe net undeveloped resource potential.

Energen has set a capital spending budget this year of $1.1-1.3 billion. Drilling and development capital is expected to increase to $1.6-1.8 billion in 2020, assuming it continues a 50/50 capital allocation between the Midland and Delaware formations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |