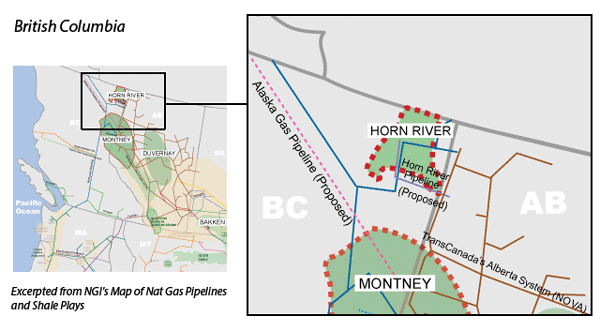

View more information about the North American Pipeline Map

Background Information about the Horn River Basin

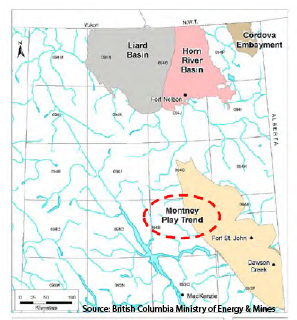

There doesn’t seem to be much question about the potential for natural gas out of the Horn River Basin (HRB), Liard Basin, and the Cordova Embayment in Northeast British Columbia (BC). The HRB alone may possess up to 650 Tcf of reserves, and one eye-opening estimate prepared by Sproule Associates in 2012 suggests these three formations may have combined resources between 809 and 2,222 Tcf. What is in question, however, is just how much these areas will be developed, and can it be done economically?

Our main focus in this article is the HRB, and we will refer to that almost exclusively hereafter, since that area is farthest along in its development among these three plays (although activity in the HRB itself is still in its infancy). However, many of the issues we raise below apply to all three areas.

First, a quick description of these three plays:

Horn River Basin

According to the BC Oil and Gas Commission (OGC), the HRB is an unconventional shale play with dry gas from mid-Devonian overpressured shales, including the organic rich Muskwa-Otter Park and Evie formations. The HRB is in the northeast corner of BC, hemmed in along the west by the Bovie Lake Fault Zone and to the east and south by the Devonian Carbonate Barrier Complex. On a stratigraphic scale, the Muskwa-Otter Park and Evie shales are overlain by the Fort Simpson shales, and underlain by the Keg River platform carbonates. In a report published in February 2015, the OGC said the HRB represents 25.7% (11.1 Tcf) of BC’s remaining recoverable raw gas reserves. The commission said production from the Muskwa-Otter Park and Evie formations totaled 200 Bcf in 2013, accounting for 12.7% of BC’s annual production.

The OGC said an atlas of the HRB was published in June 2014, and found that the reservoir measured 1,900-3,100 meters (6,234-10,171 feet) in depth and 140-280 meters (459-919 feet) in thickness. In a separate report in October 2015, the OGC said the HRB’s reporting area encompassed about 1.15 million hectares (4,440 square miles), of which 34,670 hectares (133.9 square miles) were being used for oil and gas activities.

In its February 2015 report, the OGC indicated that oil and gas drillers have been interested in the HRB since 2005, when they began deploying horizontal rigs and applying hydraulic fracturing (fracking) technology that had been successful in the Barnett Shale in Texas, which is considered an analogous shale play. But the HRB accounted for only 8% of total drilling activity in BC in 2013; the majority of drilling took place in the Montney Shale. Still, there were 376 wells (298 horizontal, 78 vertical) drilled in the HRB by 2013, according to OGC figures. Between 2012 and 2013, a typical horizontal well in the HRB had initial production of 5.6 MMcf/d. That rate declined 44% in the first year of production, and was projected to reach boundary dominated flow after more than four years, in part because of the reservoir’s ultra low permeability. The OGC said 26 unconventional wells were permitted in the HRB in 2013, and added that since April 2005, a total of 522 wells had been permitted there.

But industry activity in the HRB has tapered off since late 2012, when Encana Corp., Canada’s top natural gas producer, deferred plans to build its Cabin processing plant in the region (see page 12). More recently, Quicksilver Resources Inc., one of HRB’s top drilling rights owners, filed for bankruptcy protection in the U.S. in March 2015 (see Shale Daily, March 18, 2015); its Canadian assets were scheduled to be auctioned in December 2015.

Besides poor prices, the HRB suffers from natural disadvantages. The deposit is the most remote Canadian shale formation, in an uninhabited and all but roadless region along BC’s boundary with the Yukon and Northwest Territories. And the initial exploration flurry showed that the deposit is dry gas, lacking the liquid byproducts that kept drilling going elsewhere.

The last newsletter circulated by the Horn River Basin Producers Group (HRBPG), in early 2013, included a brief public explanation of why the region should lower expectations until further notice.

“While there has been significant attention drawn to activities in the HRB, including media announcements and development activity updates, it should be noted that current commercial viability has not yet been established for the area,” said the group. “While infrastructure needs are being constructed for parts of the basin, companies continue to look at ways to reduce overall costs in order to make this project more economically viable in the future given the state of gas prices over the near term.”

Canadian industry attention shifted to the Montney and Duvernay shale formations because both are within reach of established road and pipeline networks, and both yield high concentrations of liquid byproducts. The Montney straddles north-central BC and Alberta, with some of its richest zones lying along southern legs of the Alaska Highway in the well populated and served Dawson Creek-Fort St. John area. The Duvernay is accessible within an area of northwestern Alberta that is laced with pipelines, roads and other services developed over a long history of conventional gas drilling.

How the Horn River ranks in the Canadian industry scale of priorities shows in the current edition of an annual assessment by the National Energy Board (NEB): Short Term Canadian Natural Gas Deliverability 2015-17.

In the NEB’s mid-range case, with a mild price recovery emerging gradually, “Western Canada deliverability falls in 2016 before increasing in 2017 as gas-directed activity increases with a continued focus on higher productivity wells. Tight gas activity grows over the projection with 901 tight gas wells drilled in Western Canada in 2017 including 544 in the Montney tight gas play. The Duvernay Shale play continues to see most Canadian shale gas activity with 40 wells drilled in 2017, compared to five wells in the Horn River Basin; activity in this dry-gas resource could increase if additional markets emerge in Canada and the U.S., or if activity increases in preparation for LNG exports.”

Liard Basin

The Liard Basin is another unconventional shale gas play, located just to the west of the HRB. The two plays are separated by the Bovie fault zone, a major structural feature. According to the OGC, the Liard is comprised of a layer of sedimentary rocks more than five kilometers (16,404 feet) in thickness, which includes thick, organic shales within the Upper and Lower Devonian Besa River strata. In September 2015, the OGC said the Liard reporting area encompassed 934,304 hectares (3,607.4 square miles), of which 12,150 hectares (46.9 square miles) were being used for oil and gas activities. In a separate report in February 2015, the OGC said 11 unconventional wells were permitted in the Liard in 2013, with a total of 22 wells permitted since April 2005.

According to the OGC, oil and gas drillers began to explore the Liard in 2008. Preliminary estimated ultimate recovery (EUR) rates, booked in 2013, totaled 100,000 Bcf, based on production from four existing wells – two vertical and two horizontal. Three vertical and two horizontal test wells were drilled and stimulated in the Liard between 2009 and 2013, in an area previously without any deep test wells. Initial test results were 7 MMcf/d for a vertical well and 30 MMcf/d for a horizontal well, which the OGC called “very promising and among the best of any shale play in North America.” The commission, using a decline analysis, forecast an EUR of 8 Bcf/well for the vertical wells and 19 Bcf/well for the horizontal wells.

Cordova Embayment

The Cordova Embayment — another unconventional shale play that includes dry gas from the mid-Devonian Muskwa-Otter Park and Evie formations — is situated just to the east of the HRB and shares geologic characteristics. It covers approximately 2,700 square kilometers (1,042 square miles) and is bordered by the aforementioned Devonian Carbonate Barrier Complex. And like the HRB, it is where the Muskwa-Otter Park and Evie formations are overlain by the Fort Simpson shales, and underlain by the Keg River platform carbonates. According to the OGC, the Cordova hasn’t been explored as much as the HRB, possibly because it is thinner (70-120 meters) and a more normally pressured reservoir. But the OGC said the Cordova “contains a significant number of wells and infrastructure” associated with the development of the overlying Helmut field Jean Marie formation. The commission said the Cordova’s reporting area encompassed 269,006 hectares (1,038.6 square miles), of which 7,492 hectares (28.9 square miles) were being used for oil and gas activities.

According to the OGC, the first gas wells were drilled in the Cordova in 2008. The commission added that as of Dec. 13, 2013, there were 21 horizontal and five vertical wells drilled there. Annual production was 11.9 Bcf in 2013, with 21 wells in production at year’s end. The OGC estimated that the Cordova held 87.6 Bcf of raw gas in remaining reserves in 2013.

Interestingly, much of the potential interest in the Cordova is coming from Asia. Mitsubishi Corp. purchased a 50% stake of Penn West Energy Trust’s Cordova acreage in 2010, and a year later sold pieces of its stake to Chubu Electric Power Co. Inc., Tokyo Gas Co. Ltd., Osaka Gas Co. Ltd., and South Korea’s Korea Gas Corp. (KOGAS). Nexen Inc., the Canadian subsidiary of China National Offshore Oil Co. (CNOOC), also holds acreage in the Cordova (see Daily GPI, May 10, 2011; Aug. 25, 2010; and Shale Daily, July 1, 2011).

Jean Marie Formation (not pictured)

This natural gas play is more a mix of traditional conventional, carbonate, and tight sands. There have been very few horizontal wells drilled here to date.

Activity started out strong beginning in 2008, when several oil and gas companies — including Nexen, EOG Resources Inc., Apache Corp., Encana Corp., Devon Energy Corp. and Quicksilver — began taking a serious interest in the aforementioned shale plays. Eleven producers, in an effort to share information about the basin and minimize land surface disruptions, formed the HRBPG in 2010 (see Shale Daily, Nov. 22, 2010). Encana’s history dates back even farther, to 2001, and by 2008 was the busiest operator in the HRB. Encana and Apache formed an area of mutual interest, and controlled more than 400,000 acres at the center of the HRB (see Daily GPI, April 9, 2008). Apache’s net stake with Encana was 207,000 acres at the time, but it began to build its position in the Liard in 2009. By June 2012, Apache had amassed 430,000 acres in the Liard, which held an estimated 48 Tcf, or 8 billion boe (see Shale Daily, June 15, 2012).

In December 2012, a subsidiary of Chevron Corp. acquired a 50% stake in the proposed Kitimat liquefied natural gas (LNG) export facility planned for BC, and a 50% interest in 644,000 acres in the HRB and the Liard, effectively becoming a joint venture (JV) partner with Apache (see Daily GPI, Dec. 26, 2012). Encana and EOG, formerly 30% non-operating owners in Kitimat and the Pacific Trail Pipeline, sold their interests and exited the JV. Under the deal, Chevron Canada Ltd. acquired about 110,000 net acres in the HRB from Encana, EOG and Apache, and about 212,000 net acres in the Liard from Apache. But by 2014, Houston-based Apache was looking to monetize most of its international portfolio (see Daily GPI, July 31, 2014). Apache sold its 50% stake in Kitimat and its related upstream acreage in the HRB and the Liard to Australia-based Woodside Petroleum Ltd. for $854 million in April 2015 (see Daily GPI, April 2, 2015; Dec 15, 2014).

Meanwhile, Nexen doubled its position in the HRB to more than 300,000 acres in 2010, and began looking for partners to help develop the leasehold and possibly delve into LNG exports (see Daily GPI, July 16, 2010). Nexen landed Japan’s Inpex Corp. as JV partner in 2011 (see Shale Daily, Nov. 30, 2011).

In January 2013, Quicksilver, at that time swamped with debt, said in an operations update that during the previous month it had ramped up production in the HRB to 100 MMcf/d of raw gas from nine wells (see Shale Daily, Jan. 7, 2013). Over the next two months, Canada’s National Energy Board (NEB) denied TransCanada Corp. permission to build the Komie North pipeline, a project that would have connected HRB production to TransCanada’s system in Alberta (see Shale Daily, Feb. 26, 2013; Feb. 4, 2013). At the time, the rejection was seen as a boon to Quicksilver, since it was project’s sole producer. But Quicksilver’s efforts to find a JV partner in the HRB foundered (see Shale Daily, May 8, 2013), and despite filing with the NEB for permission to liquefy its HRB production and export it to Asia (see Daily GPI, July 29, 2014), Quicksilver filed for bankruptcy in March 2015.

In February 2013, the NEB said it was “plausible” that HRB production could grow to 3.5-4.0 Bcf/d. Current low natural gas prices are choking off some investment in the play for now, but most operators in the HRB have up to 10 years before they start losing their lease positions. However, in order to achieve significant large scale production in the HRB, we believe the industry must overcome the following issues that face all the natural gas formations in northeastern BC:

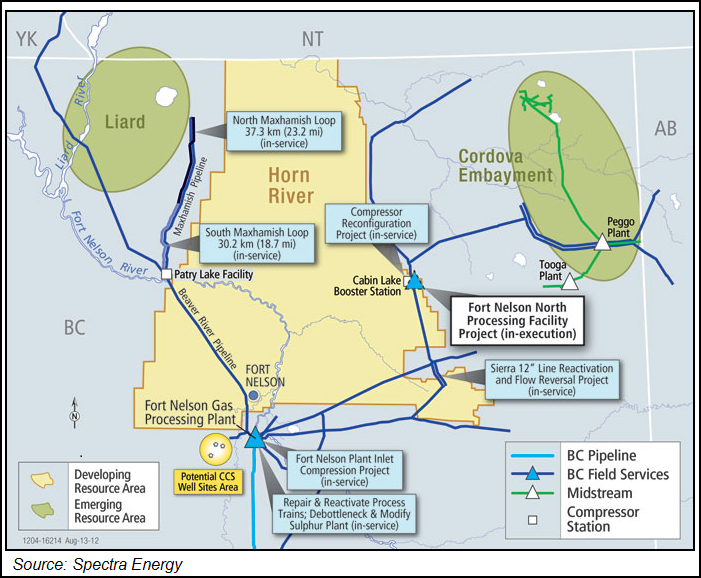

Lumpy Progress on Infrastructure

Spectra Energy currently has 1.2 Bcf/d of treating capacity and gathering pipelines in the Ft. Nelson area, including the 250 MMcf/d Ft. Nelson North processing facility it placed in service in 2013 (see Daily GPI, May 7, 2013). On the other hand, Enbridge Inc. and its partners announced in October 2012 plans to defer both phases of its proposed 800 MMcf/d Cabin Gas Plant indefinitely (see Daily GPI, Oct. 23, 2012). That additional 800 MMcf/d of capacity is probably not necessary to accommodate current production and drilling activity in the region, but we believe the decision to delay the project does underscore the lack of coordinated infrastructure growth between producers and midstream companies that is typical of more developed and less remote natural gas areas, such as the Marcellus Shale.

Relatively Poor Economics

Despite the fact that royalty rates in BC are quite low by industry standards, in February 2013, the NEB estimated that supply costs in the HRB averaged C$3.50/Mcf (U.S. dollar at par), well above competing gas plays in the United States. Much of that cost is no doubt the result of high transportation costs spread over lower volume. A lack of infrastructure always creates something of a chicken and the egg problem. High drilling costs prevent producers from drilling, which in turn makes them less likely to underwrite gathering and pipeline projects. On the other hand, if producers had enough infrastructure in place, they could ramp up production, and lower unit costs.

But even after prolific drilling and anticipated efficiency improvements improve economies of scale, HRB expenses are still projected to average C$2.20/Mcf in time, the NEB concluded. Moreover, producers must contend with weak basis differentials, and HRB production is dry gas, so they do not receive an economic uplift from NGL sales.

According to the Short-Term Canadian Natural Gas Deliverability 2014-2016 report issued by the NEB in May 2014, drilling in deeper dry gas formations like the HRB would not be significant unless prices were to reach US$6.00/MMBtu, which the NEB calls its higher price case. If prices were to average US$6.00/MMbtu in 2016, then the NEB assumes HRB shale gas deliverability increases from 380 MMcf/d in 2013 to 468 MMcf/d in 2016. In its mid-range case, where prices would average US$4.35 in 2016, “drilling in the HRB is minimal at 14 wells in 2016.” But in its lower price case, prices average US$3.75 in 2016, which the NEB believes would be too low to spark any new drilling in dry gas plays.

As of December 3, 2015, the 2016 CME/NYMEX futures strip stood at just US$2.40/MMbtu, which would suggest little to no new drilling in the HRB area for the foreseeable future.

Competing Supply

Gas volumes flowing east on TransCanada’s mainline have decreased in recent years, in no small part because of they must now compete with growing volumes from the Marcellus Shale. Moreover, if the Ohio Utica/Point Pleasant Shale formation and maybe even the Upper Devonian Shale reach full development mode, that may compete directly with gas from TransCanada into the Midwest. HRB gas also has to contend with other emerging Western Canadian plays, such as the Duvernay, Montney, and possibly even the Bakken Shale if more gas infrastructure is built there. Western Canada will no doubt need growing production from unconventional sources to help counter natural declines in its legacy production. However, given these other emerging areas, HRB production may not be necessary to achieve that.

LNG Export Facilities to the Rescue?

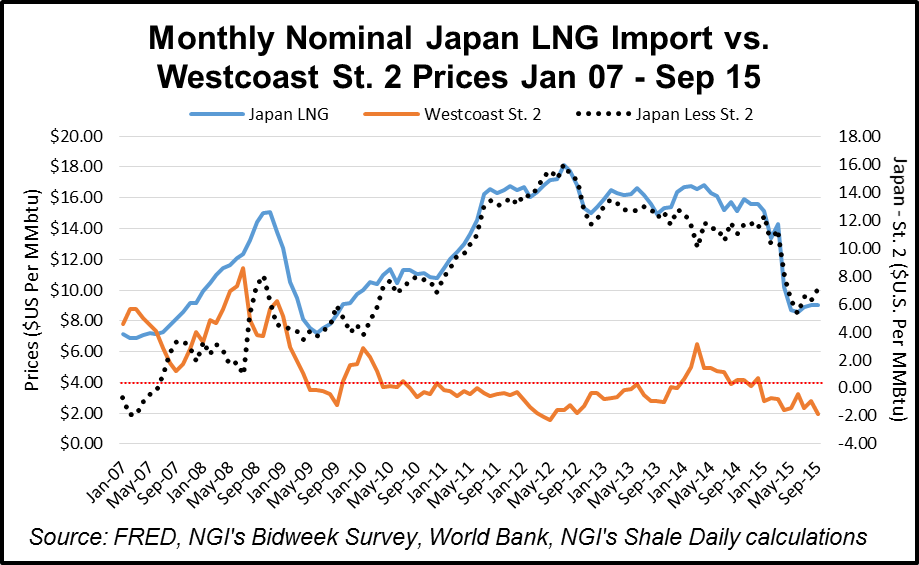

According to the Natural Resources Canada, as of Nov. 30, 2015, there were 16 LNG export facilities proposed for the west coast of BC. The newest to receive NEB approval is Cedar LNG Export Development Corp., a venture of an aboriginal community, the Haisla Nation (see Daily GPI, Dec. 1, 2015). Cedar LNG received a 25-year license to export 7.6 Tcf of gas at a rate of about 800 MMcf/d from the port of Kitimat. If any of the projects are built, Canadian producers would be in prime position to take advantage of any cost spread in Asia. We believe the HRB is particularly well suited for exports, since it is relatively closer to the coast of BC than most other Canadian producing regions, and it is dry gas, so that would likely give it some cost advantage over more liquids rich gas that would first have to have those liquids removed.

But there are several major impediments working against potential Canadian LNG exports that may prove to be too difficult to overcome. First and foremost, persistently low commodity prices have caused oil and gas companies to rethink projects they have on the drawing board. In December 2015, an analysis by Tudor Pickering Holt & Co. found at least 150 global natural gas and oil projects — including several LNG export projects — could be deferred for at least another five years (see Daily GPI, Dec. 3, 2015). Other analyses by Wood Mackenzie Ltd. and Rystad Energy came to the same conclusion (see Daily GPI, July 28, 2015; Dec. 5, 2014). Among the projects shelved: Chevron’s proposed Kitimat LNG export facility.

Other roadblocks include the ability of producers to obtain firm supply contracts at favorable pricing. Canadian LNG would flow to the Far East, and there are already several major projects being built to export LNG to that area, particularly in Australia. Every day that Canada is unable to start building its own export facilities is another day some other gas producing nation can. We believe many BC export facility project owners are holding out hope that they can receive oil based prices for their LNG, even though we also think that buyers in the Far East would prefer prices that are linked to a gas index, such as the Henry Hub. Another challenge is that many of the proposed pipelines that would connect Canadian production to these BC export facilities are facing major aboriginal resistance within the province. If such opposition does not prevent these pipes from being built, it may delay their progress long enough for buyers in the Far East to seek LNG from other nations.

The BC government reached out to the oil and gas industry in June 2015, urging the companies to keep momentum with programs despite low commodity prices (see Daily GPI, June 26, 2015). Like all his BC government peers, Ken Paulson, COO of the OGC, said no one believes all of the BC LNG projects can possibly make it into construction but that the terminal and pipeline sponsors are still striving to advance them. “One thing is for sure. We’ve got a lot of gas in BC and we’re producing more and more of it — it’s up every month this year. It doesn’t really show any sign of changing,” Paulson said.

Provinces

British Columbia

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily