The world’s thirst for electricity this year has led to an uptick in coal consumption and cut into U.S. natural gas consumption, according to the International Energy Agency (IEA).

The global energy watchdog earlier this month said the world is getting back to business following the depths of the pandemic, with energy demand rising quickly.

Coal generation had lost ground mostly to natural gas and more recently, it has given ground to renewables. However, sharply rising energy demand overall has given coal an edge.

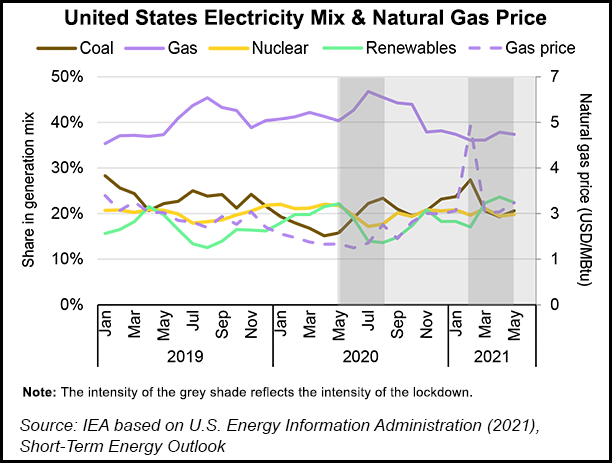

For example, U.S. gas-fired generation had been on a tear before Covid-19, with consumption peaking last July at 44%, according to IEA. Domestic gas demand, though, fell to around 35% in the last two months of 2020.

“This decline was set off by gas-to-coal...