Higher Costs, More Restructuring Ahead For Upstream Oil/NatGas, Consultancy Says

While the oil and natural gas sector recovery is in progress, there is a danger of a “sharp snap back” in costs for oilfield equipment and services, warns consultancy AlixPartners in a new study. Further, companies that have not yet restructured are in for tough sledding as the competition has gotten leaner and more efficient.

“Though there’s certainly more optimism in the industry today than there was a year ago, the year ahead is still likely to be one characterized by three words starting with ‘R,’ more restructurings, including more in the upstream and oilfield-services sectors as well as in the downstream sector for the first time in this cycle; more realignment, including more mergers and acquisitions throughout the industry; and, for those companies that take requisite actions, at long last 2017 could be a year of rebuilding,” said Bill Ebanks, a managing director in the firm’s oil, gas and chemicals practice.

“However, which of the three categories individual companies fall into depends on how aggressive they are on everything from repairing balance sheets to offsetting what are likely to be higher services and other costs in the year ahead,”

According to the firm, during the downturn there were 134 corporate bankruptcies, more than 350,000 job losses, annual reductions in capital spending of more than $100 billion since 2014 and cuts in operating costs of more than $15 billion a year.

The study asserts that the core of the industry still faces a $43 billion cash flow gap, which it said is the equivalent of oil prices rising, and staying at, $80/bbl — or of an additional 40% cut in capital spending versus year-end 2016 levels.

“Companies throughout the industry would be smart to ‘base-case’ their planning this year as if crude prices were going to be around just $45/bbl, to keep any surprises on the upside, not the downside. For one thing, there’s likely to be a significant ‘snap-back’ in equipment and services costs this year,” said Bob Sullivan, a managing director in the firm’s oil, gas and chemicals practice.

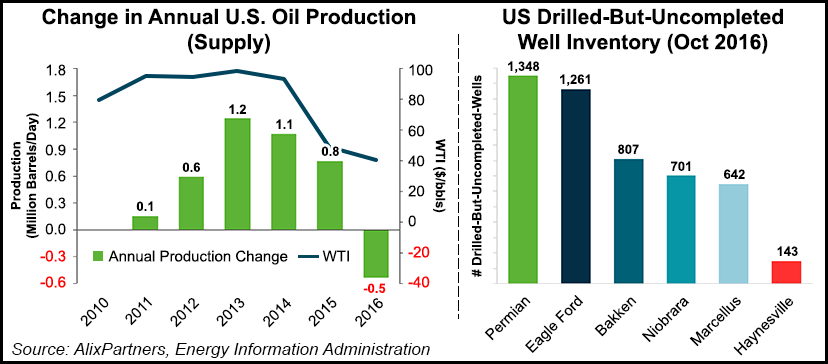

Upstream players, which in North America are sitting on an inventory of a 4,902 drilled-but-uncompleted wells, according to the firm, are likely to encounter a higher cost environment as they complete wells and in other ways move to restore production. As one example, the study found that a 10% increase in equipment and services costs in the Permian Basin, the area with the most uncompleted wells in the Lower 48 states, would wipe out the profitability benefits of a 10% increase in crude prices — illustrating the importance of upstream players working closely with suppliers and continuing to focus on efficiency improvements, AlixPartners said.

Companies in all sectors that have not yet restructured their balance sheets, either internally or through bankruptcy, will likely be facing an added competitive challenge going forward against companies that have, the firm said. U.S. exploration and production companies that have not already addressed balance-sheet issues have more than twice as much leverage as competitors — an average of $26,000/boe per day of debt versus just $12,000/boe per day of debt. While some companies may hope to simply “grow” their way out of their debt problems, such a strategy is likely unrealistic, especially given oversupply issues that already plague the industry globally — plus the fact that even the best mergers and acquisitions usually add to overall debt loads.

“The fact is, despite the whopping 134 bankruptcies and all the other restructurings that have taken place, many companies in this industry have yet to address their balance-sheet issues,” said John Castellano, a managing director in the firm’s oil, gas and chemicals practice. “For those that haven’t, 2017 could well wind up being a very tough year — unless they take action quickly. The clock is very much ticking for those companies.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |