E&P | NGI All News Access | NGI The Weekly Gas Market Report

Hess Sharpens Focus on Bakken, Expects 200,000 Boe/d from Play by 2021

Buoyed by increased U.S. crude oil production and with an eye more clearly focused on “high return, low cost opportunities” in the Bakken Shale and Guyana, Hess Corp. said Wednesday it slashed financial losses in 4Q2018.

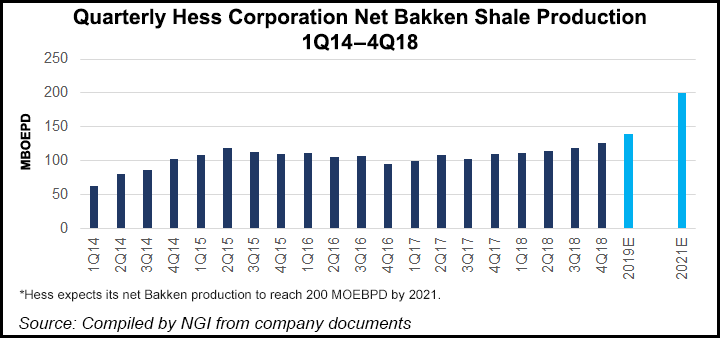

Overall production excluding Libya averaged 267,000 boe/d in 4Q2018, Hess said, with net production out of the Bakken reaching 126,000 boe/d, up 15% compared with 110,000 boe/d in the year-ago quarter. For all of 2018, Bakken production average 117,000 net boe/d, compared with the company’s guidance of 115,000-120,000 boe/d. The New York-based exploration and production company expects Bakken production to average 135,000-145,000 net boe/d this year.

“In 2019, we plan to drill approximately 170 wells and bring approximately 160 new wells online, compared to 121 wells drilling and 104 wells brought online in 2018,” COO Gregory Hill said during a conference call with analysts Wednesday.

Hess previously announced plans to ramp up to six rigs and produce 135,000-145,000 boe/d in the Bakken Shale in 2019 as part of a $1.87 billion capital expenditure (capex) budget in the United States. The company has set an overall 2019 capex budget of $2.9 billion, including $1.89 billion for production, $570 million for development and $440 million for exploration and appraisal.

Broken down by region, Hess plans to spend $835 million in South America, $150 million in Asia and $45 million in other regions, along with the $1.87 billion planned for the United States. Roughly 75% of the company’s total 2019 budget will go to high return growth assets in the Bakken and Guyana, management said.

“We have built a focused portfolio with a combination of short cycle and long cycle investment opportunities with Guyana and Bakken as our growth engines, and the deepwater Gulf of Mexico and the Gulf of Thailand as our cash engines,” CEO John Hess said.

The Bakken, which is the company’s largest operated growth asset, is key to company strategy, the CEO said. Hess has more than a 15-year inventory of high return drilling locations in the Bakken, and “our transition to plug and perf completions should increase net present value of the asset by approximately $1 billion. Net production is expected to grow to 200,000 boe/d by 2021, generating approximately $750 million of annual free cash flow post-2020 at current oil prices.”

Production in the deepwater Gulf of Mexico averaged 68,000 net boe/d in 4Q2018 and 57,000 net boe/d for the full year, “reflecting strong performance from our new Penn State Deep 6 well in the early return to production of the Conger Field,” Hill said. “We forecast 2019 production from our deepwater Gulf of Mexico assets to average between 65,000 and 70,000 net boe/d.”

Proved reserves at the end of the year stood at 1.19 billion boe/d, the CEO said.

Hess reported a 4Q2018 net loss of $4 million (minus 5 cents/share), compared with a $2.68 billion net loss (minus $8.57) in 4Q2017. For the full year 2018, Hess reported a $282 million loss (minus $1.10), compared with a $4.07 billion loss (minus $13.12) in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |