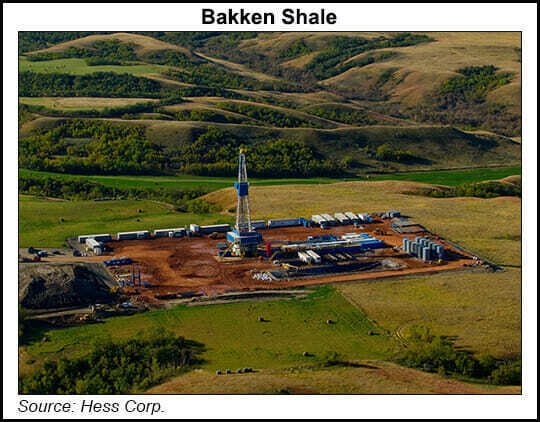

Hess Corp. has set a $3.7 billion exploration and production budget for 2023, with more than 80% of funds allocated to its flagship Bakken Shale and Guyana operations. This would be up from the $2.7 billion budget for full-year 2022 that the firm forecasted in October.

New York City-based Hess is targeting average net production of 355,000-365,000 boe/d this year, including 165,000-170,000 boe/d in the Bakken and about 100,000 b/d of oil from Guyana, management said. Bakken net production averaged 166,000 boe/d in the third quarter of 2022, up 12% year/year.

“Our capital program reflects continued execution of our strategy to invest only in high return, low cost opportunities within our portfolio,” CEO John Hess said. “More than 80% of our 2023 budget is allocated to...