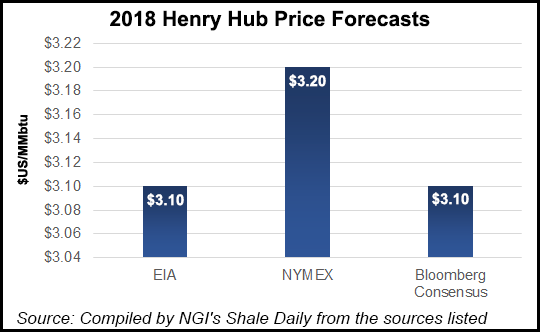

Henry Hub NatGas to Average Just $3.10/MMBtu in 2018, Says EIA

Henry Hub natural gas spot prices will average $3.01/MMBtu this year, and on the strength of growing exports and domestic consumption will climb to $3.10/MMBtu in 2018 — both numbers lower than previously forecast — according to the Energy Information Administration (EIA).

It was the second consecutive EIA Short-Term Energy Outlook (STEO) to include declining natural gas price forecasts. Last month, EIA said it expected an average of $3.03/MMBtu for 2017 and $3.19/MMBtu next year; the September STEO concluded that prices would average $3.05/MMBtu this year and $3.29/MMBtu in 2018.

In October, the average Henry Hub natural gas spot price was $2.88/MMBtu, up 10 cents/MMBtu from the September level, EIA said.

New York Mercantile Exchange contract values for February 2018 delivery traded during the five-day period ending Nov. 2 suggest a price range of $2.08-4.52/MMBtu, encompassing the market expectation of Henry Hub prices in February at the 95% confidence level, EIA said.

“The front-month natural gas futures contract for delivery at Henry Hub settled at $2.94/MMBtu on Nov. 2, an increase of 2 cents/MMBtu from Oct. 2. Futures prices traded within a 31-cents/MMBtu range in October, the narrowest range for that month since 1995. Working natural gas injections in storage were below average in October, bringing inventories for the week ending Oct. 27 to 3.8 Tcf, which is 1.1% lower than the five-year average and 4.6% lower than last year at this time.”

Growing export demand and below-average storage injections could add upward pressure to prices, but projected mild winter temperatures could have the opposite effect, EIA said.

The five-day moving average spot price at Tennessee Zone 4, in the northern part of the Marcellus Shale region, declined to 68 cents/MMBtu on Oct. 6, the lowest level in a year, according to the STEO.

“The price spread between Tennessee Zone 4 and Henry Hub reached -$2.19/MMBtu on Oct. 25, the widest point since last year. The differential to Henry Hub, which had widened in October 2016 because of constraints in takeaway capacity, narrowed after projects such as the Ohio Valley Connector, the Rockies Express, and the Algonquin Incremental Market pipelines entered service in the last quarter of 2016 and the beginning of 2017.

“However, with increased natural gas production in 2017, takeaway capacity is constrained again. The ramp-ups of the Rover Pipeline, Cove Point LNG facility, and the Nexus Gas Transmission Project in the last quarter of 2017 and the first quarter of 2018, which will have a combined 5.5 Bcf/d of new takeaway capacity, will likely narrow the spread between Marcellus area and Henry Hub prices.”

EIA expects U.S. dry natural gas production to average 73.4 Bcf/d this year, a 0.6 Bcf/d increase compared with 2016, and then expects it to grow another 5.5 Bcf/d in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |