Markets | NGI All News Access | NGI Data

Hefty Storage Pull Fails to Rouse NatGas Futures

Natural gas futures advanced Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was greater than what traders were expecting. Following a lower open, futures, however, were unable to move past Wednesday’s settlement.

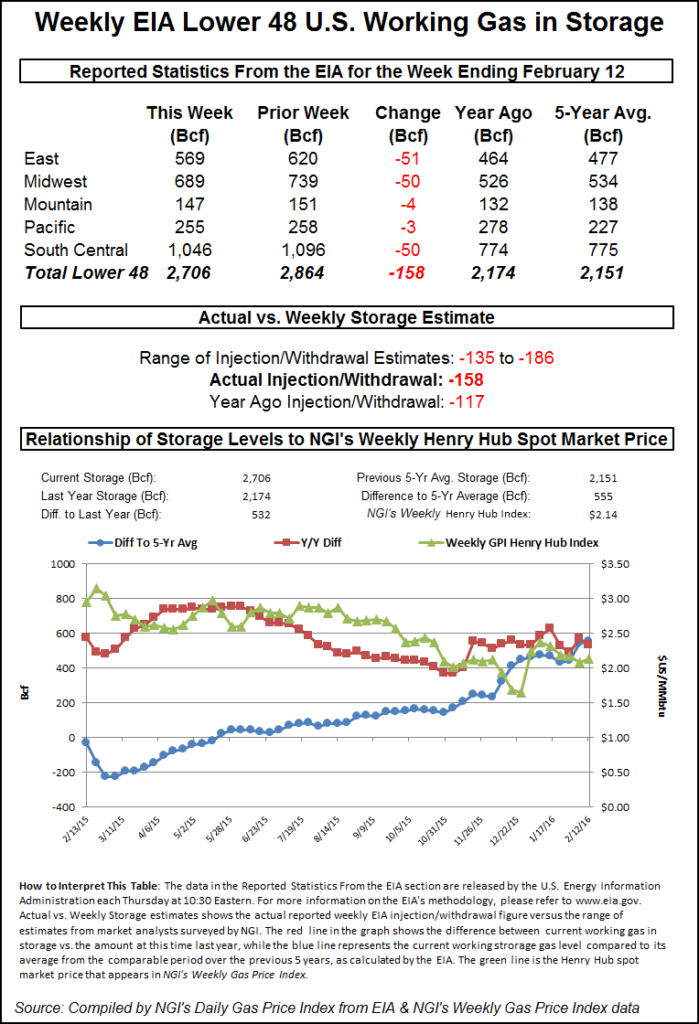

EIA reported a 158 Bcf withdrawal in its 10:30 a.m. EST release; the withdrawal put inventories at 2,706 Bcf. March futures rose to an intra-day high of $1.911 in the minutes following the release of the storage data, but that was still down 3.2 cents from Wednesday’s settlement.

“You would think off of this it would be bullish, but we are trading right in mid-range on the day,” said a New York floor trader. “We were trading at $1.880 before the number came out and we are at $1.910 now. The market didn’t touch the day’s highs or lows.”

Analysts saw the number as mildly supportive. “The 158 Bcf net withdrawal for last week was somewhat more than expected and may support market sentiment on that basis,” said Tim Evans of Citi Futures Perspective. “At the same time, however, we note the draw was still less than the 170 Bcf five-year average and so still somewhat bearish on a seasonally adjusted basis. With forecasts for mild temperatures ahead, we’d also suspect that any upward price reaction off the storage report may prove short-lived as the overall bearish trend of below-average storage withdrawals is likely to continue.”

Inventories are still a hefty 532 Bcf greater than last year and 555 Bcf more than the five-year average. In the East Region 51 Bcf was pulled, and the Midwest Region saw inventories fall by 50 Bcf. Stocks in the Mountain Region were down by 4 Bcf, and the Pacific Region was lower by 3 Bcf. The South Central Region shed 50 Bcf.

Salt cavern storage was lower by 22 Bcf to 290 Bcf, while the non-salt cavern figure fell 28 Bcf to 756 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |