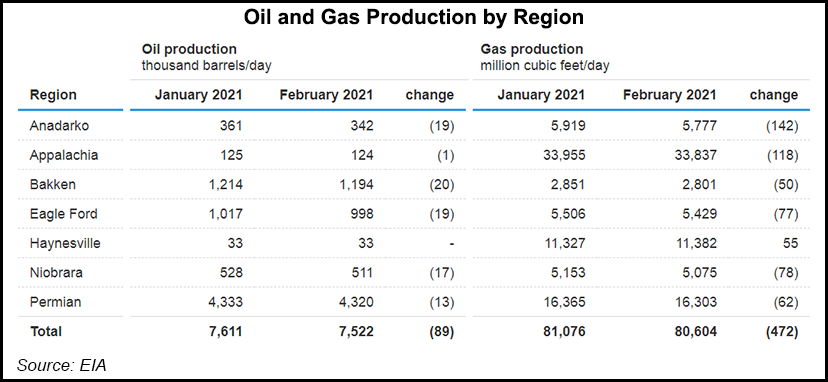

Cumulative natural gas production from seven key U.S. onshore regions is set to fall by 472 MMcf/d from January to February, extending a downtrend that goes back to early 2020, according to updated projections published Tuesday by the Energy Information Administration (EIA).

In its latest Drilling Productivity Report, EIA said it expects the Anadarko, Appalachian and Permian basins, as well as the Bakken, Eagle Ford, Haynesville and Niobrara formations, to produce 80.604 Bcf/d in February, down from 81.076 Bcf/d in January.

The Haynesville Shale, which straddles East Texas and North Louisiana, is the only Lower 48 basin that is expected to grow output over January, EIA said. The shale play is forecast to increase output in February by 55 MMcf/d month/month (m/m) to 11.382...