Shale Daily | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Harvey, Onshore Rig Pullback May Weigh on E&P, OFS Results for 3Q, Say Analysts

The third quarter earnings season is getting underway in earnest this week, with investors eyeing what the declining onshore rig count may mean as prices have barely budged. Kinder Morgan Inc. was first out the blocks late Wednesday, with the Big Three oilfield services (OFS) operators bookending the weekend, as Schlumberger Ltd. and Baker Hughes, a GE company, sharing their results on Friday and Halliburton Co. reporting on Monday.

The exploration and production (E&P) sector had a lot of moving parts during the quarter, with Hurricane Harvey weighing on some results, and a pullback in the venerable Permian Basin noted. The efficiencies gained as E&Ps recalibrated on lower commodity prices may have reached their zenith, some analysts said.

“With advances in efficiency and productivity gains less pronounced today — and certain producers being vocal about extended cycle times, a development that could prove less transitory than hoped — the rate of change appeal of the group is waning,” said BMO Capital Markets analysts Phillip Jungwirth and Dan McSpirit.

“Add to this the increasingly loud market demand that spending be right-sized to cash flow and you have a group challenged to generate competitive returns in the current commodity tape. We see few producers as able to adapt and evolve.”

The BMO duo is leaning on the “most basic of measures when emphasizing one equity over another: producing more molecules per dollar invested. Rate of change can still play a role where we can find it.”

Batter Up

In the spirit of the Major League Baseball playoffs, Jungwirth and McSpirit said they were taking inspiration “from the wise one, Yogi Berra,” to organize their thoughts.

“The future ain’t what it used to be,” they said. “Many producers, mostly of the Permian variety and a first for some, have pre-announced 3Q2017 production slippage on downtime connected to Hurricane Harvey and greater cycle times owing to less experienced fracture crews, as well as general delays in non-operating activity (always a crowd pleaser).”

Productivity and efficiency gains also appear to be moderating in the Lower 48 oil-bearing basins, with 2017 well data showing relatively small improvements and mixed results overall in the Permian Basin, the “primary growth engine,” as well as the Eagle Ford and Bakken shales, Oklahoma’s stacked reservoirs and the Niobrara formation.

There also are rising gas-to-oil ratios in places outside the Permian, the BMO analysts said.

“It’s like deja vu all over again,” they said, giving a nod to Berra. “Spending to cash flow is a big topic of conversation these days. Yet, producer behavior lends little support for this outcome materializing in a way that’s desired by certain market participants.”

BMO estimates indicate a narrowing between capital spending and cash flow, but producers, on average, “exhibit reinvestment rates of 110-115% on our 2018 estimates. We forecast spending to increase about 13% year/year, much of it exit-rate driven.”

At that spending level, net oil output growth by the publicly traded E&Ps may be more than 660,000 b/d in 2018 from about 240,000 b/d this year.

“It ain’t over ’til it’s over,” said Jungwirth and McSpirit. “Our models show large-cap diversifieds spending to cash flow in 2018 and even cash flow generative in 2019-plus. Natural gas, Permian, and most small-to-mid-cap producers outspend cash flow until 2020 on our assumptions. We see these same producers as the first to accelerate at $55.00/bbl, capital availability withstanding of course.”

Goldman Sachs analyst team, led by Brian Singer, said third quarter results would likely be “noisy” because of hurricane-related delays. Analysts will be watching three key areas: operational execution and the E&P sector’s ability to achieve the step-up in growth implied in full-year guidance; confidence in capital-disciplined growth in 2018, and resource base improvement.

“On execution, we continue to prefer producers with scale and see potential for upside revisions of consensus estimates,” Singer said.

Execution is a “prerequisite for receiving credit for resource base improvement,” but the Goldman team is expecting to see updates on higher-intensity completions in the Permian, longer laterals in Appalachia and density pilots in Oklahoma’s stacked reservoirs to draw investors’ focus.

Rigs, Pressure Pumping Questions

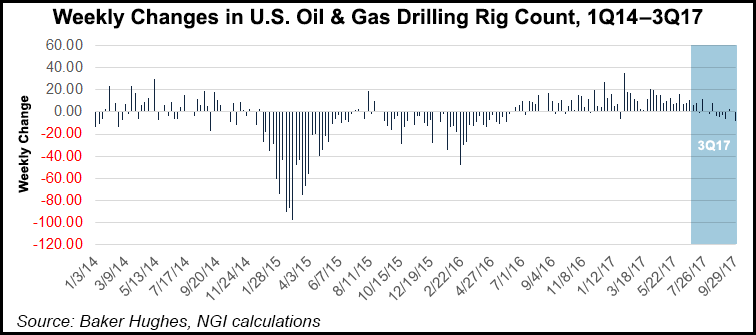

Sanford Bernstein’s Colin Davies and Laura Tao see four themes shaping discussions this earnings season, which, more important, may inform positioning for 2018. They will be listening in to hear more about the declining U.S. land rig count, offshore drilling prospects, a potential U.S. pressure pumping pullback and a potential revival on the international front.

How low can the U.S. land rig count go, the Bernstein analysts asked.

“We are in the middle of E&P capital planning season with a falling rig count but some rising optimism on oil price,” they said. “While we are still cautious with $50/bbl next year and expect to lose 100 horizontal rigs before recovering (count is already down by 24 since July); the pace of loss does seem to be slowing.

Commentary from the land drillers on activity and rate trends “will be crucial prior to a clearer view from the E&Ps on 2018 spend.”

For domestic pressure pumping, they also wonder if operators now are tapping the brakes.

“Hydraulic fracturing has been the recovery story with pricing increases sticking while the industry struggles to address rapidly increasing demand,” said the analysts. “But if rig count falls, growth will slow.

“Drilled but uncompleted wells, we think, can provide a cushion. However, there are headwinds and questions will be focused on further pricing improvement, demand outlooks as well as capacity/new build discipline.”

Evercore ISI’s James West and his analyst team said “the time is now” for the OFS sector to not only disassociate from crude, but also for those “execution companies” in their coverage to differentiate from the rest of the field.

“Will it be the pressure pumpers that finally coax long only capital into the sector?,” he asked. “Will land drillers show evidence of continued dayrate traction?”

Fracture sand guidance will be key, he said, as investors appear split between regional sand pricing pressure and the “sheer service intensity demand drivers” that will accelerate as the industry builds out high horsepower systems.

Like other analysts, West also said a sharp rig count inflection could be in the cards.

“The recent momentum is warranted by improving commodity prices and strengthening macro outlook. However, consensus is still a bit wary of the sustainability of the U.S. rig count, considering the impending pullback in 4Q2017 drilling capital expenditures as communicated by several prominent U.S. E&Ps.”

Fears of a big rig count pullback may be influencing the way the market is reading the discrepancy between communicated rig releases and a permit count that continues to march toward pre-downturn highs, West said.

Permitting Still Strong

Evercore’s team said recent permitting strength across the Lower 48 may serve to at least stabilize the rig count, with commodity gains driving incremental rig count growth through year’s end. West compiles a monthly report on U.S. onshore permitting, which he said recently had reached an inflection point.

“Combined with what is anticipated to be a strong winter drilling season in Canada, this makes for perhaps the best fundamental setup that North American OFS has seen in three years,” West said.

Analyst Gabriele Sorbara of The Williams Capital Group, who covers more than two dozen onshore E&Ps, said investor expectations for 3Q2017 “are low on the back of longer cycle times and downtime/delays” because of inexperienced fracture crews and/or delays from Hurricane Harvey, along with concerns about the gas-to-oil ratios.

Overall, E&P production growth forecasts to year’s end and into 2018 should be about at consensus, as telegraphed by management teams on longer cycle times and higher OFS costs.

“Overall for 3Q2017, we forecast a greater number of production misses relative to consensus,” but most teh E&Ps should be on track, Sorbara said. “We expect sellâ€side estimates to reset lower for production impacts during the quarter, as well as adjust for actual 3Q2017 commodity prices and differentials.”

Mizuho Securities USA LLC’s Brian Zarahn, managing director of Americas research, said energy infrastructure earnings reports for the midstream operators are likely to focus on “dividends, hurricanes and volumes.”

For the midstream sector, “hurricane headwinds and nascent volume recovery” may not cure investor malaise, according to Mizuho’ Securities analyst team led by Brian Zarahn.

“During earnings, we believe three key topics are dividends, hurricanes and volumes,” he said. “Given industry bellwether Enterprise Product Partners LP’s Oct. 12 announcement lowering its distribution growth rate to increase coverage, we believe some management teams will face questions on whether they should follow suit to reduce future financing needs.”

Regarding hurricanes, the Mizuho team expects companies with Gulf Coast and Caribbean assets to experience some negative, but generally manageable, impact.

“While investor sentiment is relatively weak, we believe the volume recovery (rising production, exports, ethane demand), projects and dropdowns will support midstream cash flow growth in 2018,” Zaharn said.

A calendar of 3Q2017 earnings conference call dates and our coverage of those calls for some publicly traded energy operators is being updated weekly on NGI’s website.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |