NGI Archives | NGI All News Access

Halliburton Seeing Growth Domestically, Overseas

With the exception of some flattening in the overall oil and natural gas rig count this year, a steady increase is forecast through 2015, particularly for horizontals drilled on multi-pad well sites, according to Halliburton Co. COO Jeff Miller.

Miller, who spoke at the Barclays CEO Energy-Power Conference, said the rig count is one thing, but the underlying efficiency gains are as important, which has led to fewer rigs but more production. Halliburton estimated in July that about half of U.S. wells being drilled now are on pads, which has made the rig count somewhat superfluous (see Shale Daily, July 23).

All types of oilfield services are in Halliburton’s wheelhouse: unconventional, deepwater and mature assets, and they should continue to “outgrow” the market,” said Miller. “As we look out in the next year, what I see is, it could be the first time since 2005 where we see growth in both markets, both internationally and domestic.”

Halliburton’s horizontal drilling technology has kept business hopping worldwide, said Miller.

“Globally, over a third of all land rigs in the world today are drilling horizontally,” he said. “This is up from less than 8% in 2005. And so when we look at revenue multiplier, or basically the service intensity associated with horizontal rigs versus vertical rigs, we see about a three-to-four times multiplier compared to a conventional rig,” otherwise known as service intensity.

North America was the horizontal drilling pioneer, “but there are dozens of other countries experimenting with these techniques, including Russia and Mexico, “where horizontal drilling has become an important part of infield drilling and also enhanced recovery in mature fields.”

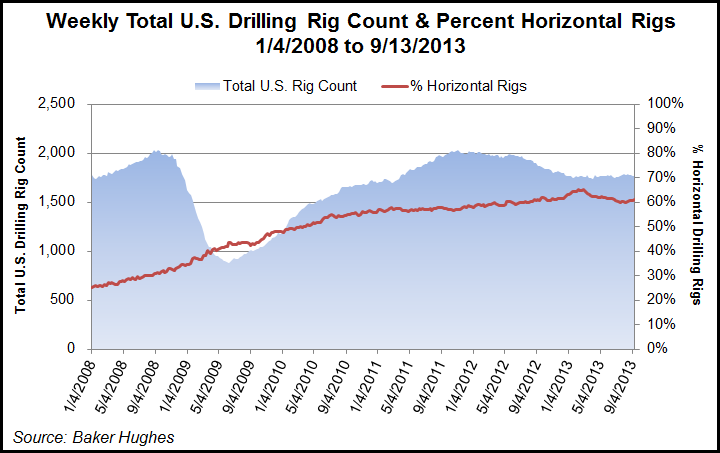

According to Baker Hughes data, horizontal drilling now accounts for the majority of U.S. drilling. During the week ending Jan. 4, 2008, horizontal rigs accounted for 25% of the 1,774 U.S. rigs in operation at the time. Fast forward to the week ending Sept. 13, 2013, where 60% of the 1,768 total rigs in operation were horizontal rigs.

It’s the efficiencies that are making a big dent in costs and a big gain in production.

“We think there is about a day of efficiency from an operator standpoint associated with a pad in terms of moving from well-to-well,” Miller said. Looking at only horizontal drilling activity, “this is the place where service companies probably have the greatest impact on efficiency.”

There’s still “quite a number” of verticals being drilled that may dilute the overall efficiency numbers, he said. However, between 2011 and 2012, Halliburton “tracked a 14-16% improvement in drilling efficiency, and this is really what we’re seeing in the activity levels.”

Improved efficiencies in North America’s onshore lifted Halliburton’s drilling operations by 16% in the first half of this year versus a year earlier, or about 8-10%, including verticals, Miller said.

“I’m not necessarily projecting the same pace to continue, but we still see substantial efficiency opportunity as we move now from fewer verticals to more horizontals, and in key basins around North America…Leave it to pads, which provide more opportunities for efficiency.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |