Halliburton Not Worried About Rig Count Plateau, Says CEO

Halliburton Co. CEO Jeff Miller said the company isn’t concerned about a onshore rig count plateau, viewing it as a sign that customers are trying to ferret out the best opportunities for production. Meanwhile, the largest oilfield services company in North America is navigating through $50/bbl oil, even as global oil production could decline by as much as 1 million b/d by 2021.

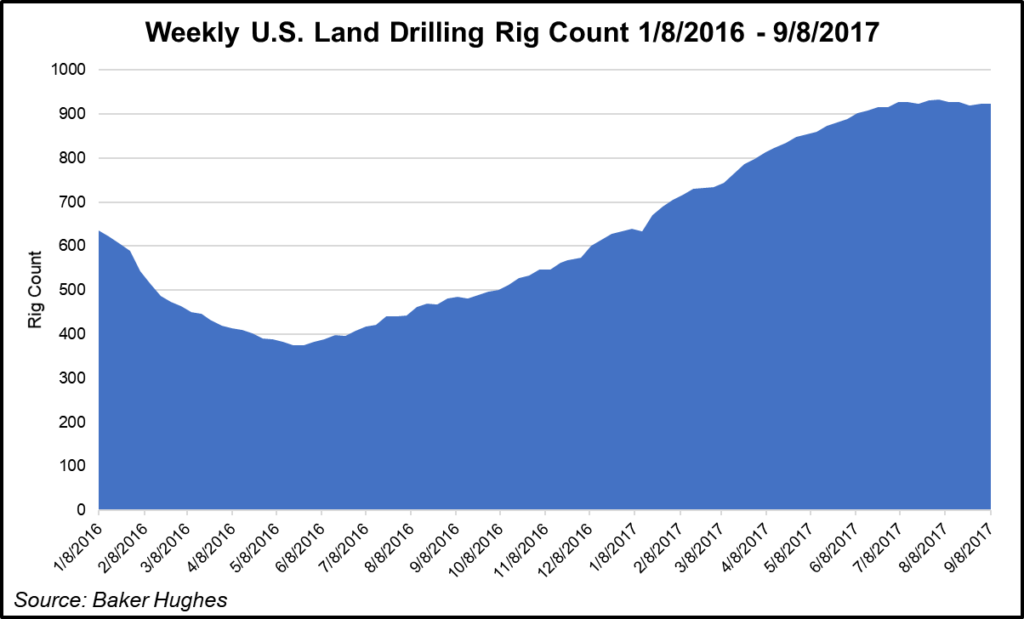

Miller spoke last Wednesday at the Barclays CEO Energy-Power Conference in New York. He said with the rig count in North America climbing back above 500 for the first time since the price trough, conversations have now turned to a rig count plateau, and what such a plateau could potentially mean to the oilfield services sector in 2018.

“The behavior that we are witnessing is not [being viewed as a] crisis by us and certainly not by our customers,” Miller said. “In fact, what we’re seeing is rational stabilization in the hunt for better production. And so, after a 300% growth in the rig count, the last few weeks really provide [evidence that] there is still plenty of work to be done in 2018.

“The behavior that we’re witnessing today is solid…Our customers do plan to work…We’re drilling today about the same footage that we drilled in 2014. And so, while we may be seeing some rig count stability, rig count stability for a short time in my view isn’t a bad thing. Rig count stabilization is where our clients focus on efficiencies, optimization and making more barrels, all of which are things that Halliburton does really, really well.”

Navigating $50 Oil

During follow-up questions, Miller said Halliburton’s focus on maximizing asset utilization and velocity, coupled with efficiencies and discipline over capital, will help the company navigate through $50 oil and deliver solid free cash flow.

“The near-to-medium term markets are unconventionals and mature fields, and our value proposition is dead focused on that,” Miller said. “That means that we are working closely with our customers, but at the same time driving toward what’s most important to them. It creates fantastic alignments and the ability to collaborate with our customers. The steps that we go through to do that keep us aligned with our customers.

“The types of markets that we’re in are high velocity markets which are consistent with what are important to us, and I believe that in a $50 world, we get lots of reps on our equipment and our strategy to drive better velocity on our equipment ultimately yields cash flow.”

Miller conceded that Halliburton has been more conservative in its outlook of the international market, but said the market has played out that way so far. He added that the Houston-based company expects the outlook bottomed in 1Q2017 and has since started to recover.

“I think that what we’ll see is an increase in activity broadly, but sort of painting that over the entire world — not just deepwater, but international in general,” Miller said. “As a result, it doesn’t create the kind of tightness in any particular market that ultimately drives a pricing inflection, which is probably more relevant. And so, we do expect to see modestly increasing activity, but [in a] very competitive price environment…

“As we move through 2018 — if there is enough increase in activity in a particular place — that should be enough to drive levels of inflection on price.”

Oil Output To Decline Through 2021

Miller said global oil production remains strong, with discipline by the Organization of the Petroleum Exporting Countries (OPEC) being offset by the resilience of non-OPEC, non-North America production. Increased activity in North America, made possible by a modest price recovery and lowered unconventional breakevens, is expected to keep global production strong into 2018.

“What changes this dynamic? The change that I see is really what lies ahead for non-OPEC, non-North American production, and the support and continued strengthening of global demand,” Miller said. “It shouldn’t come as a surprise that start-up production from the backlog of major international projects that were sanctioned in the late stages of the last cycle will be reduced by half as we go into 2019.”

With a reduction in the number of projects, and accelerating reserve depletion and reservoir depletion rates, Miller said global oil markets will experience a significant production declines in coming years, perhaps by as much as 1 million b/d by 2021. He said the decline would come despite signs that global demand from Europe, Japan, China and other emerging markets is growing.

“While North American resources are terrific, all basins are not created equal and North American production will not likely make up that sort of difference over time,” Miller said. “The point of all this is that the commodity market is still correcting, and given the fundamentals that work today, I have a strong conviction in a long-term outlook for the oil market.”

But in the meantime, Miller said price recovery today is driven by reserves that demonstrate the lowest lifting cost and shorter cycle returns, which are right in Halliburton’s wheelhouse.

“North American unconventional and international mature fields, specifically led by activity in the Middle East and Russia, are squarely in the bull’s eye and are most important over the near- and medium-term,” Miller said. “In contrast, traditional deepwater projects are the most disadvantaged today, principally because of cost and project duration. While I expect deepwater to recover, I believe it recovers more slowly and sort of as the macro supply and demand self-corrects.”

‘Too Early To Know’ Harvey Impact

In the aftermath of Hurricane Harvey, Miller said Halliburton’s customers temporarily shut in production across a wide swath along the Gulf Coast, including parts of the Eagle Ford Shale and in East Texas. The company’s supply chain was also tested by the storm.

“It’s too early to know any financial impact for North America for the third quarter,” Miller said. “However, our priority right now is to get our employees’ lives back together and to serve our customers as they restart operations. We view the impact, if any, simply as revenue deferred, but not revenue lost.”

Miller also touched on the alliance between Halliburton and Microsoft Corp., which was announced last month. The merger of Microsoft’s technological expertise and Halliburton’s global knowledge of the oil and gas industry is expected to provide operators with exciting products and services.

The alliance, will enable “real-time data streaming from devices across the oilfield, and the ability to apply deep-learning artificial intelligence to optimize drilling and production, to lower cost and to improve efficiency for our customers,” Miller said. “This alliance is an example of our strategy to partner with leaders in other fields and offer the best solutions for customers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |