E&P | Eagle Ford Shale | NGI All News Access

Halcon Down to One Rig, Not Planning to Add More Until Prices Recover

Halcon Resources Corp. dropped down to one operated rig in the Williston Basin during the first quarter, but it could deploy another in East Texas if crude oil prices recover. Production has declined but so have operating expenses.

The Houston-based company reported that it is currently running one operated rig in the Fort Berthold (FBIR) area of the Williston Basin, and plans to keep it running for the remainder of the year. The company said it doesn’t plan to add any additional rigs until commodity prices improve, but when oil prices recover, it will deploy one rig in East Texas, in a portion of the Eagle Ford Shale north of Houston dubbed the El Halcon.

CEO Floyd Wilson said that despite low commodity prices, it makes economic sense to continue running the one rig in the FBIR area because it’s deployed on a multi-well pad. He added that the company was continuing to watch the futures market and was “looking for another place to start hedging.” The company has 25,331 b/d of oil hedged for the remainder of 2016, at an average price of $80.50/bbl.

“We’re not quite there, but it’s looking interesting,” Wilson said during a conference call Tuesday.

During the first quarter, Halcon operated an average of two rigs in the Williston and one in the El Halcon. The company spud four wells and put five online in the FBIR area, and spud two wells and placed four wells into production in the El Halcon.

The company said it plans to use its one operated rig in the FBIR area to spud 15 gross operated wells — with an average working interest (WI) of approximately 64% — over the remaining three quarters of 2016. It also plans to participate in 15-20 gross non-operated wells (0.5% WI) during the same time frame.

The additional wells are expected to have an estimated ultimate recovery of about 900,000 boe. Current drilling and completion costs are estimated at $6.2 million per well in the FBIR area, and $5.7 million per well in Williams County, ND. Halcon currently has 14 wells being completed or awaiting completion in the Bakken Shale, but none in the Eagle Ford.

Halcon reported that it holds a WI in approximately 123,000 net acres in the Williston, with most of it held by production (HBP). The acreage is prospective to the Bakken Shale and the Three Forks formation. It also holds a WI in about 88,000 net acres overlaying the Eagle Ford in the El Halcon, of which 76% is HBP.

“We paused drilling at El Halcon simply because we can’t [keep going],” Wilson said. “We have a huge asset there…more than 500 operating locations. It can be very economic, almost where the strip [price] is now. So we’re going to maintain that great position there. We may add rigs depending on how our efforts go in this balance sheet business. We may reduce rigs. We can go either way.”

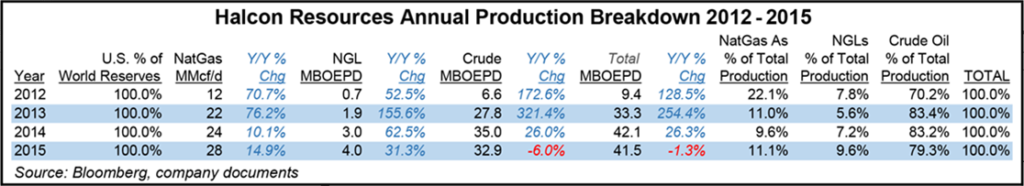

Production averaged 39,527 boe/d in 1Q2016, an 8.2% decline from the year-ago quarter (43,078 boe/d). Crude oil accounted for 77% of the total, followed by natural gas and natural gas liquids (NGL), at 12% and 11%, respectively. Broken down by play, production averaged 28,606 boe/d in the Williston Basin and 8,380 boe/d in the El Halcon.

CFO Mark Mize said Tuesday that the company still plans to meet its full-year production guidance of 37,000-39,000 boe/d. He added that Halcon spent $52 million on drilling and completion costs during the first quarter, the bulk of its full-year guidance for capital expenditures, which ranges from $140-160 million.

Total operating expenses declined 11.6%, from $762.4 million in 1Q2015 to $673.7 million in 1Q2016. Lease operating expenses fell significantly (39%) between the two quarters, from $33.8 million to $20.6 million.

At the end of the first quarter, Halcon’s liquidity totaled approximately $564 million, which includes cash on hand and undrawn capacity on the company’s senior secured revolving credit facility of $700 million. Halcon’s next borrowing base redetermination is scheduled for Sept. 1.

The company reported a net loss to stockholders of $566.9 million ($4.72/diluted share) in 1Q2016, compared to a net loss of $601.2 million (minus $7.16/share) for the year-ago quarter. After adjusting for some items mostly related to a non-cash, pre-tax full cost ceiling impairment charge, Halcon posted net income of $29.7 million (21 cents/share) in 1Q2016, compared to an adjusted net loss of $16 million (minus 19 cents/share) in 1Q2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |