NGI Archives | NGI All News Access

Gulfport’s Utica Is ‘as Good as Best Part of Eagle Ford,’ Says CEO

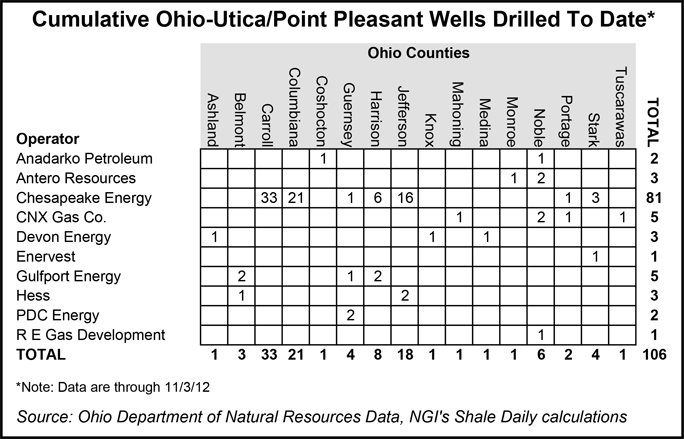

Gulfport Energy Corp. has spud some of the largest producing wells in the Utica Shale to date, and the play continues to be the Oklahoma City-based operator’s “primary focus area,” according to CEO James Palm.

The producer contributed its Permian Basin interests to a Diamondback Energy initial public offering. Gulfport also completed a $250 million offering of senior notes due in 2020.

“Based on an “interpretation of the rock properties, the pressure regime and the product phased windows, we believe that our position in the Utica could be as good as the best part of the Eagle Ford, based upon the overall productivity and economics.”

Palm told analysts during a conference call that he had “rarely encountered anything like what we are seeing today in the Utica. With each new well that we test, I continue to be impressed by the sheer magnitude of the production and the consistency of the resource across our acreage.”

With a recent senior notes issuance, as well as contributing Permian Basin assets to a Diamondback Energy initial public offering, “we’ve freed up significant capital to be redirected toward the development of this once-in-a-lifetime play. The Utica Shale is absolutely a company changer for Gulfport, and we intend to devote the necessary capital to allow to develop to its full potential.”

In October Gulfport reported the best producing well to date in the Utica, according to initial production data (see Shale Daily, Oct. 15). The Shugert 1-1H well in Belmont County, OH, near Kirkwood Township recently tested for 32 hours at a maximum rate of 20 MMcf/d of natural gas, 144 b/d of condensate and 2,002 b/d of natural gas liquids. The well is expected to begin flowing to sales by early December. Shugert topped an earlier Gulfport well, the Wagner 1-28H in Harrison County, which was brought online in August after testing at a gross peak of 17.1 MMcf/d and 432 b/d of condensate (see Shale Daily, Aug. 16).

The solid production continued throughout 3Q2012, Palm said. The BK Stephens 1-16H well was drilled to a vertical depth of 8,225 feet, with a 5,276-foot horizontal lateral and completed with a 19-stage hybrid hydraulic fracturing (fracking) treatment that consisted of about 550,000 pounds of sand per stage.

“The well tested at a peak rate of 1,224 bbl/d of condensate and 6.9 MMcf/d of gas on a 32/64-inch choke,” said Palm. “Based upon composition analysis, the gas being produced is 1,207 Btu rich gas. Assuming full ethane recovery, this composition would produce 110 bbl of natural gas liquids per MMcf of gas, resulting in a gas shrink rate of 11% and a total rate of 3,007 boe/d.”

In ethane rejection mode, he said, the well would produce produce 42 bbl of NGLs per MMcf of gas, resulting in a gas shrink of 1% and a total rate of 2,652 boe/d. “As we do not expect to begin flowing the BK Stephens into a sales pipeline until the end of January, we’ve resumed resting the well, and in approximately 30 days, we will test it again. While we are currently still sticking with our 60-day resting period, we are very encouraged to see this level of production from the well following the shorter resting period. Of course, our objective is to determine the shortest resting period needed to make the most economical well.”

Gulfport also has finished drilling the Stutzman 1-14H well to a true vertical depth of 9,020 feet, with an 8,634-foot horizontal lateral and a total measured depth of 17,282 feet.

“The Stutzman 1-14 is now the longest lateral and total measured depth with any well Gulfport has drilled,” said the CEO. “We are big proponents of longer laterals and shorter frack intervals, which we believe will benefit us in the long run by providing higher overall estimated ultimate recoveries.”

However, “we have not yet been able to bring any of our wells into full production.” MarkWest Energy Partners LP “has experienced construction delays due to a number of factors, many of which are outside of its control. Permitting and right-of-way acquisition in Ohio in particular are very challenging. We had hoped to have the first sales from the Wagner and Boy Scout [wells]…but due to Hurricane Sandy, we now anticipate sales to begin later this month…We’re all frustrated by these delays. However, I have personally been near daily contact with Frank Semple, MarkWest’s CEO, and I’m confident the project is getting the highest level of attention on their end.”

Semple on Thursday in a separate conference call said its Gulfport service was a top priority (see related story).

“We recently signed a letter of intent with MarkWest to gather our condensate,” said Palm. “This is another key element of our midstream solution, and MarkWest will construct an integrated condensate gathering and stabilization system that will consist of gathering facilities, field injection stations, stabilization equipment, storage, pipelines and truck and rail loading facilities. This system will be a companion to the developing rich gas gathering and processing facilities, and be advantaged by the associated multi-line rights of way.

“The integrated solution will enable Gulfport to increase the value of its condensate production by virtually eliminating losses typically related to weathering and/or field transportation. We expect to further enhance the value of our condensate by stabilizing it at the Harrison County [OH] plant and marketing the stabilized product to regional refineries or to the Canadian oilsands producers for use as diluent. While we were still in the initial stage of the detailed engineering, we are planning to begin gathering and stabilizing condensate through this new system as early as September of next year.”

Gulfport plans to run two rigs through the winter, with a third rig expected in early March. “We will likely add one rig every two or three months following, ultimately peaking at about five to six rigs running at the Utica to exit the year. Currently, we budgeted to…drill approximately 50 gross, 25 net wells for a total cost of approximately $215 million to $225 million.”

For 3Q2012, net income was $500,000 ($0.01/share) on oil and natural gas revenues of $60.5 million. A year ago the company earned $77.45 million ($1.63/share) on revenues of $160.3 million. Operating cash flow was $43.76 million versus $119.77 million a year earlier. The latest results included one-time costs related to its contribution to Diamondback of its Permian assets. Adjusted net income was $16 million (28 cents/share) versus $68 million ($1.21).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |