View more information about the North American Pipeline Map

Background Information about the Granite Wash Play

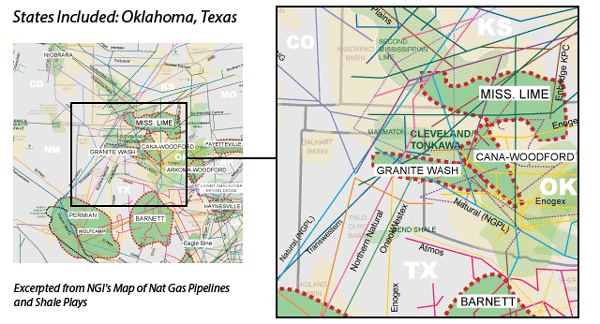

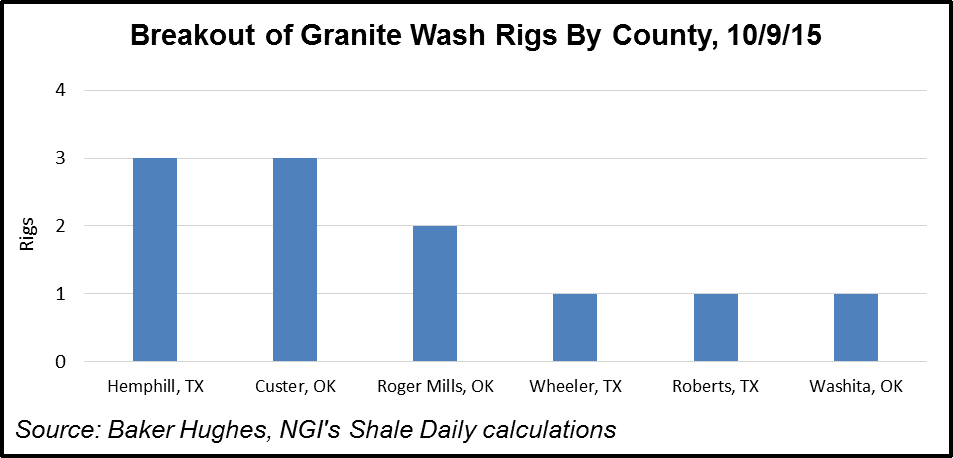

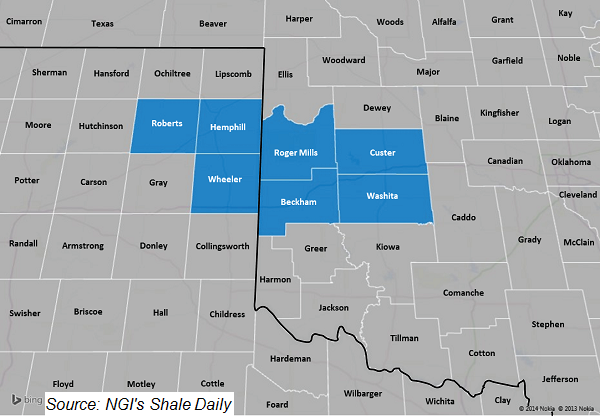

According to the American Association of Petroleum Geologists, the Granite Wash (GW) is a liquids-rich tight sands play about 160 miles long and 30 miles wide, covering parts of Western Oklahoma and the Texas Panhandle. We at NGI’s Shale Daily place the GW in Hemphill, Roberts, and Wheeler Counties, TX, and Beckham, Custer, Roger Mills, and Washita Counties on the Oklahoma side of the play.

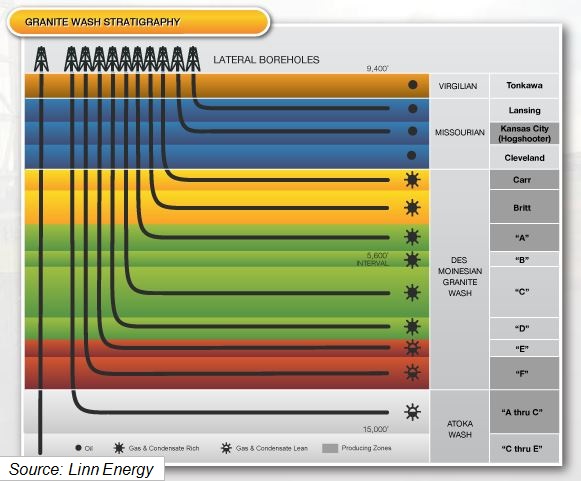

Even though there were already many existing wells in the Granite Wash area, the advent of horizontal drilling combined with hydraulic fracturing has given the decades-old play new life. Most producers’ earlier wells were vertical, drilled through the Granite Wash to targets in the Atoka or Morrow formations of the Anadarko Basin.

The Granite Wash is one of the deeper unconventional formations in North America, lying at depths between 10,000′-14,500′. There are a number of layered washes, or zones, within the GW. These zones are listed as “A,” “B,” and so on, as shown in the chart below. Gas in the Granite Wash tends to be liquids-rich, with natural gas liquids and condensate typically accounting for 30-40% of well production. Just below the Granite Wash is the Atoka Wash, which has five intervals of its own, but is more of a dry gas formation. Atop the Granite Wash are several oilier intervals, most notably the Tonkawa, Cleveland, Hogshooter, and the Marmaton (not pictured). For more information about these formations, please see the Oklahoma Liquids Plays page.

In 2009, Forest Oil COO J.C. Ridens explained the peculiarities of the Granite Wash. “The overall Granite Wash producing trend was set up by a mountain front originated from northwest to southeast,” Ridens said. “The Wichita mountain front became the source of deposition as the erosion of the mountains occurred, and these granitic sediments were deposited in a direction primarily southwest to northeast, and lobes coming off the mountains, thus the term ‘Granite Wash.’

“A very basic way to view this depositional environment is to lay your hand on the table, viewing your knuckles as the mountain front and your fingers as the lobes that were subsequently deposited. Much like your fingers, the lobes of the Granite Wash are fairly straight [and] do not exhibit the serpentine nature of mature stream channels, thus making the geology fairly predictable.”

“This significantly increases the value of this production strength,” Ridens said of the liquids output. The results give “us further confidence in the huge potential that this play has to offer. We estimate that a horizontal well here will recover about 6.5 Bcfe, compared to about 1.5 Bcfe for a vertical well. This means we are getting about four times the reserves for a little over twice the cost comparing a horizontal to a vertical well.”

In 2003, operators were drilling wells in the Granite Wash tight-sand gas reservoir with estimated ultimate recoveries of around 1 Bcf/well, according to the Oklahoma Geological Survey. But the switch to horizontal drilling in the play created some eye-popping results. Many initial horizontal wells drilled in 2008-2009 turned in 24-hour IPs in excess of 20 MMcf/d, which were similar to the gaudy results being registered in the Haynesville Shale at the time.

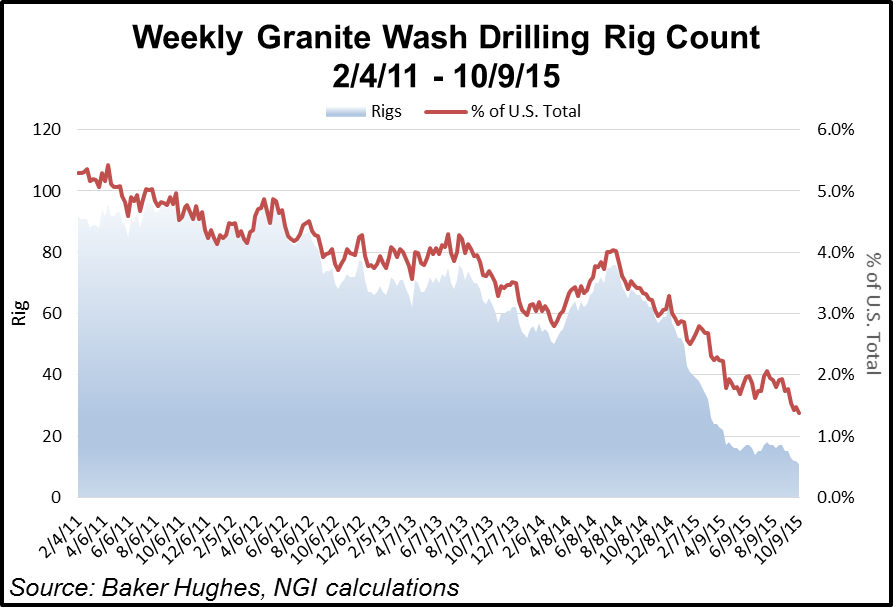

Initial horizontal efforts in the Granite Wash focused more on natural gas, but by 2014 operators had refocused their drill bits toward the shallower oily intervals within the Granite Wash area. In mid-2011, oil-focused rigs accounted for just 18% of the rigs working the play, but that number was closer to 65% in November 2014. More recently, rig counts in the Granite Wash have fallen precipitously. There were just 11 rigs operating in the Granite Wash in early October 2015, an 83% decline from the 64 rigs in the play a year earlier.

The Granite Wash had 8.8 Tcf of technically recoverable natural gas as of January 1, 2013, according to the Energy Information Administration.

Some of the largest operators in the Granite Wash are Apache, Chesapeake Energy (both directly and via its Granite Wash Trust), ConocoPhillips, Devon Energy, EnerVest, Marathon Oil, Sabine Oil & Gas, and Samson Resources.

Operators in the play haven’t been immune to the pitfalls associated with depressed commodities markets: in 2015, Houston-based Sabine, struggling with heavy debt and deflated oil/gas prices, filed for Chapter 11 bankruptcy protection (see Shale Daily, July 15, 2015). The independent, which also has significant operations in the Cotton Valley Sand and Haynesville Shale in East Texas, the Eagle Ford Shale in South Texas and the Haynesville in North Louisiana, expected to continue operations and “emerge with increased financial flexibility and a sustainable capital structure that will enable us to devote capital to grow our business,” said CEO David Sambrooks. And in November 2015, Chesapeake Granite Wash Trust, which owns royalties in Chesapeake wells in the play, cut its quarterly dividend by 9.7%.

Credit Suisse consistently listed the Granite Wash as one of the highest breakeven plays in North America in 2015, with a breakeven NYMEX price of ~$5.75/MMBtu. Furthermore, RBN Energy estimated in July 2015 that the typical Granite Wash well generated negative rates of return at that time, in the order of -2% to -6%.

Counties

Oklahoma: Beckham, Custer, Roger Mills, Washita

Texas: Hemphill, Roberts, Wheeler

Local Major Pipelines

Natural Gas: ANR, CenterPoint Energy, El Paso, Enogex, NGPL, Northern Natural, OGT, Oneok Westex Transmission, Panhandle Eastern, Southern Star, Transwestern

Crude Oil: Glass Mountain, Phillips 66

NGLs: Blue Line (ConocoPhillips), Southern Hills

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily