NGI Archives | NGI All News Access

Goodrich Spending Targeting Oil in Eagle Ford, TMS

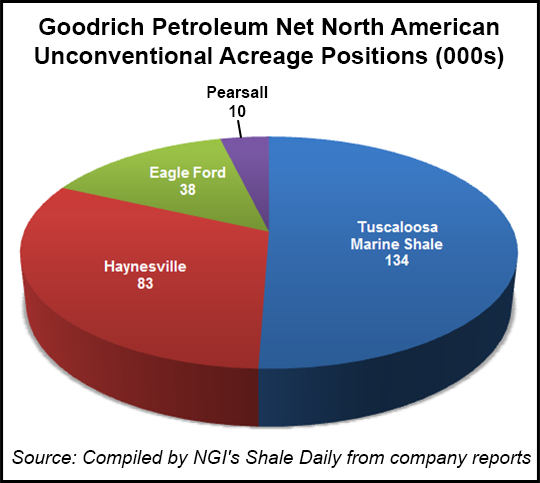

Goodrich Petroleum Corp. said Thursday it plans to spend between $175 million and $200 million on capital expenditures (capex) in 2013, most of which will go toward drilling for oil in the Eagle Ford Shale and Tuscaloosa Marine Shale (TMS), but a small portion will be spent on dry gas in the Haynesville Shale.

The Houston-based company said its preliminary capex budget includes $160 million to $185 million for drilling and well completions, and $15 million for leasehold and infrastructure expenses. Goodrich said it plans to drill or complete 44-48 gross (24-26 net) wells in 2013, about 85% of which will target oil.

“Our preliminary plans will allow us to achieve robust growth in oil production volumes over 2012, which will equate to approximately two-thirds of our projected revenue in 2013,” said CEO Gil Goodrich.

The company added that although it plans to be flexible with its capex allocations between the Eagle Ford and TMS, it will primarily focus its oil efforts in the Eagle Ford, spending between $115 million and $137 million there to drill 24-28 gross (16-19 net) wells. In the TMS, Goodrich plans to spend $25 million to $50 million to drill six to 10 gross (two to four net) wells.

In the Haynesville, the company will allocate $22 million to complete 13 gross (six net) wells that have previously been drilled.

For its 2013 production guidance, Goodrich estimates oil volumes will grow 40-60% over 2012. Natural gas volumes for 4Q2013 are also expected to be 10-15% higher from the previously issued guidance for 4Q2012, but it estimated that year/year (y/y) volumes would decline 10% between 2012 and 2013, and overall production per Mcfe would be relatively flat y/y. The company estimates oil volumes will make up about 30-30% of total production and 65-70% of revenue in 2013.

“Based on our current production and commodity price forecasts, we anticipate approximately 70% of our capex budget will be funded with cash flow from operations,” CEO Goodrich said. “This high level of cash flow to capex coverage should in turn allow us to maintain ample liquidity during 2013 as we execute a number of strategic corporate objectives.”

In the Eagle Ford, the company said average drilling days per well fell 40% from 3Q2012 to 4Q2012, to 11 days per average 6,000-foot lateral. Goodrich estimates gross well costs in 2013 will range from $7 million to $7.5 million per average 6,000-foot lateral. It credited faster drilling and cycle times achieved during 2H2012, as well as reduced pressure pumping agreements set for 2013, with bringing down well costs.

The company added that it plans to spud its first test well targeting the Pearsall Shale formation in 1Q2013. The Pearsall is a formation that underlies the Eagle Ford that is believed to include portions of Dimmit, Maverick and Webb counties in South Texas.

In the TMS, Goodrich said it was unable to repair a parted casing connection at the Denkmann 33H-1 well, which is located in Amite County, MS. Goodrich holds a 75% working interest (WI) in the well (see Shale Daily, May 24, 2012).

“While we are certainly disappointed that we were not able to repair the parted casing on the Denkmann [well], we are currently working on plans to sidetrack around the obstruction and redrill the lateral portion of the well,” CEO Goodrich said. “In addition, we are pleased with the drilling of the lateral in the Crosby 12H-1 well, have set and cemented production casing, and are anticipating completion results in the coming weeks in addition to our two nonoperated Ash wells.

“We also expect a number of additional completions and data points in the next couple of months which we believe will incrementally assist in demonstrating the economic viability of this emerging oil play.”

Goodrich has a 50% WI in the Crosby 12H-1 well, located in Wilkinson County, MS, and a 12% WI in the nonoperated Ash 31H-1 and 31H-2 wells, which are both in Amite County. The company plans to begin hydraulic fracturing operations at all three wells this month.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |