Publicly listed independent Goodrich Petroleum Corp. has agreed to be taken private by Paloma Partners VI Holdings LLC in a deal valued at roughly $480 million.

Paloma, an affiliate of EnCap Energy Capital Fund XI LP, plans to launch a tender offer to acquire for $23/share in cash all of Goodrich’s outstanding common stock.

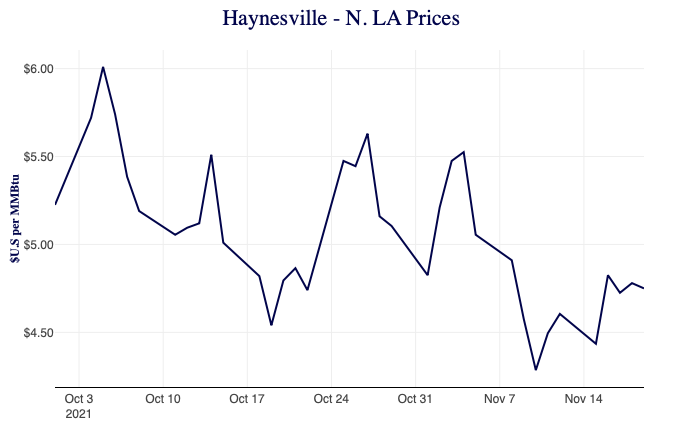

Goodrich operates primarily in the Haynesville Shale. The board has unanimously approved the offer price, which represents a roughly 7% premium to Goodrich’s closing price last Friday (Nov. 19), management said.

The tender offer is expected to be completed in December “and followed promptly by a second-step merger,” the company said. “Upon completion of the transaction, Goodrich will become a privately held company and shares of Goodrich common...