Shale Daily | Coronavirus | E&P | Earnings | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Goodrich CEO Strikes Upbeat Tone on Natural Gas Price Outlook

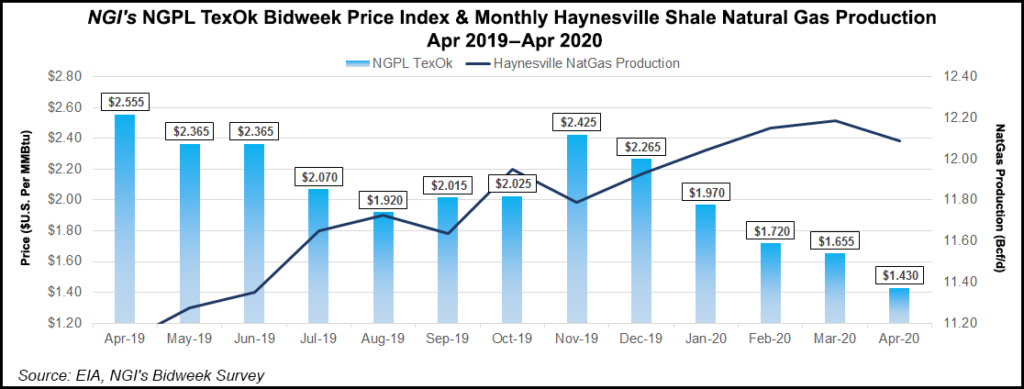

Goodrich Petroleum Corp. tapered production in the first quarter and further lowered its capital expenditures (capex) for 2020 in response to low natural gas prices spurred by a mild winter and amplified by the coronavirus pandemic that took hold in March.

However, the Houston-based independent, whose Haynesville Shale-heavy operations are weighted 98% to gas, said pullbacks in gas production and reduced oil drilling in response to the collapse in oil prices, are starting to produce pricing momentum.

“We are seeing the impact of the crude oil sell-off, including dramatic reductions in oil-directed rig count activity as well as crude shut-ins, which are reducing the amount of forecasted associated natural gas production,” CEO Gil Goodrich told analysts during a 1Q2020 earnings call Thursday. “This in turn has resulted in significant improvement in the forward-looking strip prices for natural gas…with calendar year 2021 strip prices now trading at approximately $2.70/Mcf.

“At the same time,” he added, “the steep decline in rig count is leading to materially lower bids for goods and services across the board,” for rig, pipe and fracture spread rates, “which cumulatively are reducing our average forecasted completed well cost by approximately 15-20%.

“The combination of the lower capex cost and improving natural gas strip prices have us encouraged and expecting we will be achieving even more compelling returns on our capital in the second half of the year and into 2021.”

Goodrich delivered a 12.5% return on capital invested for the first quarter.

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

Goodrich’s upbeat assessment echoed that of Frisco, TX-based Comstock Resources Inc., which works in the Haynesville and Bakken shales.

“While natural gas prices are expected to remain low in the near-term as we manage through an oversupplied market resulting from the winter heating season, we anticipate a much healthier supply and demand balance for natural gas later this year and in 2021,” Comstock CEO Jay Allison said in reporting 1Q2020 results.

Goodrich’s realized gas prices averaged $2.19/Mcf in the first quarter, when factoring in realized hedge gains on natural gas derivatives. The company said hedging would continue to play an important role the remainder of this year and into 2021.

“We are well hedged throughout the balance of this year with a combined 70 MMcf of gas hedged with a blended average floor price of $2.60/Mcf,” the CEO said on the call. “In addition, we recently took advantage of the significant improvement in the longer-term strip prices for natural gas by adding to our calendar year 2021 and early 2022 positions…We now have approximately 40% of our current production levels hedged throughout 2021 at a blended average price of approximately $2.55.

“While we expect natural gas prices to improve from here, we believe the current hedge position is prudent and provides appropriate downside and risk mitigation,” he added.

Goodrich pulled back on development in response to current low gas prices. It expects to generate free cash flow in 2020 and keep debt levels low. The company, which emerged from bankruptcy protection in 2016, had net debt of $106 million at the close of 1Q2020.

Production averaged 137 MMcfe/d (98% gas) in 1Q2019, up from 104 MMcfe/d (97% gas) a year earlier. However, production fell modestly from the prior quarter.

“We tried to maintain roughly flat production,” Goodrich said. That approach should continue “for the balance of this year, with a significantly reduced capex program.”

The midpoint production guidance for 2020 is 140 MMcfe/d (99% gas), down from 149.3 from earlier guidance. Capex is guiding to $40-50 million, down from $55-65 million previously.

Goodrich reported net income of $3.0 million (24 cents/share) for 1Q2020up from $400,000 (4 cents) a year earlier.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |