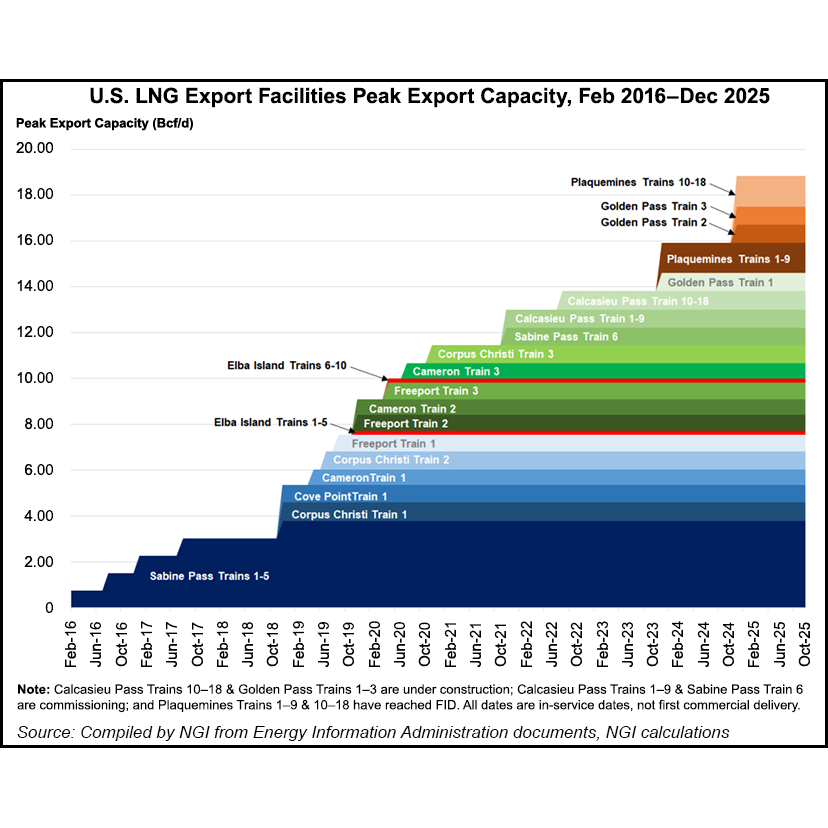

Golden Pass LNG remains on track to start production in 2024, when the first of three liquefaction trains is expected to start ramping up on the Texas coast.

The other trains are set to begin coming online at intervals about six months apart as commissioning continues, said Chief Commercial Officer Jeff Hammad on the sidelines of the North American Gas Forum in Washington, DC.

Hammad told NGI that he expects liquefied natural gas cargoes loaded at Golden Pass in Sabine Pass, TX, to be on the water by 2024.

The facility started service in 2010 as an import terminal. In 2019, QatarEnergy and ExxonMobil made a final investment decision to add liquefaction trains and export capabilities.

There are currently about 5,500 workers on site, Hammad said, adding that number would...