Extreme weather events, supply shortages, post-Covid-19 demand growth and technical failures gave rise to roughly 4% of the world’s population, roughly 350 million people, experiencing major power outages in 2021, according to IHS Markit researchers.

IHS Markit analyst Rama Zakariasaid some of the largest outages occurred in regions with a relatively reliable supply of energy, including the United States and China.

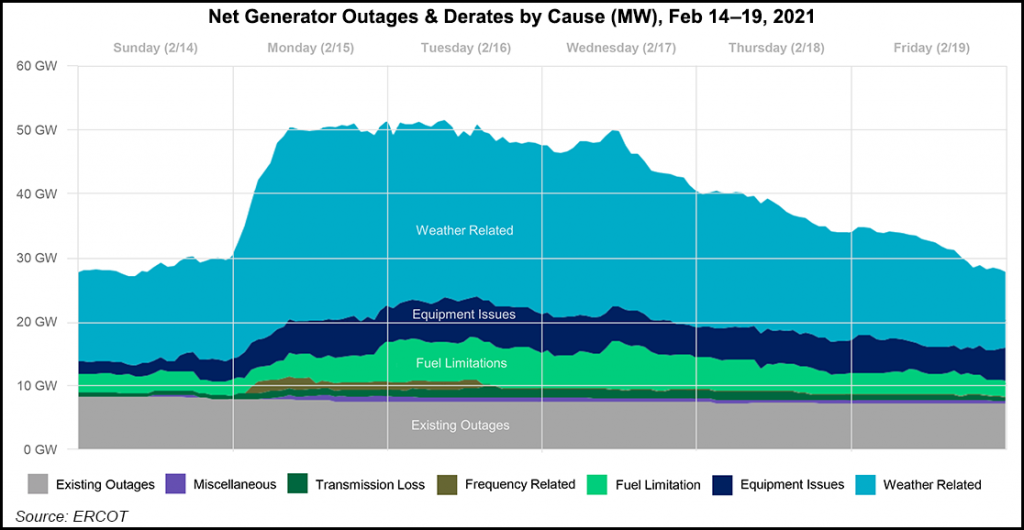

For example, IHS Markit estimated that Winter Storm Uri in February 2021 left more than five million without power in the south central United States, with most of the outages occurring in Texas. The Electric Reliability Council of Texas (ERCOT), the grid operator for around 90% of the state, noted that about 10,500 MW of customer load was shed at the highest point...