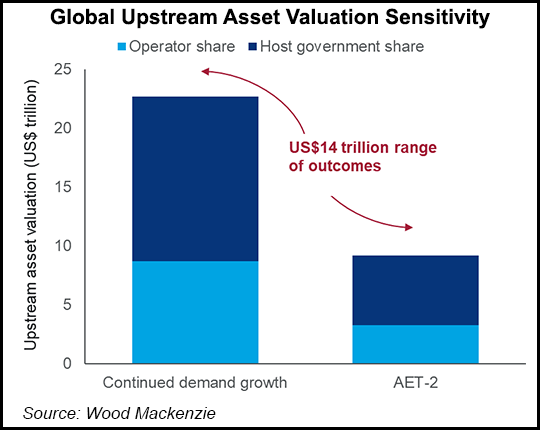

The transition to a net-zero carbon future puts uncertainty into an estimated $14 trillion worth of upstream oil and natural gas assets, with no assurance that demand will continue to rise, according to analysts.

The industry, whose fortunes are tied to discoveries, consumption and price volatility, has seen its risks “tempered by a single tenet, that demand would continue to rise indefinitely,” Wood Mackenzie analysts said. “As the energy transition gathers momentum, that belief has all but evaporated.”

While global oil demand is forecast to increase for another decade or more, there is growing pressure to limit global warming to 2 degrees C by 2050. The International Energy Agency, the global energy watchdog, said Tuesday no more oil and gas field developments should...