Shale Daily | E&P | NGI All News Access

Global, Oil, Gas Execs Eye Dealmaking in 2019, with Focus in U.S., Canada

Most global oil and gas executives expect to make deals to buy or sell assets in 2019, nearly 10% above the global average, with most of the activity likely to be in the United States, spurred by onshore transactions, and in Canada, according to a recent survey.

The 19th EY Oil & Gas Global Capital Confidence Report found that 55% of energy executives are contemplating mergers and acquisitions (M&A) in the coming year. EY refers to the global organization of the member firms of Ernst & Young Global Ltd.

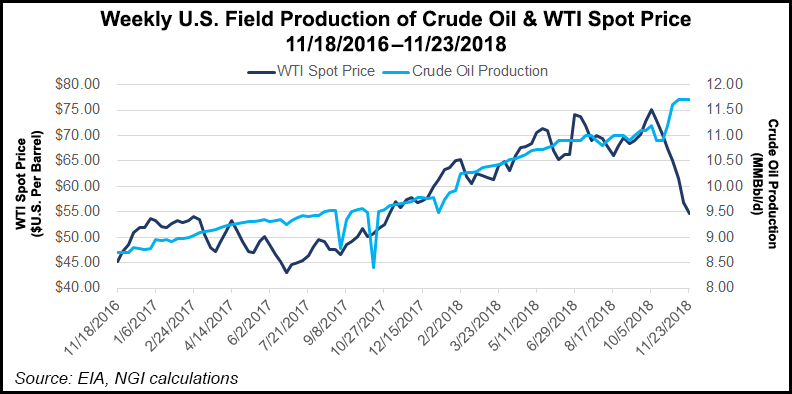

The uptick in oil prices — at least during 3Q2018 — increased executive confidence and even though prices now are well below the highs achieved between July and September, there’s still optimism about the ability to make deals.

West Texas Intermediate crude oil prices have fallen sharply in recent weeks, with oil prices hovering around the $50/bbl mark early Thursday. However, third quarter crude averaged $70.98/bbbl in July, $68.06 in August and $70.23 in September, according to the Energy Information Administration.

“Notwithstanding the recent pause in the oil price recovery, we see continued confidence in market fundamentals, companies’ earnings outlooks, availability of credit and equity values,” EY researchers said.

Geographically, the United States is the top oil and gas investment destination, executives said. Going forward, North American shale and tight oil and gas plays are likely to receive the most investment in driving M&A activity, the survey found.

Improved prospects for the development of liquefied natural gas (LNG) export projects helped push Canada into second position. The Royal Dutch Shell plc-led LNG Canada export project is moving forward on British Columbia’s west coast to move gas supply to Asia Pacific markets.

After the United States and Canada, other countries considered to have improving M&A prospects are, in order, the UK, Norway and the United Arab Emirates.

The global “oil and gas deal appetite remains robust, as disruptive forces including geopolitical uncertainty and the energy transition drive oil and gas executives to intensify portfolio reviews,” the EY survey found.

More than half of the executives (59%) surveyed said they scrutinize their portfolios at least every six months. Companies are positioning for a new “medium-term supply-demand dynamic” and plan to improve their responsiveness to evolving energy technologies, EY noted.

About 44% of the respondents cited regulatory and policy uncertainty as the biggest potential threats to dealmaking, even while all (99%) believe global economic growth remains stable or is improving.

A full 80% expect the global M&A market to improve in the next year, which is up from 64% six months ago.

“Global oil and gas sector confidence in market fundamentals, earnings outlooks, availability of credit and equity values remains strong,” EY’s Andy Brogan, global oil and gas transactions leader said. “Leaders are responding proactively to uncertainty around the energy transition, geopolitical issues and the oil price outlook by taking steps to plan for multiple future scenarios.”

More than half (58%) of the executives who responded to EY’s survey said they are “stress testing strategies and financial resilience,” as well as “taking the opportunity to identify assets to sell that are either underperforming or at risk of disruption.”

Portfolio optimization is said to be the key driver for increased M&A activity, and 76% expect more competition for assets from the private equity buyers that have fueled most of the U.S. onshore dealmaking in recent years.

Conversely, nearly all (95%) of the executives who responded to the survey said they have either failed to complete or canceled a planned acquisition in the last 12 months, as the “valuation gap, government intervention and policy concerns” thwarted their M&A aspirations.

“Looking ahead, we expect to see more activity from private equity and rising cross-sector M&A driven by technology and digital,” Brogan said. “Businesses are also finding cross-sector companies attractive as they boost investments in renewables, battery technology and mobility.”

However, revamped regulations and trade uncertainty “mean that the sector will mainly be looking closer to home for deals,” he added. “While recent price volatility may lead companies to reassess their medium-term outlook, it is encouraging that this starts from a position of confidence.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |