LNG | LNG Insight | Natural Gas Prices | NGI All News Access

Global Natural Gas Prices Give Up Gains on Warmer Weather — LNG Recap

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

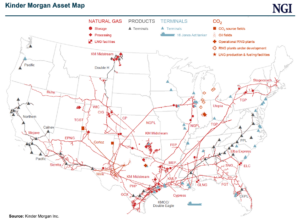

Producers of natural gas may be struggling with low prices, but for pipeline operators like Kinder Morgan Inc. (KMI), the outlook is anything but bearish. The Houston-based midstreamer, which transports about 40% of the natural gas consumed in the United States, kicked off the first quarter earnings season with stellar results and a positive message…

April 18, 2024Infrastructure

Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.