Markets | LNG | NGI All News Access

Global LNG Trade Sets Record Annual Increase on U.S., Australia Exports

The liquefied natural gas (LNG) trade climbed to 38.2 Bcf/d worldwide last year, nearly 10% higher than in 2016 and the largest annual increase on record, according to the International Group of Liquefied Natural Gas Importers (GIIGNL).

Worldwide, imports last year reached 289.8 million metric tons (mmt), up by 26.2 mmt or 9.9% higher than in 2016 and the strongest growth rate since 2010. The number of exporting countries remained at 19, while one country, Malta, joined the import community to bring the number of LNG-importing countries to 40, the nonprofit said in its annual report.

Five onshore liquefaction trains were commissioned last year: two in Australia (Gorgon Train 3 and Wheatstone Train 1); two in the United States (Cheniere Energy Inc.’s Sabine Pass Trains 3 and 4); and one in Russia (Yamal LNG). A floating LNG (FLNG) unit also was commissioned in Malaysia.

“The surge in LNG supply was driven by new production from Australia (10.7 mmt) and from the United States (9.6 mmt) as well as by better performance of existing liquefaction plants in Algeria, Angola and Nigeria (6.2 mmt),” according to GIIGNL researchers.

During the first quarter, Cheniere exported 67 LNG cargoes from Sabine Pass in Cameron Parish, LA, a 56% increase year/year. It also delivered 30 cargoes totaling more than 2 mmt. Through April 30 year-to-date, about 90 cargoes had been produced, loaded and exported.

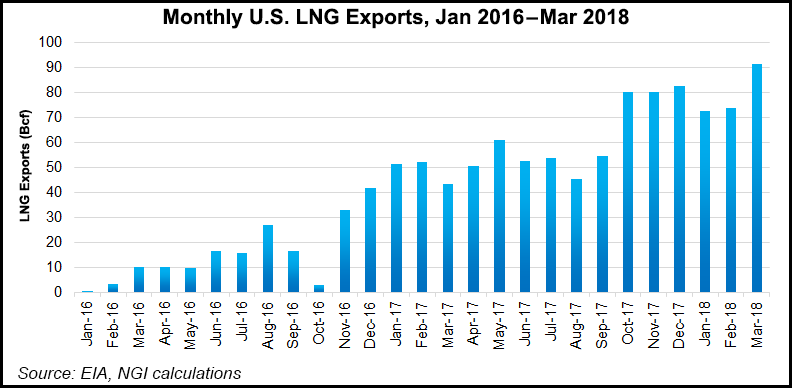

U.S. exports topped 1.94 Bcf/d last year, sharply higher than the 0.5 Bcf/d in 2016, with all of the shipments originating from Sabine Pass, according to the U.S. Energy Information Administration. The United States is forecast to add about 6.05 Bcf/d of capacity by 2021, which would be in addition to the 3.5 Bcf/d now in operation.

The Elba Island LNG project in Georgia this year is set to commission six of 10 small modular liquefaction trains, with a combined capacity of 0.2 Bcf/d. In the next three years, trains are expected to come online at Cameron LNG in Louisiana and at two Texas projects, Freeport LNG and Corpus Christi LNG. Freeport LNG has delayed startup for its three-train project, with commercial operations beginning sequentially for the trains in the second half of 2019 into the first half of 2020. Cheniere sanctioned Corpus LNG in May.

The United States also is projected to become the third-largest LNG exporter in the world by 2020, behind only Australia and Qatar.

According to GIIGNL, the Pacific Basin last year still was the largest source of supply with 131.4 mmt, or 45.3% of the global market, followed by the Middle East (31.5%) and the Atlantic Basin (23.2%). The Atlantic Basin’s LNG volumes are expected to rise as new liquefaction plants come online in the United States.

“Despite several delayed start-ups, new liquefaction capacity continued to come online in various areas of the world, ranging from the United States to Australia, Malaysia and Russia,” which led last year to a 26.2 mmty increase in LNG supply from 2016, said GIIGNL President Jean-Marie Dauger.

“Meanwhile, expectations of an LNG surplus and of depressed prices have not materialized, as rising imports into China contributed substantially to balancing the market.”

With gains expected in U.S. LNG exports, the supply build-up ahead “could further transform our industry and bring on new evolutions, including a rise in market liquidity and flexibility,” he said.

“New commercial instruments are implemented to adapt to the new realities of the markets as some traditional ones — such as destination restrictions — tend to be progressively shelved. As aggregators and traders take a greater share of the market, the break-up of the traditional value chain is gathering pace.”

Spot LNG prices last year followed the same seasonal profile as in 2016, although an increase in prices late in 2017 was stronger on higher-than-expected Chinese demand and colder-than-normal weather in Northeast Asia. Contract LNG prices also increased because of higher oil prices, while spot charter rates finished 2017 “on a bullish note,” driven by demand for ships to transport U.S. gas.

The current contracting and pricing environment may be challenging for new supply developments, however. While two projects were sanctioned in 2016, only one LNG facility received a positive final investment decision last year: Coral FLNG. ExxonMobil Corp. and Eni SpA last year sanctioned Coral in Mozambique in the same region as an export project underway by Anadarko Petroleum Corp. Together the two Mozambique projects could make the southeastern African nation the world’s fourth-biggest gas exporter.

Even with “competitive” LNG prices, however, “practical commercial and regulatory challenges still need to be overcome in order for new importers to develop LNG import infrastructure,” in light of only Malta joining the importer group last year, Dauger said.

Besides the United States and Australia, other countries contributing to exports in 2017 included Angola, Nigeria, Malaysia, Algeria, Russia and Brunei, which offset declines in exports from Qatar, Indonesia, Norway, Peru, the United Arab Emirates and Trinidad.

Mexico’s LNG import trade increased by 17% year/year as domestic production continued to decline and infrastructure construction was delayed to connect the domestic grid to gas pipeline exports from the United States.

Asian countries led the growth in global gas imports during 2017, accounting for almost three-quarters (74%), or 2.6 Bcf/d, of last year’s growth. Japan remained the largest importer during 2017 at 11 Bcf/d.

China in 2017 also overtook South Korea as the world’s second largest importer as the Chinese government works to restrict coal use to reduce pollution.

“Our industry seems to experience an acceleration of change, and 2017 was indeed a year for pioneers: first FLNG plant online, first LNG bunkering vessels operating in Europe and first LNG exported from the Arctic region,” Dauger said. “As meaningful, the first large order of nine LNG-fueled containerships indicated that new market sectors are ready to embrace LNG and paved the way for the worldwide implementation of LNG as a solution to reduce marine pollution.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |