Markets | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Global LNG Investment Hits New Record of $50B, Says IEA

Japan’s Minister of Economy, Trade and Industry (METI) Isshu Sugawara said Thursday $10 billion would be invested in liquefied natural gas (LNG) projects worldwide by the country’s private and public sectors.

Financing is to come from various sources, including the Japan Bank for International Cooperation, as well as investment from state-backed Japan Oil, Gas and Metals National Corp., along with trading houses and financial institutions. Government owned Nippon Export and Investment Insurance would offer full coverage for LNG-related financing provided by foreign funds and other institutional investors.

“On top of Japan’s commitment two years ago of investing or financing more than $10 billion in energy supply chains, we are making a fresh commitment of additional and collective $10 billion funding from both public and private sectors,” Sugawara said.

Japan met its 2017 target by investing in large-scale LNG projects, including the LNG Canada project, partly funded by Mitsubishi Corp., as well as Mitsui & Co.’s investments in Novatek’s Arctic LNG 2 project and the Mozambique LNG project.

As a part of Japan’s effort to broaden the use of LNG, it also plans to train 500 experts in LNG technology, Sugawara said. “By making these commitments to help develop the global LNG market, Japan will work hard to reinforce global energy security,” he said. Since 2017, Japan’s METI has trained 400 LNG experts.

Japan’s continued investment in global LNG infrastructure is part of a strategy to boost the global LNG market and reinforce energy supply security. It also shows how far the country has come from the aftermath of the 2011 Fukushima Daiichi nuclear meltdown that subsequently saw all of the country’s 54 nuclear reactors needed for power generation taken offline.

The following two years after the Fukushima disaster saw Japan become increasingly reliant on LNG for power generation in a market where supply was limited, with increasingly high prices for both contract and spot prices.

Spot prices for LNG in the Asia-Pacific region, home to around two-thirds of global LNG demand, finally breached the $20/MMBtu price point in February 2014, the same year that Japan’s LNG imports reached a record high. However, over the next three years, due to a ramp up in LNG production in Australia, the United States, Russia and elsewhere prices flattened out again.

Now, an historic supply overhang of the fuel from even more production has been keeping downward pressure on prices. Spot prices for LNG in Asia hit the $4/MMBtu price point earlier this year, a three year low, and are projected to remain under pressure even as winter approaches, which typically sees a marked increase in prices for the fuel in the region and stronger demand.

Because of changing LNG market conditions, several Japanese utilities as well as JERA, a joint venture between Tokyo Electric and Power Co. and Chubu Gas, have become major traders and resellers of the fuel in both Asia and globally.

Japan’s investment pledge comes as global investment in LNG reaches a record high this year. The International Energy Agency (IEA) said Thursday record investments of $50 billion have turned 2019 into a banner year, with North America the main driver.

“This year, 2019 already broke the highest amount” for final investment decisions “for the first time ever, $50 billion,” Executive Director Fatih Birol said. “The industrial sector in Asia is the biggest driver of LNG, with China set to overtake Japan as the world’s top LNG importer in a few years.”

“The biggest growth is coming from China. In the next five years, about one-third of global LNG demand will come from China alone.”

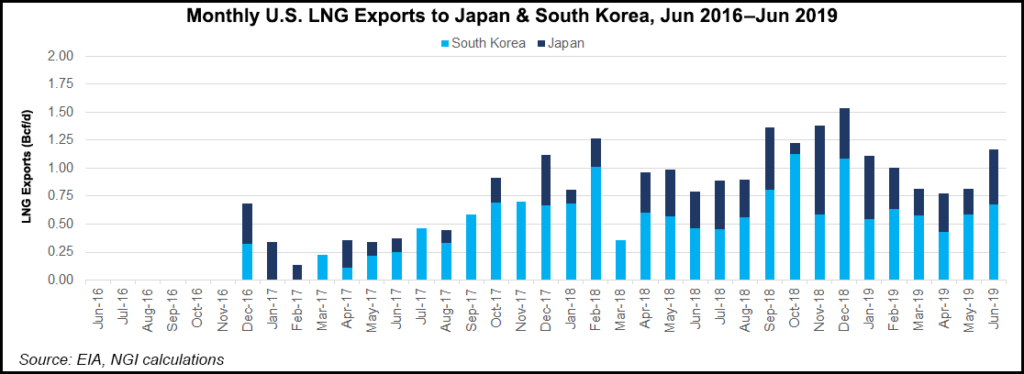

Japan, and South Korea are expected to remain important, but slowing growth in the region means the biggest contributor to LNG growth will come from China, Birol added.

Currently, Japan is the world’s top LNG importer, followed by China, South Korea, India and Taiwan. New LNG demand growth also is to come from Pakistan, Bangladesh, Vietnam, the Philippines and Thailand as these countries all grapple with domestic gas production shortages and economic growth.

European LNG imports will also increase as domestic gas production declines and nations diversify supply, while the United States will make up two-thirds of global growth in LNG exports, Birol said. This could turn pricing dynamics in Asia toward more gas-linked, rather than oil-linked LNG contracts. Currently, long and mid-term LNG contracts in Asia are still usually linked to a Brent crude oil indexation.

About 70% of LNG contracts are oil-indexed, with the rest geared to gas. That could soon change to a 50-50 pricing mix, Birol said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |