Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Global LNG Demand Set for Another Sharp Increase in 2019, Says Shell

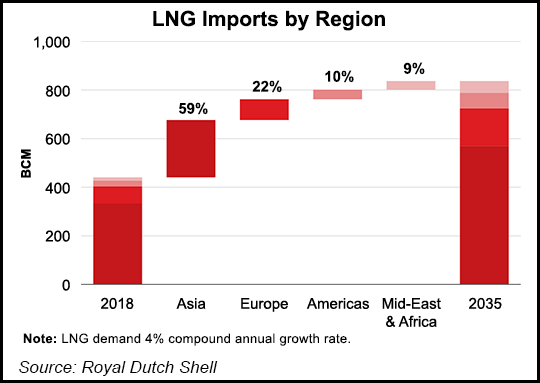

Strong demand in Asia is driving rapid growth in liquefied natural gas (LNG) use, with global consumption on track to rise sharply again this year after climbing by 27 million metric tons (mmt) in 2018, according to Royal Dutch Shell plc.

In its annual LNG Outlook, Shell said consumption worldwide last year increased to 319 mmt, with global supply set to increase by 35 mmt this year.

Demand is forecast to rise to 384 mmt in 2020, according to the supermajor, one of the world’s largest gas producers and LNG suppliers. The LNG trade in 2000 was estimated at 100 mmt.

Europe and Asia are expected to absorb all of the additional supply this, according to Shell’s research.

In addition, a rebound in new long-term LNG contracting last year may “revive investment in liquefaction projects.” However, based on current demand projections, LNG supply is still seen tightening in the mid-2020s.

Ongoing efforts to improve urban air quality by shuttering coal-fired plants saw China’s imports of LNG surge by 16 mmt in 2018, up by 40% year/year. And on the supply side, Australian LNG exports caught up with those of long-time leading supplier Qatar toward the end of 2018 and are expected to rise by 10 mmt in 2019.

Both Australia and China are considered “well positioned to supply rapidly developing

economies across Asia with gas they need to improve air quality by displacing coal-fired power and heating,” researchers noted.

“The continued surge in Chinese LNG imports has helped improve air quality in some of its biggest cities over the last few years,” said Shell’s Maarten Wetselaar, director of Integrated Gas and New Energies. “China’s success in making the air cleaner for millions of people shows the critical role that natural gas can play in providing more and cleaner energy to the world.

“We saw Asian LNG demand growth exceed expectations again in 2018 and we expect this strong growth to continue. Investment in new supply projects is picking up, but more will be needed soon.”

Shell’s majority owned (67.5%) Prelude floating LNG facility in Australia, considered the world’s largest floating project, opened some wells in December. The project is designed to produce 3.6 mmt/year (mmty), with exports directed to Asia Pacific markets.

Shell is also majority owner of LNG Canada, sanctioned last year for the British Columbia coast. LNG Canada is now tracking to be online and shipping to Tokyo Bay by the mid 2020s. Initially, the project is to consist of two liquefaction trains that together would provide 14 mmty.

An increasing number of countries have turned to gas to meet their growing energy needs in the last few years as they look for ways to reduce emissions. LNG shipments have grown in tandem, as pipelines are lacking in many parts of the world.

Meanwhile, LNG projects typically require long-term sales agreements to secure financing before they move forward.

“From 2014 through 2017, LNG buyers had increasingly been looking to sign shorter, smaller and more flexible contracts,” researchers noted. “Shell warned in its 2018 LNG outlook

that this mismatch between suppliers and buyer needs would have to be resolved to enable developers to go ahead with new projects.”

In a positive sign for the long-term health of the global LNG market, the average length of contracts signed more than doubled to about 13 years in 2018 from six years in 2017, Shell noted. “Meanwhile, the total contracted volume more than doubled to almost 600 mmt in 2018.”

The United States is becoming a huge player, third behind Qatar and Australia.

The Federal Energy Regulatory Commission last week said it had “reached an agreement that may provide a path forward” for considering more LNG export terminals, quickly applying the new approach to approve Venture Global’s 10 mmty Calcasieu Pass export project in Cameron Parish, LA.

For Calcasieu Pass, the Commission used a new approach to consider direct greenhouse gas emissions from LNG facilities. “A multi-pronged approach to improve its process in recent months has put it in a position to move forward more efficiently with a dozen other pending LNG projects,” said Chairman Neil Chatterjee.

NGI last month launched the U.S. LNG Export Tracker, and accompanying Natural Gas Volumes historical chart, to provide a more comprehensive view of the burgeoning market. The new tracker is designed to enable readers to get a headstart on when various LNG trains enter commissioning and commercial operation stages, as well as show any significant changes in feed gas deliveries from factors like planned maintenance or unplanned outages.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |