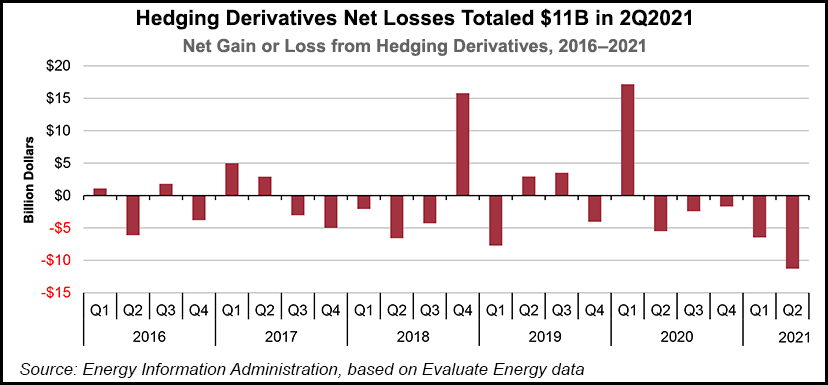

Global oil and natural gas explorers made some wrong-way bets on the direction of commodity prices during 2Q2021, with hedging losses for 90 of the biggest U.S. and overseas producers totaling $11 billion, the Energy Information Administration (EIA) said Wednesday.

The net hedging losses among the world’s largest exploration and production (E&P) companies were the largest in the 2016-2021 period, the EIA’s Petroleum and Liquids Fuels Markets team said in a note.

“In this study of 90 companies, the combined petroleum liquids production level decreased 3% in 2Q2021 from 2Q2020, and natural gas production remained the same,” the EIA researchers said.

The findings are part of a financial review of the global industry’s performance between April and June. During the...