International | LNG | LNG Insight | NGI All News Access

Germany’s RWE Halts New Contracts for Russian Natural Gas

RWE AG said Tuesday it would not sign new energy supply contracts with Russian counterparties, joining a list of companies that have halted business as sanctions increase following the Kremlin’s decision to invade Ukraine.

RWE, a major German energy provider, also said it would end non-energy supply business with Russian entities immediately.

In keeping with Europe’s plan to gain independence from Russian fossil fuels by 2030, RWE added it could bring back or extend coal capacity at the government’s request and plans to ensure high levels of natural gas in storage ahead of winter. Over the longer term, RWE said it would accelerate its energy transition to renewables and diversify gas supplies. The company is a partner in the proposed 8 billion cubic meters/year liquefied natural gas (LNG) terminal in Brunsbuttel near Hamburg.

RWE also has a long-term natural gas purchase agreement with Russia’s Gazprom PJSC. The agreement allows contractual changes to be negotiated depending on market conditions during price reviews, “should it remain effective,” the company said. Management added that how the war in Ukraine would impact the contract “remains to be seen.”

Russian Gas Flowing

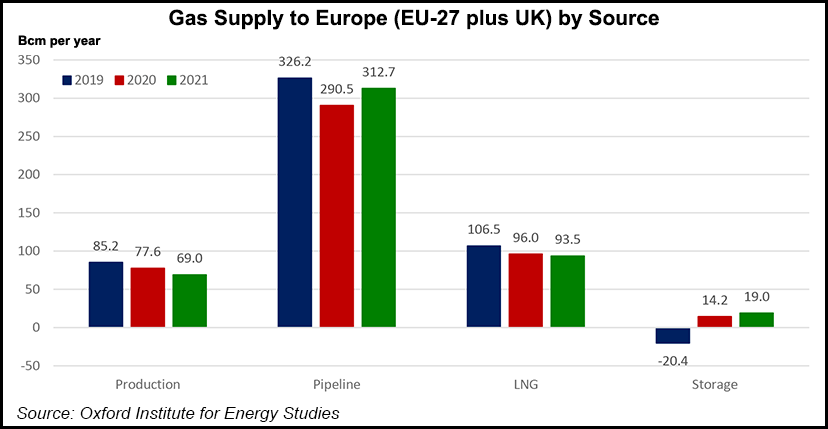

Russian natural gas flows to Europe have remained strong since the conflict started late last month, but the market is on edge about the possibility of supply disruptions given its heavy reliance on Russia for natural gas. The continent last year secured 45% of its natural gas imports from Russia.

RWE’s announcement came the same day that Japan’s Koichi Hagiuda, minister of Economy, Trade and Industry, said a the country would work to cut its dependency on Russian energy supplies, including the possibility of expanding LNG investments elsewhere.

Equinor ASA also said Monday it would stop trading in Russian oil. The company’s decision expands on its announcement last month to stop new investments in Russia.

A coterie of other Western energy companies, including BP plc, ExxonMobil, Shell plc and TotalEnergies SE is planning no new investments in Russia and would exit the country. Another major German energy company, Uniper SE, also recently said it would not enter into new long-term supply contracts for Russian natural gas.

Talks between Russia and Ukraine continued Tuesday as the prime ministers of the Czech Republic, Poland and Slovenia traveled to Kyiv, Ukraine to pledge the European Union’s (EU) support. The Kherson region of Ukraine was also said to be under control of Russian forces, which could strengthen its position to take the strategic port city of Mykolaiv.

After falling from record highs over much of the last week, the European benchmark Title Transfer Facility closed higher Tuesday, when the prompt contract gained about 20 cents to finish around $37/MMBtu. The possibility of a cut in Russian supplies or more stringent sanctions directly targeting Russian gas exports has created extreme volatility in the market.

More Restrictions Imposed

The EU on Tuesday announced a fourth package of restrictive measures against Russia, including what it said is a far reaching ban on new investment across the Russian energy sector. Excluded from the ban is transporting certain energy products to the EU.

“The current situation highlights just how dependent Europe is on energy imports,” data and analytics firm Kpler said in a research note on Tuesday.

Physical trade flows from Russia to Europe remain high despite the self-sanctioning announced by countries across the world to limit dealings in the country. Kpler said current imports were agreed to weeks before the invasion.

Russian LNG arriving in Europe hit a new 10-day rolling average this year on March 13. Kpler also said Europe’s imports of crude oil and refined products have not declined since the incursion began. Imports of refined products, such as diesel and gasoline, into the region are at the highest level in the last six years, according to Kpler.

“It is hard to see what could be done, outside of sanctions that include energy exports, that would lead to any different outcome than the ongoing destruction of an independent nation,” Kpler added. “The imposition of scaled sanctions on Russian commodities would directly impact the foreign income needed to keep the economy running.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |