International | Infrastructure | LNG | LNG Insight | NGI The Weekly Gas Market Report | Regulatory

Germany Revives LNG Import Plans to Cut Reliance on Russian Natural Gas in Marked Policy Shift

Germany has revived its liquefied natural gas (LNG) import plans to reduce dependency on Russian natural gas, following Russia’s invasion of Ukraine.

Germany’s energy strategy to phase out coal-fired power plants by 2030, and to shutter its nuclear power plants by the end of this year, has left the country with few alternatives to meet the country’s energy demand.

“The events of the last few days and weeks have shown us that a responsible and forward-looking energy policy is not only crucial for our economy and our climate, but also crucial for our security,” Chancellor Olaf Scholz said in a speech in German Parliament over the weekend. The government has decided to “quickly build two LNG terminals, at Brunsbuettel, and Wilhelmshaven,” Scholz said.

Three proposed LNG import projects for Germany are in various stages of development, including a floating terminal at Wilhelmshaven, German LNG (GLT) at Brunsbuttel; and the Hanseatic Energy Hub (HEH) at Stade.

German utility Uniper SE had previously proposed a 10 billion cubic meters (Bcm) per year floating terminal near the German port of Wilhelmshaven, but canceled it last year, opting to build an ammonia terminal. The German government, according to local news media reports, has now asked Uniper to revisit its LNG terminal plans.

“Uniper is currently examining the possibility of resuming plans for an LNG terminal in Wilhelmshaven,” Uniper spokesperson Linda Patricia Jaram told NGI “The site has excellent logistical prerequisites, and Uniper has already undertaken a lot of preliminary work and planning steps for a floating terminal in recent years.”

Uniper is also investigating the possibility of further increasing its LNG import capacity into the Netherlands before the end of the year, the company said in a statement. In 2021, Uniper had planned to invest in a capacity expansion of 1.0 Bcm/year at the Gate terminal to bring total capacity to 13.5 Bcm/year by 2024.

A second project, the 8 Bcm/year GLT terminal in Brunsbuttel, near Hamburg, was originally planned to be operational by the end of 2022. But the project stalled in late 2021, when one of the three partners, Dutch storage company Royal Vopak NV, pulled out of the project, leaving two partners, Dutch gas grid operator NV Nederlandse Gasunie and Germany’s Oiltanking GmbH.

Although the previous German government supported the GLT project, no federal funding had been committed. But plans have suddenly changed.

“The new Federal Government had already stated in its coalition agreement that a diversification of energy supply and also energy imports in the future are necessary. This is precisely the purpose of the infrastructure we are planning,” GLT spokesperson Katja Freitag told NGI.

“Talks with the German government about the construction are in the final stage,” Gasunie said in an email. “Gasunie hopes to start construction of the terminal before the end of the year.”

The 12 Bcm/year HEH onshore LNG terminal proposed for Stade in Northern Germany is also ready to move forward with its plans.

“German Chancellor Olaf Scholz has made clear the strategic importance of LNG terminals for the future security of supply in Germany. We are prepared to rapidly build a future-flexible energy infrastructure with the LNG terminal in Stade,” HEH’s Danielle Stoves, commercial and regulatory director, told NGI

“The technical planning has been completed. All permitting documents are close to completion and the bidding process for the general contractor has already begun,” Stoves said.

“We are taking the Chancellor’s clear commitment to complete our processes swiftly,” she said. “The approval documents for the terminal and the port are currently being finalized and can be submitted for the terminal at the end of March and for the port at the end of April.”

HEH would be a zero-emissions project with infrastructure approved for biomethane LNG and synthetic methane. HEH partners include Belgian infrastructure company, Fluxys, Swiss private equity firm, Partners Group AG, and German Logistic services, Buss Group GmbH & Co KG.

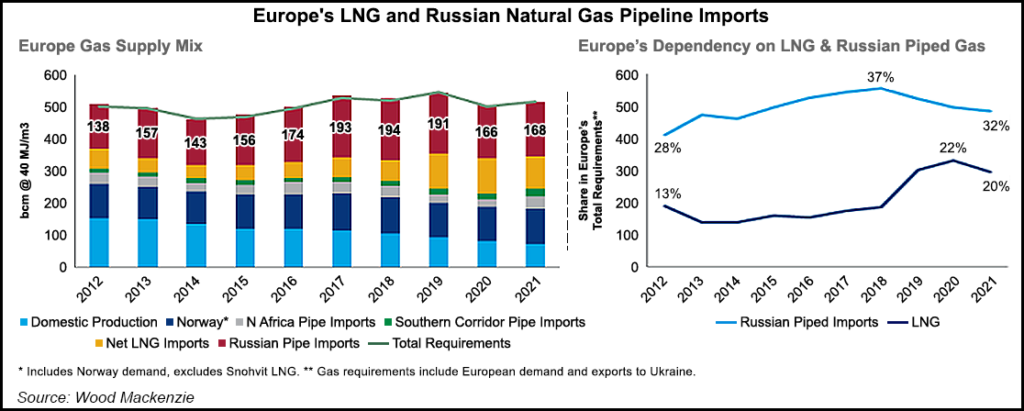

Germany is Europe’s top gas consumer, but it has no regasification facilities to receive LNG. The country imports more than 90% of its gas via pipeline to meet demand and relies on Russian supplies to meet more than 50% of the country’s energy demand.

Vortexa Ltd.’s Felix Booth, head of LNG, told NGI that while the terminals couldn’t entirely replace Russian pipeline gas in the country’s energy mix, they could significantly boost LNG demand on the continent over the next five years.

Last week, Germany also halted the certification of the 55 Bcm/year Nord Stream 2 pipeline, which is complete and ready to move more gas from Russia to Germany. The system needs German and European Union approval to start up. Given the move, Germany is moving quickly to diversify its energy suppliers.

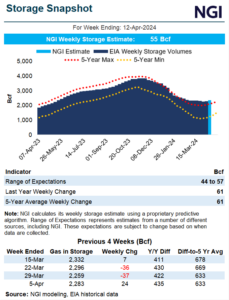

Scholz said the government would consider increasing natural gas stocks by 2 Bcm, to store in Germany’s 23 Bcm of underground caverns, which are currently at about 30% of capacity, according to Gas Infrastructure Europe data.

Under new legislation proposed Monday by the Federal Ministry of Economic Affairs and Climate Action, the country would require storage facility owners to have 65% of gas stocks filled by August, 80% filled by October and 90% filled by December.

Germany may extend its deadline to phase out coal planned for 2030 — and is deciding whether to extend the lifespan of the country’s three remaining nuclear power plants. The country would also aggressively expand wind and solar power under the proposed legislation.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 1532-1266 |