Regulatory | Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Gazoduq Quebec LNG Project Facing Big Regulatory Hurdles as Assessments Begin

Formidable regulatory hurdles are awaiting the C$5 billion ($3.8 billion) supply pipeline, Gazoduq Quebec, proposed for the French Canadian attempt at liquefied natural gas (LNG) exports as an extended federal and provincial environmental assessment begins.

The list of approval requirements alone fills a 183-page instruction manual for hearings by a combined panel of the Impact Assessment Agency of Canada (IAAC) and the Bureau d’audiences publiques sur l’environnement du Québec (BAPE).

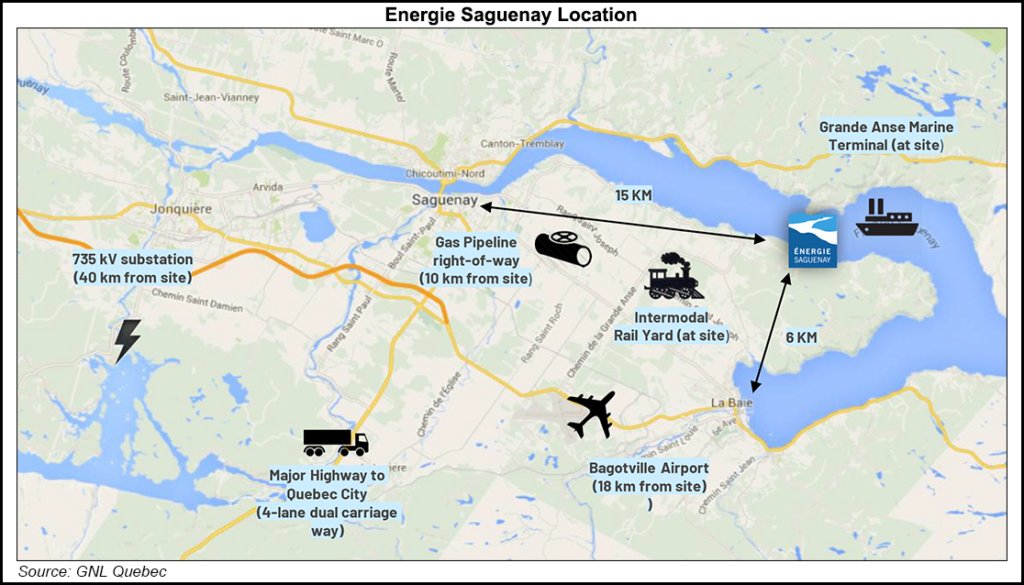

Gazoduq stands out as the first pipeline test case for a Canadian regulatory green new deal, the Impact Assessment Act, with its plan to carry up to 1.8 Bcf/d across 470 miles of Ontario and Quebec to the proposed Energie Saguenay LNG terminal.

The federal act replaced the Canadian Environmental Assessment Agency (CEAA) with the IAAC. The legislation also restructured and renamed the National Energy Board (NEB) as the Canada Energy Regulator (CER).

As of last August, the overhauled regulatory apparatus began work with an expanded mandate to police project effects on communities, women, natives, health and climate change as well as the physical environment of land, air, water and wildlife.

The requirements for Gazoduq include a notoriously difficult job to forecast carbon emissions by upstream development of gas supplies to fill the pipeline, as well as effects on global greenhouse gas volumes related to the LNG export consumption.

Neither the pipeline nor the environmental agencies control gas production or use. A similar initial Canadian government foray into total carbon emissions regulation contributed to the October 2017 cancellation of TC Energy Corp.’s C$15.7 billion ($12.6 billion) Energy East proposal for a cross-country oil pipeline.

The Canadian regulatory green new deal also dwells on a national sore spot of native rights enshrined in the country’s constitution. Gazoduq is directed to seek tribes’ cooperation and forecast its effects on their culture from hunting to spiritual values of solitude and connection to landscape.

Effects on communities of all ethnic backgrounds are to be assessed. The IAAC-BAPE hearings manual directs Gazoduq to assess pipeline “influences on community well being — for example disposable income, cost of living, lifestyle; language; rates of alcohol and substance abuse, and of illegal activities and violence; rates of sexually transmitted infections and gender-based violence; and so on – including indicators proposed by each Indigenous people.”

The assessment has begun even though the sponsor of both Gazoduq and Energie Saguenay, GNL Quebec, lost a potential partner in March when investment sage Warren Buffett’s Berkshire Hathaway Inc. rejected an invitation to buy into the LNG terminal.

GNL has vowed to keep on advancing the pipeline and terminal proposals, with about 15 Canadian, U.S. and Asian private investors still in support. The Quebec LNG project has big backers in California, where Breyer Capital in Menlo Park and Freestone International in San Francisco are the founding partners.

Gazoduq’s submission to Canada’s federal and Quebec environmental regulators suggested that the LNG plan is too valuable for all concerned to discard.

“The project is designed to be compatible with provincial, Canadian, and international energy and climate policies, as it is anticipated to facilitate an energy transition using natural gas, away from higher emitting sources of energy — for example coal, fuel oil, and diesel — currently used in international markets and locally in northern Ontario and Québec. This transition is expected to help support the fight against worldwide climate change,” said Gazoduq.

Provided Canada’s regulatory apparatus co-operates by setting a brisk pace, Gazoduq said project construction would start by early 2022 for completion in 2024.

“This will require tightly controlled, but nevertheless achievable, project execution and approval timing.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |