Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Gas, Power Markets Working During Record Cold, FERC Chairman Says

Addressing concerns surrounding this month’s natural gas and electricity price spikes brought on by record cold, FERC Acting Chairman Cheryl LaFleur told journalists Monday it is a sign that the markets are working.

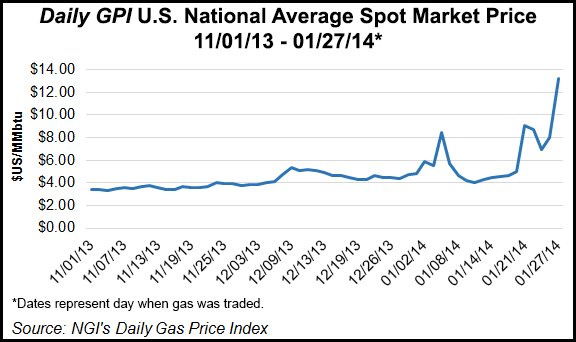

Capping off a January that contained back-to-back polar vortexes, which pushed physical natural gas prices significantly higher across the country and even created record highs in areas of the Midwest and Northeast (see Daily GPI, Jan. 27; Jan. 21; Jan. 6), LaFleur said the Federal Energy Regulatory Commission is keeping its eyes on infrastructure and on making sure that markets are properly working.

Thanks to frigid temperatures,NGI’s Daily Gas Price Index U.S. National Average Spot Market Price has soared during January, from a low of $4.24/MMBtu on Jan. 9 for Jan. 10 delivery to $13.19/MMBtu on Jan. 27 for Jan. 28 delivery.

“Because of the extreme cold, there is a great demand for gas that is driving up the price, but that is how markets work,” LaFleur said.

“At the simplest level, price spikes are caused by a mismatch of supply and demand, and we are in the most stressed time of the year for the use of natural gas both for home heating, as well as for electric generation,” LaFleur told a roundtable of journalists at the Commission’s headquarters in Washington, DC.

“We are following all of the markets closely with our folks in our Office of Market Oversight, looking to make sure that the markets are operating competitively and that we don’t see any manipulation or other problems. We have also entertained applications from the regions if they need it. Example, PJM asked for an emergency waiver to the gas and electric communications rule. We’ve also entertained and have another application pending to lift the usual market caps so that the market can adjust to the conditions we’re seeing.”

The frigid weather and high natural gas prices are straining eastern power networks. Last week, the New York ISO (NYISO) grid operator on Wednesday asked FERC to waive the $1,000/MWh cap on cost-based power generation bids it can accept. PJM Interconnection, the mid-Atlantic grid operator filed a similar petition. NYISO and PJM said the waivers were necessary because of the extreme winter weather and the high prices for natural gas. NYISO cited a $120/MMBtu price on Transco Zone 6 NY last week and asked for the waiver privilege to run through the coldest part of the winter — through Feb. 28 (see Daily GPI, Jan. 23a).

“Our division of Market Oversight, a piece of the Office of Enforcement, does look at all of the intelligence we get from the various gas pipelines and trading indices to determine how the gas is flowing,” LaFleur said. “We are also in touch when there are either pipeline issues or operational flow orders. We hear from the pipelines themselves to keep track on what is going on out there. Finally, we are in touch with the electric regions and the electric companies that are in many cases the customers of the pipelines. We look at the different faces of the prism to keep a sense of what is going on.”

With such high gas prices during this winter’s peak cold, LaFleur addressed the topic of fuel diversity. She said the country is witnessing a change in fuel choices driven by “affordable and available natural gas, the growth in renewables, and other new resources and new environmental regulations.”

This cold “is really stressing both the energy infrastructure…and the energy markets. The energy markets were really set up to let a market decide what the next resource is that will shift risk from customers to the investors. They were not set up to have built-in fuel diversity. Now 15 years into their life…we are seeing discussions of that in the different regions. How do we ensure…reliability including diversity. Diversity in itself is a value that most people would agree to. How much they want to pay for it” is another question. “We’re looking region by region and taking a little bit more of a measured approach as we look to how the market is working.”

She added that programs enacted by electric regional groups can mitigate the effects of severe cold on commodity prices.

“In general in New England, we’ve seen somewhat of a moderation of the gas prices compared to New York and the Mid-Atlantic,” she said. “That is in large measure due to the effort that ISO-NE made to put in place a special winter reliability program where they are relying a lot on dual fuel and oil right now.

“From a larger perspective, we’ve been looking at the coordination of the gas and electric markets,” she said, pointing out that there are some significant fundamental differences between the two that need to be bridged. “The way the gas markets and the electric markets attract investments is on a different timeline. Pipelines are built in this country based on a 10-15 year firm commitment and electric markets are priced in real time or three years ahead. That’s the structural issue in some of the competitive market regions of the country. What the regions have been working on is changing the electric markets to attract more of the capital they need for fuel security. It is a market issue rather than an individual unwillingness because the generators are economically motivated to do what makes sense to them, which is only buy the gas when they need it.”

Last week, the governors of six New England states through the New England States Committee on Electricity (NESCOE) called on grid operator ISO-NE to provide technical support and assistance with necessary tariff filings for new electric and natural gas infrastructure to diversify the region’s energy supply portfolio (see Daily GPI, Jan. 23b).

“From what I know of [NESCOE’s] proposal, it is innovative and I applaud the fact that they are looking at it from the whole region with six states working together,” LaFleur said Monday. “I do think elements of this will probably come before FERC, so that is why I can’t comment in detail on the proposal.”

Coordination between the gas and electric segments is key for optimization and reliability, but in addition, LaFleur said additional investment is likely necessary.

“As in other areas, I think more investment is likely to be needed,” she said. “Whether it be this winter, where we saw investment in the dual fuels, we saw more LNG coming down from Canada and there are proposals for pipelines. I think beyond communications and coordination we will see investment needs. Whether or not that will require FERC action “is to be determined,” but LaFleur admitted

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |