E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gas-Focused Harvest Oil Posts Loss, Output Declines

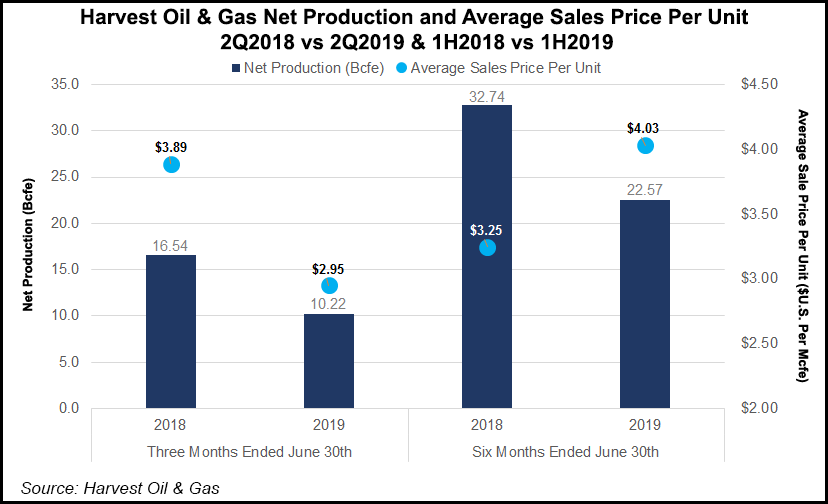

Houston-based Harvest Oil and Gas Corp., which has a natural gas-weighted asset base in formations across the Lower 48, posted significant year/year declines in production for the second quarter.

Harvest, previously EV Energy Partners LP before emerging from a planned Chapter 11 restructuring in June 2018, reported total 2Q2019 output of 10.2 Bcfe, down by 38% from the comparable period last year.

Of Harvest’s total production, the company produced 146 million bbl of oil, 7.1 Bcf of gas and 369 billion bbl of natural gas liquids (NGL), down by 60%, 33% and 41% year/year, respectively.

The yearly decline stems from asset sales in Central Texas, South Texas, the Midcontinent and the San Juan Basin, which have been ongoing since last summer.

The latest sales included two July agreements inked for a sale of Barnett Shale assets for $72 million and another Midcontinent package for $6.5 million, both of which are expected to close by the end of September.

The quarterly decline in production was attributed to completing the San Juan and Midcontinent sales specifically, as well as natural production declines. The asset sales will result in lower production volumes for the remainder of 2019, management said.

Harvest forecasts 3Q2019 production should average 7.7-8.5 Bcfe, and it expects to produce 4.1-4.6 Bcfe in the fourth quarter.

In a March presentation to investors, Harvest management stated it expected to achieve positive free cash flow this year and would use the proceeds of the various sales to pay down debt and return capital to shareholders.

In its 2Q2019 earnings report, the company also said it paid down its remaining debt, $55 million.

Harvest reported a net loss in 2Q2019 of $60.9 million (minus $6.05/share), which compares with a 2Q2018 net loss of $595.1 million (minus $11.81).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |