Utica Shale | E&P | NGI All News Access

Gaining Momentum, Gulfport Energy Beats 3Q Production Guidance

After a slow first half, Gulfport Energy Corp. beat the high-end of its third quarter guidance, producing 734.1 MMcfe/d or 10% more than it did in 2Q2016.

The company had guided for 685-705 MMcfe/d for the period. Other than legacy assets on the Gulf Coast in Southern Louisiana and a stake in the Canadian oilsands, the company primarily operates in Ohio’s Utica Shale, where it has focused heavily this year on its east and central dry gas windows. Gulfport’s production during the third quarter was 86% natural gas, 9% natural gas liquids and 5% oil.

Third quarter production was up from 664.7 MMcfe/d in 2Q2016 and up 13% from the year-ago period, allaying investor concerns about this year’s growth. It has guided for 695-730 MMcfe/d for 2016.

The company didn’t complete any new wells in 1Q2016 when it idled a completion crew. It later brought them back, pushing tie-ins to the end of the second quarter. Management also said in August that high gathering line pressures in its dry gas window curtailed some second quarter production (see Shale Daily, Aug. 4).

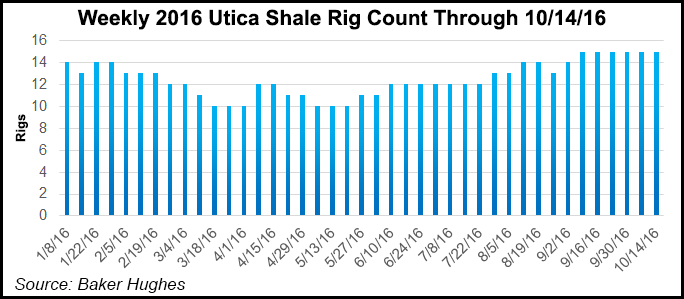

At the time, the company was working on adding pad-level compression and management said full-field compression would be phased-in during the second half of the year. A fourth rig was also expected to begin work last month, while the company has highlighted plans for a six- to eight-rig program next year.

The company said its total average realized price for the third quarter was $2.87/Mcfe, down from the year-ago period when it reported $3.87/Mcfe. Realized prices, however, included a non-cash derivative gain of $22.4 million. Gulfport is scheduled to release its 3Q2016 earnings on Nov. 2 after the markets close.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |