Markets | NGI All News Access | NGI Data

Futures Gain Despite Plump Storage Stats

In the aggregate, spot natural gas prices for Friday delivery traded flat in Thursday’s exchanges, but swings were seen in the Rockies as a major gas plant explosion disrupted receipts and deliveries. At eastern points mild, seasonal temperatures along with softer power prices prompted weaker next-day quotes.

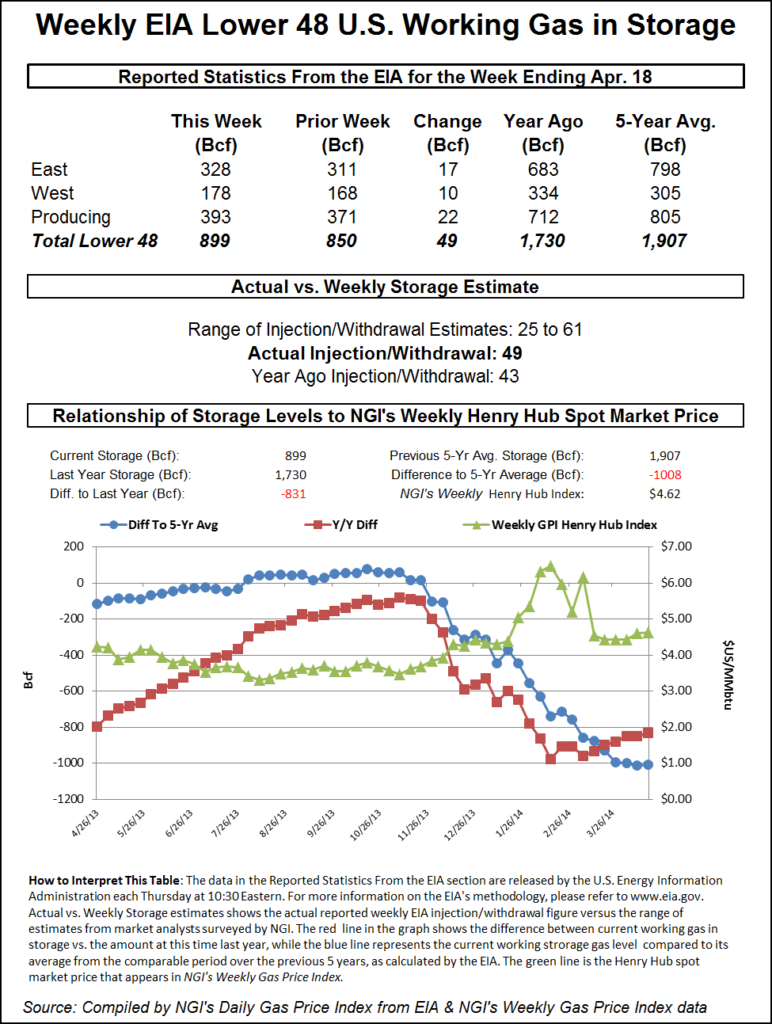

The Energy Information Administration in its 10:30 a.m. EDT release of storage data reported a build of 49 Bcf, well above industry estimates, and at the close May was down 2.5 cents to $4.705 and June declined by 2.4 cents to $4.723. June crude oil added 50 cents to $101.94.

Rockies and West Coast markets were briefly rattled when a fire and explosion at the Opal gas processing plant in southwest Wyoming forced the evacuation of a nearby town (see related story). A Rocky Mountain producer thought the effect would be minimal and did not have to shut in any wells that deliver to Colorado Interstate Gas (CIG), a major carrier into the Opal plant. “I spoke with one fellow who said most of the gas has found another home, and Ultra Resources is saying it won’t impact them,” said a Denver-based producer. He added that a lot of his company’s gas goes south on Southern Star pipeline into Kansas.

Market points affected by as much as 1 Bcf/d from the plant include CIG, down 11 cents at $4.49, and Northwest Pipeline Wyoming rose 7 cents to $4.66. Transwestern San Juan rose 9 cents to $4.71, and packages at the Cheyenne Hub rose a penny to $4.63.

Malin, a major destination for gas out of Opal, rose a stout 18 cents to $4.85, and Kern River Deliveries were quoted at $4.88, up 10 cents.

In spite of the mishap, NGI was able to compile an Opal price as the NGI methodology includes points not affected by the shutdown of the plant. NGI includes deals done at connecting pipelines in the Opal area, including Kern River, Northwest, CIG, Rockies Express, Ruby Pipeline, Questar, Overthrust Pipeline, and Wyoming Interstate Company (WIC). NGI also includes trades at the Muddy Creek Compressor station, and the Pioneer, Hams Fork, and Roberson Creek receipt points along Kern River Pipeline. Opal gas came in at $4.73, up 10 cents.

Northeast locations slumped as temperatures Friday were expected to be within a few degrees of normal. AccuWeather.com reported that Boston’s high of 61 degrees Thursday would hold for Friday before dropping Saturday to 49. The normal high in Boston for late April is 59. New Haven, CT’s Thursday high of 60 was expected to drop to 59 Friday and bounce back to 60 on Saturday. The seasonal high in New Haven is 62. Princeton, NJ’s high Thursday of 62 was predicted to rise to 64 Friday before reaching 68 on Saturday. The normal high in Princeton is 65.

The Mid-Atlantic, however, is not expected to bring any lasting warmth and residents may want to keep furnaces up and running. Alex Sosnowski, an AccuWeather.com meteorologist, said, “The weather pattern through this weekend will bring temperatures fairly typical for this time of the year to Philadelphia. Temperatures typically range from a morning low in the upper 40s to a high in the upper 60s F. The next chance of rainfall is Friday into Saturday as a system moves in from the Midwest. However, while there can be a couple of showers and a thunderstorm either day for outdoor activities, neither of the two days will be a washout. Temperatures both days will peak within a few degrees of 70 F.”

Friday packages destined for New York City on Transco Zone 6 plunged 32 cents to $4.08, and gas at Tetco M-3 Delivery was down 31 cents to $4.09.

Gas at the Algonquin Citygates slumped 21 cents to $4.58, and deliveries to Millennium slumped 18 cents to $4.02. Gas on Tennessee Zone 6 200 L plunged 28 cents to $4.63.

Going into the EIA release of storage data Tim Evans of Citi Futures Perspective was forecasting a storage build of 26 Bcf, well on the light side of other estimates that were closer to 40 Bcf. The problem is that even at 40 Bcf, little impact is made on the year-on-five-year deficit, and figures show the industry will have to inject well over 100 Bcf weekly to come anywhere close to last season’s starting inventory of 3.8 Tcf.

“With storage on this path, the year-on-five-year average storage deficit would expand to 1,055 Bcf as of May 2 before declining slightly to 1,048 Bcf as of May 9,” said Evans. “While we continue to see risk that a break in temperatures could prompt at least a partial cycle of speculative long liquidation that would weaken prices, the current storage outlook remains supportive. In fact given the magnitude of the storage deficit, we would view even the absence of a declining deficit as supportive for prices.”

“Last week EIA reported a build of just 24 Bcf, well short of industry expectations that were about 10 Bcf higher, and spot futures romped to a 21 cent gain. One school of thought had it that this week’s report is ripe for a revision, suggesting that the actual figure may come out above industry estimates, which curiously this week are also hovering around 40 Bcf. “

Last year, 30 Bcf was injected, and the five-year average is for a 47 Bcf build. In addition to Evans’ estimate, a Reuters poll of 21 traders and analysts revealed an average 42 Bcf with a range of 25-61 Bcf, and United ICAP calculated an increase of 35 Bcf. Ritterbush and Associates, which last week came about as close as anyone with a 27 Bcf estimate, was projecting a build of 50 Bcf for this week’s report.

Some were thinking that the EIA would be reporting a larger number than what people were thinking because the EIA will adjust the numbers. “Many analysts we spoke to this week expect a bigger build than perhaps their respective numbers would have it or then our consensus might reflect,” said John Sodergreen, editor of Energy Metro Desk (EMD).

“How’s that? Simple. Given the big misfires coming out of EIA these past few weeks, there is a big expectation for a sort of true-up of sorts. EIA is fairly predictable in this; give the market two bombshells and on the third week after, we see a build that more or less sets things right.” The EMD survey came in at a 44 Bcf build, not far from the actual figure of 49 Bcf.

Inventories now stand at 899 Bcf and are 831 Bcf less than last year and 1008 Bcf below the five-year average. In the East Region 17 Bcf was injected and the West Region saw inventories up by 10 Bcf. Inventories in the Producing Region rose by 22 Bcf.

The Producing region salt cavern storage figure increase by 13 Bcf from the previous week to 89 Bcf, while the non-salt cavern figure rose by 9 Bcf to 304 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |