Markets | E&P | NGI All News Access

Freeport McMoRan Lays Off 25% of Oil, Gas Workforce

Freeport-McMoRan Inc. (FCX) dismissed one-quarter of its workforce last week and continues to look for a buyer to take over the distressed U.S. energy portfolio, CEO Richard Adkerson said Tuesday.

The Phoenix-based global conglomerate, which also mines for copper, gold and molybdenum, in early April sacked the executive management team of Freeport-McMoRan Oil & Gas (FM O&G), which has lost money almost continuously since it was formed about three years ago (see Daily GPI, April 5; Dec. 6, 2012). The gold and copper markets improved slightly in 1Q2016, but the same could not be said of oil and gas.

“Further weakening in oil and gas prices and negative credit and financing market conditions during first quarter 2016 had a significant unfavorable impact on the process,” management said. “While the process did not identify a buyer for the entire oil and gas business, a number of parties have interest in select assets, and FCX continues to engage in discussions with parties interested in potential asset or joint venture transactions.”

Adkerson, who helmed a conference call to discuss the results on Tuesday, told analysts, “I am feeling much better today than I did in January.”

Based on the quarterly results, however, there was little to cheer about. FCX posted its sixth straight quarterly loss, posting $4.2 billion versus a loss of $2.5 billion in 1Q2015. Revenue fell 15% to $3.5 billion. Writedowns totaled $3.8 billion “to reduce the carrying value of oil and gas properties.”

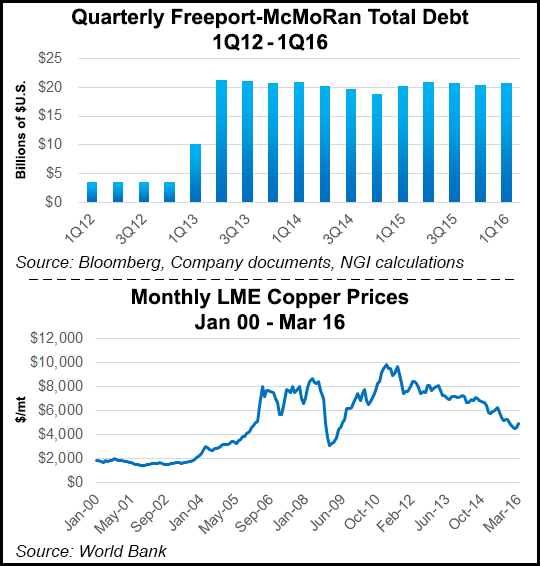

The primary issue is debt, which skyrocketed after FCX spent billions to create the oil and gas business in late 2012. The CEO admitted as much. The oil and gas business by itself has roughly $20 billion of debt, created by the initial investments in late 2012 and subsequent spending.

“That was really upset by initially the fall in oil prices and then when copper prices fell, that took away the ability of the copper business to support it with its own cash flows,” Adkerson said. “So that’s why we’re having to take these really aggressive actions now to rectify our balance sheet.” The new oil and gas organizational structure has been integrated into the corporate to reduce costs.

“Our company is over-leveraged,” he said. “I mean, in the nature of the business that we’re in, where you have such high operating leverage from commodity prices, you just should not be this leveraged because when conditions unfold as they do from time to time, and your revenues drop because of what’s going on in global commodity prices, having this kind of debt is a killer.”

Because of the layoffs at FM O&G, the corporation expects to record a $40 million charge in the second quarter. FCX has reached agreements to sell $1.4 billion of its global assets, which are expected to be completed by the end of June. Advanced talks also continue about other asset sales, but Adkerson declined to offer many details. He repeatedly highlighted the value of the company’s portfolio.

“At the end of the day, we have good assets,” he said. “We have great resources. We can create a good company. We’re going to have to give up some of those to get us to a position of where we’re not over-leveraged.”

Besides laying off people, FCX is reviewing “office facilities and other cost elements,” he said. “We’re winding down significant capital spending.”

In the deepwater Gulf of Mexico, where the biggest operations are underway, FM O&G recently completed a series of tie-back wells “to maintain near term production without additional drilling.”

Among its offshore prospects are the Holstein, which began production this month; two more wells are coming on by June. At the Horn Mountain and Marlin tiebacks, production has ramped up on the D-13 King well. Tiebacks also are progressing for the Kilo/Oscar Quebec/Victory wells, with more new wells in the inventory that should be brought on to maintain production for the foreseeable future. FM O&G also has stakes in at the Lucius and Heidelberg wells offshore, as well as a development project in the Vito area of Mississippi Canyon.

There are lots of good prospects. But there are no buyers.

“We looked for potential buyers for the business during the first quarter aggressively,” Adkerson said. “We worked with our established bankers, canvassed the market, and because of the conditions in the marketplace, with low oil prices, with credit pressures on companies from the very largest through the business with the lack of credit, we just concluded at this point that the values that might be available in sale or monetization transactions simply didn’t reflect the long-term value of these assets.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |