E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Freeport LNG Buyer Osaka Gas Taking Stakes in Sabine Oil Haynesville Acreage

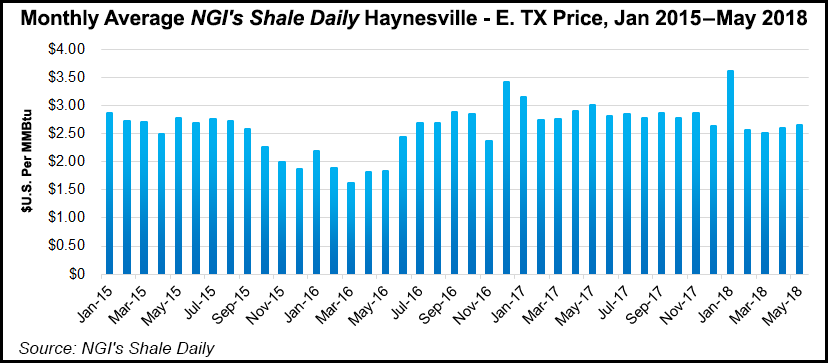

Japan’s Osaka Gas Co. Ltd., which has agreements to buy liquefied natural gas (LNG) from the Freeport LNG project on the Texas coast once it ramps up, on Friday agreed to put more skin in the game through a $144.5 million deal with Houston-based Sabine Oil and Gas Corp. to buy into a gassy Haynesville Shale project.

The deal between OG East Texas LLC with Sabine East Texas Basin LLC would give the Asian operator a 35% stake in a Haynesville/Cotton Valley gas project underway in Harrison and Panola counties northeast of Houston.

The project now is producing an estimated 45 MMcfe/d from 450 wells across 100,000 net acres; the transaction would deal 35,000 net acres to Osaka. The partners plan to continue developing the leasehold to increase production.

“Participation in this project will further enhance the upstream operating capability of Osaka Gas, adding to its upstream business portfolio to build the natural gas value chain in the U.S.A., which includes Freeport LNG liquefaction business and electric power business,” said Osaka, which is a unit of Daigas Group.

“Under its long-term management vision ”Going Forward Beyond Borders 2030,’ which focuses on overseas energy markets as one of the growth areas, the Daigas Group pursues its endeavor to expand its energy business globally along the value chain.”

Besides the Haynesville, Sabine Oil also works in North Texas, where it targets the Granite Wash formation. In South Texas it has operations in the Eagle Ford Shale.

Cheniere Energy Inc.’s Freeport export project is expected to begin commercial operations in the second half of 2019 or early 2020.

The three trains are designed for about 700 MMcf/d of capacity. As of April, about 13.4 million metric tons/year of capacity has been contracted under use-or-pay liquefaction tolling agreements with customers that include Osaka Gas, Jera Energy America LLC, BP Energy Co., Toshiba Corp. and SK E&S LNG LLC.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |