Fracture Sand Provider Emerge Energy Seeking Chapter 11 Protection

Emerge Energy Services LP, which provides silica sand proppant for U.S. onshore operators, has filed for Chapter 11 protection, the second provider to seek bankruptcy protection in less than a week.

The voluntary filing by Emerge in U.S. Bankruptcy Court for the District of Delaware is for the publicly held company and its subsidiaries (No. 19-11563).

In a declaration of support for the Chapter 11 filing, restructuring officer Bryan Gaston highlighted the impact of factors that led to an oversupply of fracture sand and resulting price erosion. He cited the decline in well completion activities by end-users and more competition from in-basin sand competitors, which squeezed the Fort Worth, TX-based operator. In-basin competitors directly mine, process and deliver in the basin where consumption occurs, cutting down on transport costs.

Emerge also cited the continuing impact of issues at a new in-basin site in Texas where a levee breach shut down critical operating lines.

Moody’s Investors Service in May had said the price of fracture sand was “ no longer highly correlated” to the price of West Texas Intermediate crude, which in turn was weakening the credit quality of U.S. sand operators.

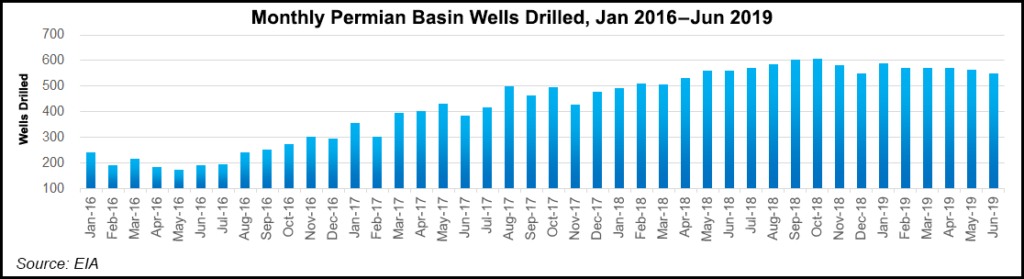

Fracture sand demand “decreased during 2015 and 2016 as a result of an industry downturn due to low commodity prices,” Gaston’s declaration stated. “Commodity prices stabilized in the middle of 2016, however, leading to an improvement in drilling activity during the third quarter of 2016, and into 2017 and early 2018.”

Sand demand began to soften again last August following a decline in “well completion activities resulting from the exhaustion of capital budgets for oil and gas exploration and production companies.”

These factors and new production from in-basin fracture sand competitors “led the…sand market to quickly turn from a state of short- supply in the first half of 2018 to over-supply in the second half of 2018…”

Emerge in April had entered into a restructuring support agreement (RSA) with its operating subsidiary Superior Silica Sands LLC and the partnership’s other subsidiaries, as well as general partner Emerge GP and the equity holders, lenders and noteholders. Under the RSA, the parties agreed to a proposed financial restructuring.

Emerge, which mines, produces and distributes silica sand through Superior Silica, had been notified in May by the New York Stock Exchange (NYSE) that it was no longer in compliance with continued listing criteria. The NYSE in May then delisted the common units and trading was suspended.

Last week, private sand operator Shale Support Global Holdings LLC and seven affiliates also filed for voluntary protection with the U.S. Bankruptcy Court for the Southern District of Texas (No. 19-33884). Shale Support also cited lower demand and cash-strapped energy sector clients, lower prices and fixed railcar leasing costs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |