E&P | NGI All News Access | NGI The Weekly Gas Market Report

FPSO Awards Seen Rebounding Sharply in 2021 as Offshore Oil, Natural Gas Project Sanctioning Resumes

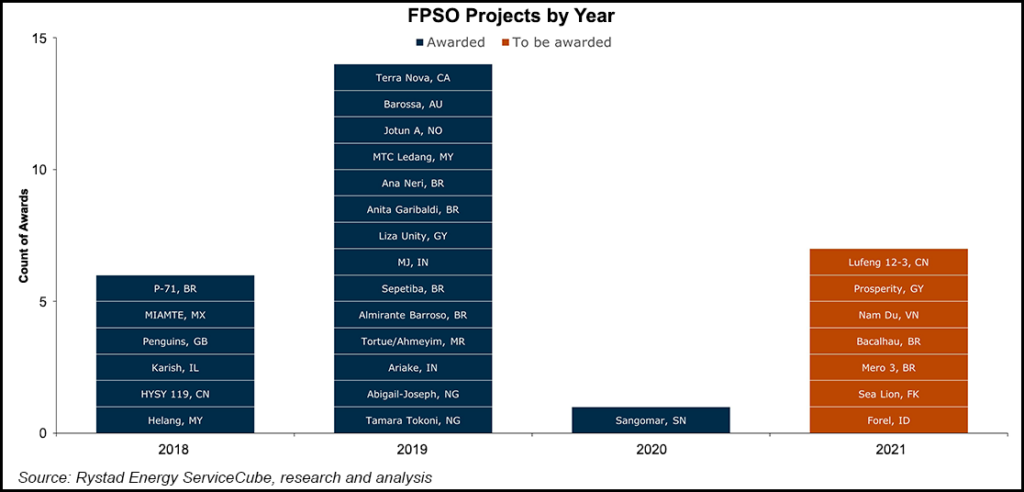

Oil and gas companies are expected to award seven floating production, storage and offloading (FPSO) vessels in 2021, versus a likely total of one this year, as offshore project sanctioning recovers from the current downturn, according to Rystad Energy.

Tokyo-based Modec Inc. won the only FPSO contract awarded so far this year, to supply a turnkey FPSO for Woodside Energy’s Sangomar project off the coast of Senegal, Rystad analysts led by Aleksander Erstad said Wednesday.

The vessel would have capacity to handle 100,000 b/d of oil and 130 MMcf/d of natural gas, said analysts, adding that Sangomar phase 1 would require estimated total greenfield capital expenditure (capex) of around $4.2 billion.

Analysts said they do not expect any other new FPSO contracts to be awarded this year.

“Over the last 10 years, only 2016 saw a lower level of activity when not a single FPSO contract was awarded,” the Rystad team said. “However, from 2016, activity quickly rebounded with 27 awards in the three-year period from 2017 to 2019.”

The current cycle is shaping up to follow a similar pattern, according to Erstad, who highlighted seven offshore projects slated for sanction in 2021.

These include the Payara project in Guyana, as well as the Bacalhau and Mero 3 projects in the pre-salt area of Brazil’s Santos Basin.

Payara is part of the Stabroek Block operated by an affiliate of ExxonMobil with a 45% working interest, in partnership with affiliates of Hess Corp. (30%) and China National Offshore Oil Corp. (CNOOC) (30%).

The Bacalhau field is operated by Norway’s Equinor SA with a 40% stake, in consortium with ExxonMobil (40%) and Petrogal Brasil S.A. (20%), a subsidiary of Portugal’s Galp Energia, SGPS, S.A.

The Mero field is operated by Brazilian national oil company Petróleo Brasileiro S.A. (Petrobras) with a 40% interest, in partnership with Total S.A. (20%), Royal Dutch Shell plc (20%), CNOOC Ltd. (10%) and China National Petroleum Corp. (10%).

In a Wednesday note to clients, analysts at Tudor, Pickering, Holt & Co. (TPH) said that Covid-19 related disruptions caused Brazil’s crude oil output to plummet by 193,000 b/d in May versus April to 2.77 million b/d, following roughly flat production over the preceding two months.

Petrobras reported stoppages or production restrictions at several FPSOs, with the Lula field accounting for the largest share (154,000 b/d) of the month/month decline.

“The trajectory of Covid-19 cases and how Brazil tackles its mounting issues over the coming months will be the key determinant in overall supply trends and whether we see a production rebound in 2H2020,” the TPH team said, adding, “With coronavirus problems only worsening for Brazil in June, it’s likely that we see production remain depressed over the next few months.”

Reuters reported Wednesday that Petrobras is preparing a tender for what would be Brazil’s largest-ever FPSO with a capacity of 225,000 b/d, citing two sources with knowledge of the matter.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |