Markets | NGI All News Access | NGI Data

Former Trading Range Revisited; October Slumps Post EIA Data

Natural gas futures fell following the release of government storage figures that were somewhat greater than what traders were expecting.

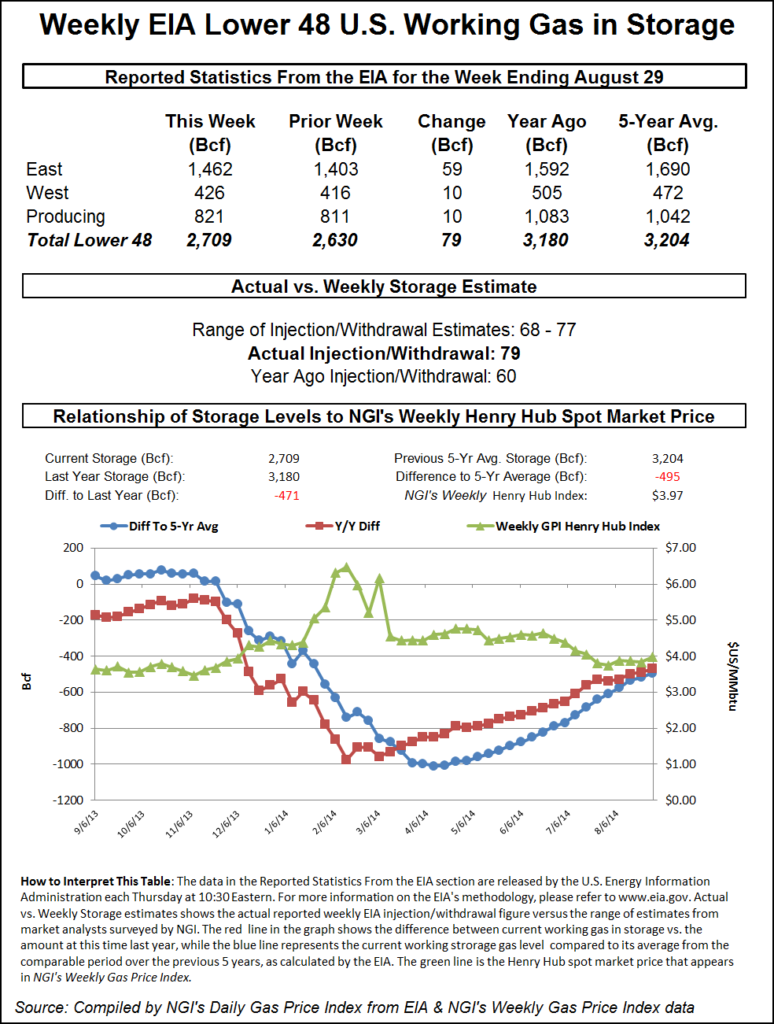

The injection of 79 Bcf was about 5 Bcf more than market surveys and independent analyst projections, and for the week ended Aug. 29 the Energy Information Administration reported an increase of 79 Bcf in its 10:30 a.m. EDT release. October futures fell to a low of $3.789 soon after the number was released and by 10:45 a.m. October was holding $3.804, down 4.3 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a build of approximately 74 Bcf. A Reuters survey of 23 traders and analysts revealed an average increase of 73 Bcf with a range of 68 Bcf to 76 Bcf. IAF Advisors was looking for a build of 76 Bcf, and Bentek Energy’s flow model anticipated an injection of 77 Bcf.

With the day’s decline traders lamented that “we are back to the old trading range of $3.75 on the downside and $4 on the upside. We were looking for a build of 73 Bcf to 75 Bcf,” said a New York floor trader.

Traders see the plump report as auguring more ample future supplies. “The 79 Bcf net injection was more than the consensus expectation and also bearish relative to the 56 Bcf five-year average number,” said Tim Evans of Citi Futures Perspective. “It also suggests a weakening of the background supply-demand balance, possibly related to a further increase in production, with bearish implications for the weeks to follow.”

Inventories now stand at 2,709 Bcf and are 471 Bcf less than last year and 495 Bcf below the five-year average. In the East Region 59 Bcf was injected and the West Region saw inventories up by 10 Bcf. Inventories in the Producing Region also rose by 10 Bcf.

The Producing region salt cavern storage figure added 1 Bcf from the previous week to 211 Bcf, while the non-salt cavern figure rose by 9 Bcf to 610 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |