Shale Daily | Eagle Ford Shale | NGI All News Access | Permian Basin

Forest Unloads Texas Panhandle Assets for $1B, Focusing on Eagle Ford

Forest Oil Corp. struck a $1 billion deal to sell oil and gas assets in the Texas Panhandle to Templar Energy LLC as part of a deleveraging program that will allow the company to focus on the Eagle Ford Shale. One analyst called the sale a positive, but investors booed and sent Forest shares tumbling on Friday.

The sale is expected to be free of federal and state income taxes with proceeds to be used to reduce debt.

“This transaction comprises a major component of the strategic deleveraging program we instituted in mid-2012 and will allow us to significantly reduce long-term debt and greatly enhance our financial flexibility and liquidity,” said Forest CEO Patrick McDonald. “This divestiture sharpens our operational focus and enables us to maintain development efforts in our core Eagle Ford Shale asset, where oil production is projected to show notable growth over the next several years.”

The divested properties have produced about 100 MMcfe/d during 2013, Forest said, and have generated earnings before interest, taxes, depreciation and amortization of $180 million over the last 12 months. Proved reserves were 517 Bcfe as of Dec. 31, about 57% natural gas. Templar unit Le Norman Operating LLC will operate the assets. The deal is expected to close by Nov. 25 with an effective date of Oct. 1.

Wells Fargo Securities analyst David Tameron, who has an “outperform” rating on Forest, said the sale was a positive, particularly since Wall Street was expecting the sale price to be around $900-950 million; “…in fact, some were skeptical [Forest] could get the deal done at all,” he said in a note Friday.

Investors were anything but enthusiastic about the deal Friday, sending Forest shares down nearly 10% to close at $5.74 after trading as low as $5.71 intraday in heavy volume.

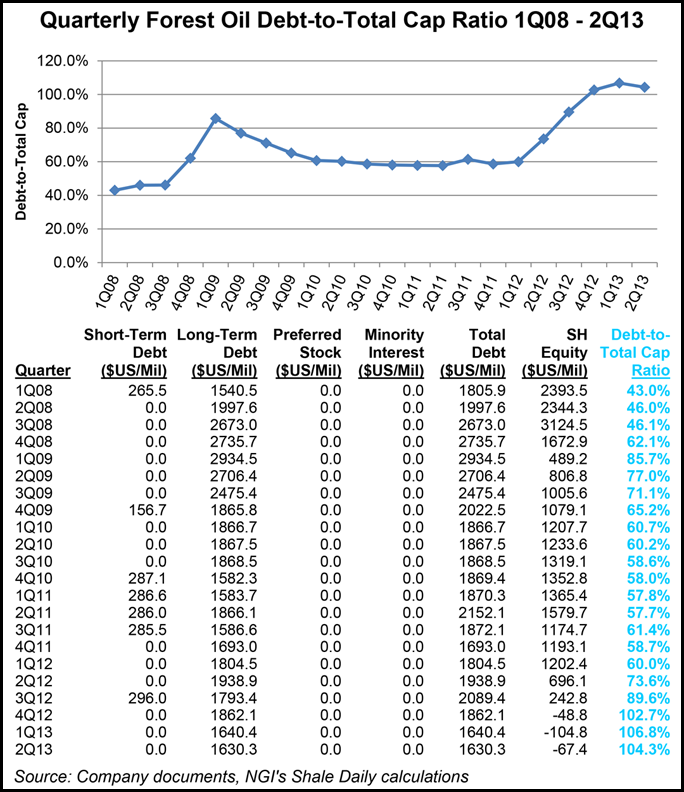

Tameron said that at the start of August Forest had $150 million drawn on its $700 million borrowing base. While the deal allows this to be freed up, the roughly 50% reduction in reserves will shrink the borrowing base, he said. “Assuming no corporate taxes on the transaction…pro forma for this transaction [Forest] will have $630 million of long-term debt…” Second quarter debt was $1.63 billion, Tameron said.

In July Forest said it was marketing its Panhandle properties after having received unsolicited interest in them (seeShale Daily, July 16). The Denver-based company recently agreed with an undisclosed buyer to sell a portion of its largely undeveloped acreage position in the Permian Basin of West Texas for proceeds of about $35 million (see Shale Daily, Sept. 4).

The Panhandle acquisition gives Le Norman Operating and Le Norman Fund I production of more than 20,000 boe/d, they said, and an estimated proved reserve base of 145 million boe net. With the acquisition, their resource potential exceeds 750 million boe net, focused entirely in the greater Anadarko Basin located in northwest Oklahoma and the Texas Panhandle. “The company has to date focused on the development of geologic targets containing significant oil and high-liquid yielding natural gas, and will continue to do so across its expanded, opportunity-rich property set,” said CEO David Le Norman.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |