Forecasts ‘Very Constructive’ for Natural Gas Demand as Futures Called Higher

A continued strong showing for July heat in the latest forecasts helped lift natural gas futures sharply higher in early trading Monday. The August Nymex contract was up 8.5 cents to $1.819/MMBtu at around 8:40 a.m. ET.

While changes to the forecast were mixed over the holiday weekend, the overall pattern continues to look “very impressive,” including some “quite hot” days added later this month as the 15-day outlook has rolled forward since Friday, according to Bespoke Weather Services.

The latest forecast keeps this month “on pace to challenge 2011 and 2012 as the hottest July on record” in terms of total gas-weighted degree days, Bespoke said. “Regionally we see some differences in where heat is focused, as the West has moved hotter in today’s six to 15 day outlook, while the Southeast is projected to see less heat, staying near normal overall.

“Given the look of the projected pattern out in days 14 to 15, it seems likely that strong heat would continue into the 16 to 20 day time frame as well.”

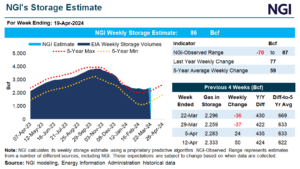

Meanwhile, looking back at last week’s Energy Information Administration (EIA) storage report, a 65 Bcf injection for the week ending June 26, analysts at Tudor, Pickering, Holt & Co. (TPH) called it a “fairly uneventful print.”

“Degree days for the week were in line with seasonal norms and on a weather-adjusted basis the build implies a roughly balanced market,” the TPH analysts said. “While the print was uneventful, it was an active week for several moving pieces within the gas market.

“Most notable is the supply side, where the start of July brought a wave of gas production, as associated volumes increased around 1.5 Bcf/d on the week and total volumes were up about 2.0 Bcf/d as the Marcellus continues to nudge higher.”

Liquefied natural gas exports also remain in focus for the market, according to the analysts. TPH estimates show an average 3.1 Bcf/d in feed gas volumes since the calendar flipped to July, down about 1.0 Bcf/d from June levels.

“The increase in production and decrease in LNG puts the market back into an oversupply situation on a weather neutral basis, but, thankfully, current forecasts are very constructive for gas demand,” the TPH team said.

August crude oil futures were up 7 cents to $40.72/bbl at around 8:40 a.m. ET, while August RBOB gasoline was up fractionally to $1.2615/gal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |