E&P | NGI All News Access | NGI The Weekly Gas Market Report

Five U.S. Onshore E&Ps Claim Top Global Spots for Highest Output Growth Since 2014

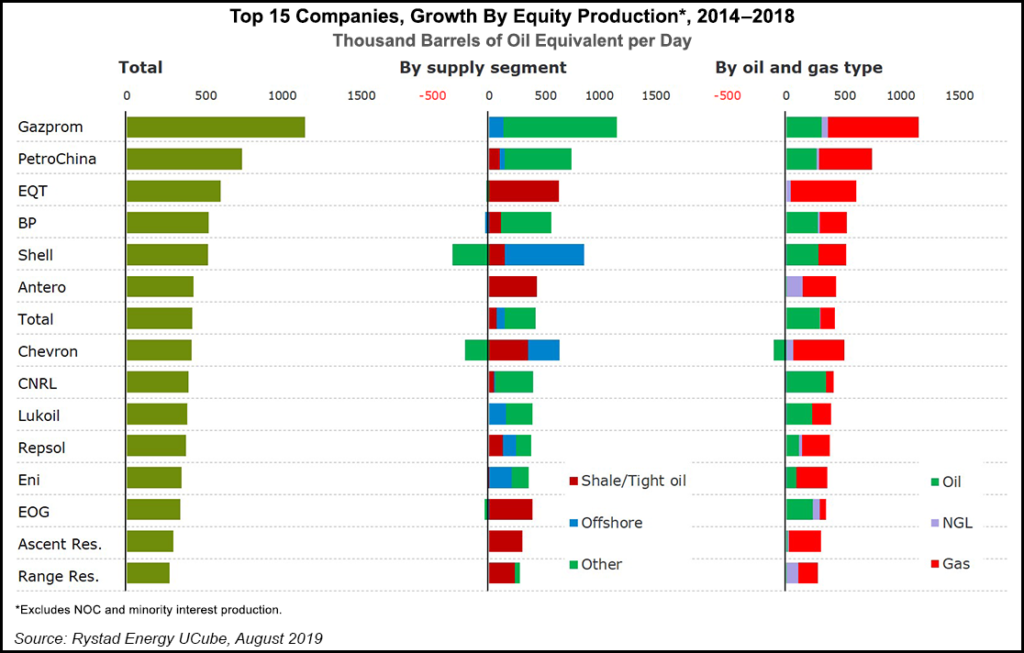

Russian giant Gazprom may have seen the highest oil and gas production growth over the last five years, but five U.S. unconventional producers also are among the Top 15 in the world, according to research by Rystad Energy.

The output for all global exploration and production (E&P) companies was reviewed and ranked by Rystad based on reserves growth from 2014 through 2018. The leaders all have one thing in common: onshore resources, whether conventional or unconventional, which were a major growth driver.

State-owned Gazprom, “the clear leader in production growth, is the only company with a total growth of more than 1 million boe/d over the last five years,” said Rystad’s Espen Erlingsen, head of upstream research. “The growth comes primarily from conventional assets, with gas being the key contributor to the spectacular development.”

Production growth, a key performance indicator for E&P companies, is commonly used by upstream players to demonstrate to investors that their portfolios are poised for growth as opposed to stagnated production.

Another state-owned enterprise, PetroChina Co. Ltd., with total growth of around 730,000 boe/d, was “also driven by conventional onshore gas production as well as splashes of shale gas growth,” Rystad noted.

At No. 3 is the largest natural gas producer in the United States, EQT Corp., which boasted equity production growth of close to 600,000 boe/d, or 340% growth in five years.

“Behind the state behemoths in Russia and China, majors and shale companies are some of the fastest-growing companies over the last five years,” Erlingsen said. “Rystad Energy expects this rise in output among the majors and shale companies to continue.”

Of the majors, BP plc posted the largest production increase since 2014, with output up almost 500,000 boe/d in the period.

“Much of the production uptick can be credited with the company’s operations in the Middle East, with significant production additions from the Rumaila field in Iraq, and in North America, where shale and U.S. deepwater are driving most of the changes,” researchers said.

Royal Dutch Shell plc, Chevron Corp. and Eni SpA also made the list of the fastest growing E&Ps. Absent were ExxonMobil and the largest independent in the world, ConocoPhillips.

“Equity production is strong not only among the majors, but also among five companies that are primarily focused on U.S. shale and tight oil,” which along with EQT, were Antero Resources Corp., EOG Resources Inc., Ascent Resources LLC and Range Resources Corp.

The benchmark analysis evaluated organic growth, i.e. increased field-level production in assets the company already owned, and inorganic growth, or production gains from mergers or acquisitions.

All of the calculations were made using each company’s equity, or working interest, across its upstream assets, Rystad noted. National oil companies, defined as national companies with activities only in their home country, were excluded.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |