Fitch Calls Mexico’s Hydrocarbons Goals Through 2024 Unrealistic

The oil production goals of Mexico’s state oil company Petróleos Mexicanos (Pemex) as set out in its recently released business plan are unlikely to be realized, according to credit ratings agency Fitch Ratings.

Although Pemex has been able to stabilize production, year/year production in 2019 will fall by more than 6% if the company is able to hit its target of 1.7 million b/d.

The decline is “roughly in line with the historical trajectory and our expectation of a 5% decline per year,” analysts said. Fitch estimated Pemex production will “likely continue to decline” by about 5%/year over the short-to-medium term as exploration and production capital expenditures (capex) remain in line with the past three years’ average.

Pemex crude production in the second quarter dropped year/year to 1.66 million b/d from 1.849 million b/d. Natural gas production in the second quarter was 3.634 Bcf/d, down 6% from 3.864 Bcf/d a year earlier.

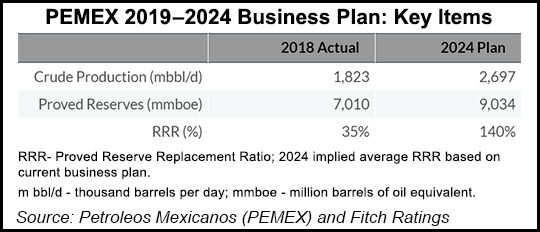

The state firm’s 2019-2023 business plan, released in July, calls for crude production to hit 2.7 million b/d in 2024, a level not reached since 2008 and an increase of about 1 million b/d on current production. The plan sets a natural gas production goal of 4.916 Bcf/d for 2024, from an expected average of 3.561 Bcf/d this year.

Analysts have suggested Pemex will need significant outside investments to reach its targets, but the business plan was explicit that the 100% state-owned firm would not seek joint venture partnerships.

Before the plan’s publication, President Andrés Manuel López Obrador had already suspended bid rounds, farmout tenders, and the migration of oilfield services (OFS) contracts to exploration and extraction contracts.

Pemex instead is accelerating the development of 22 onshore and shallow water fields entirely via contratos de servicios integrales de exploración y extracción, or CSIEEs, a type of oilfield services (OFS) contract that the company used prior to the energy reform.

“Pemex’s ongoing development of 22 oilfields could help the company’s slow production decline in the future but we view it as unlikely that these developments will completely stem production and reserve declines,” Fitch analysts said.

Fitch also warned that the credit metrics of Pemex will weaken if the company executes its business plan.

The company’s long-term capex plan could lead to an average proved reserve replacement ratio (RRR) of 50%, which when combined with the long-range production goals may significantly deplete reserves, leading to “higher than expected leverage and cash burn,” Fitch said.

Fitch calls the production goals by 2024 “aggressive,” given the relatively low expected capex levels when compared to historical finding and development (F&D) investment costs, along with significant execution challenges.

“We estimate Pemex’s average historical F&D cost per barrel has been about $18/boe, whereas the plan implies single digit F&D costs in order for it to be proportionate to production targets and 100% or above RRR.”

The business plan includes a series of short term measures to reduce Pemex’s fiscal burden, which Pemex has said is “the most grave structural problem” that it faces, but analysts suggest more is needed to free up cash for upstream spending.

Meanwhile Pemex’s financial debt stood at $104.4 billion as of June 30.

In June, Fitch downgraded Mexico’s long-term foreign currency and local currency issuer default ratings (IDRs) to “BBB” from “BBB+” and revised the outlook to stable from negative.

“The downgrade of Mexico’s IDRs reflects a combination of the increased risk to the sovereign’s public finances from Pemex’s deteriorating credit profile together with ongoing weakness in the macroeconomic outlook, which is exacerbated by external threats from trade tensions, some domestic policy uncertainty and ongoing fiscal constraints,” Fitch said.

In Pemex’s tax bill, Fitch said oil accounted for 2.3% of gross domestic product in 2018, which exceeds free cash flow, “preventing it from investing sufficiently to maintain production and reserves.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |