E&P | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

First Natural Gas Volumes from Israel’s Leviathan Set for December, Says Noble

Noble Energy Inc. said Thursday its two mega natural gas projects offshore Israel gained steam during the third quarter, with the Tamar field reaching a milestone of 2 Tcf and first volumes from the Leviathan field set to begin in December, ahead of schedule and below budget.

The Houston super independent provided the update on its Eastern Mediterranean gas developments in its third quarter results. The producer is leading development for the largest energy project in Israel’s history, with the first phase of the estimated 22 Tcf Leviathan development to include four subsea wells, each capable of flowing more than 300 MMcf/d.

“The Leviathan project is 96% complete, and the production decks were installed on the jacket in the third quarter,” management said. “Delivery of the Leviathan project is ahead of schedule and below budget.” In addition, the installed production decks set “the offshore world record for the largest crane vessel lift in history” at 15,300 metric tons.

The full hookup of the Leviathan platform and living quarters, along with platform commissioning, “continues to progress toward first production in December.” With total production capacity of 1.2 Bcf/d, Leviathan would more than double the quantity of gas flowing to the Israeli economy today.

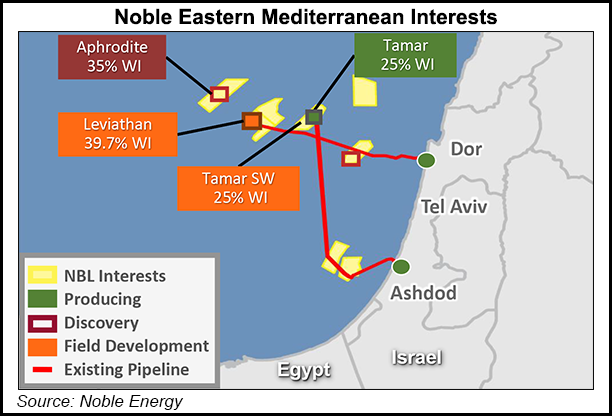

Firm contracts are in place to deliver 3 Tcf of supply from the Leviathan and Tamar fields for 15-year terms. Sales volumes from the company’s Israel assets totaled 234 MMcfe/d in 3Q2019. During the quarter, the Tamar field reached a milestone of 2 Tcf of produced gas with runtime of 99%-plus since its startup.

Noble expects to sell an average of 800 MMcf/d from Leviathan in 2020. Supply would be transmitted through two 120-kilometer subsea pipelines directly to the Leviathan platform. Gas is to be processed at the platform before the treated gas and stabilized condensate flow through a northern entry pipeline connected to the Israel Natural Gas Lines, the national gas transmission system.

Noble operates Leviathan and holds a 39.66% working interest in the field, along with other partners Delek Drilling (22.67%), Avner Oil Exploration (22.67%) and Ratio Oil Exploration 1992 LP (15%).

Last summer Delek and Noble reportedly were working to allow liquefied natural gas (LNG) exports and were negotiating with Golar LNG Ltd. and Exmar NV to finance, build, operate and maintain a floating LNG facility.

Israel also reached a landmark settlement with Egypt earlier this year, possibly opening the way for more gas consumption in the Middle East. Noble and Delek signed a deal last year with Egyptian East Gas Co. to enable gas exports into the country.

Noble COO Brent Smolik in May said the “key near-term focus” from a marketing standpoint was the Eastern Mediterranian Gas (EMG) pipeline, which would move gas into Egypt. Noble noted Thursday that it completed a deal earlier this month to buy a stake in EMG.

The sanctioned Alen gas project In Equatorial Guinea in West Africa also is progressing, the producer said. Initial sales of LNG and incremental liquids are expected to begin within two years.

Sales volumes for West Africa averaged 53,000 boe/d in 3Q2019, including 16,000 b/d of oil, Noble said. During the quarter, the Aseng field surpassed 100 million bbl of oil produced. The company has completed drilling and completion at the Aseng 6P development well, under budget, and first production began in October.

“The Alen gas monetization project continues to progress, with an anticipated start-up in the first half of 2021,” management said.

Noble invested $129 million in the Eastern Mediterranean during 3Q2019, primarily for continued development of the Leviathan project. Total gross capital for the project has been reduced by $150 million to $3.6 billion. Noble also directed $47 million to West Africa during the quarter..

In its fourth quarter guidance, Noble said West Africa gas volumes “are anticipated to be lower than third quarter primarily as a result of continued decline at the Alba field. Israel natural gas volumes are expected to be lower sequentially due to seasonal demand.”

Noble did not include sales volumes from the Leviathan project in its fourth quarter guidance.

Full-year capital expenditures (capex) were reduced by an incremental $100 million for a total reduction of $200 million versus original guidance, bringing this year’s spend to $2.3 billion. For the fourth quarter, Noble expects organic capex of $425-475 million, reflecting lower U.S. onshore spend and completed activities at Leviathan.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |