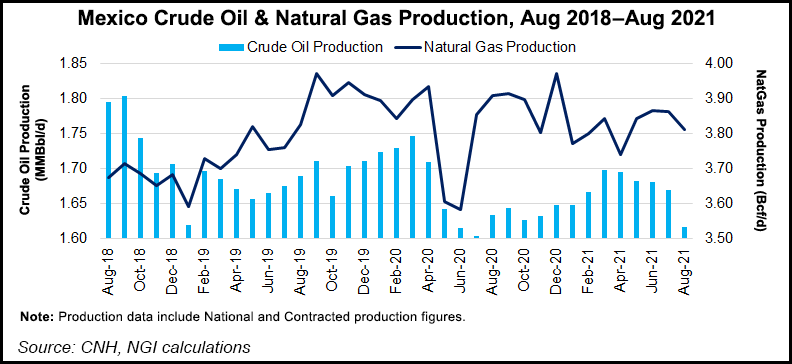

Oil production in Mexico averaged 1.62 million b/d in August, down from 1.67 million b/d in July and 1.63 million b/d in August 2020, according to the data from upstream regulator Comisión Nacional de Hidrocarburos (CNH).

Output by national oil company Petróleos Mexicanos (Pemex) fell from 1.61 million b/d in July to 1.55 million b/d in August, a month that saw 421,000 b/d of output knocked offline after a fatal fire on Pemex’s offshore E-Ku-A2 platform. Several days passed before the lost production volumes were fully restored.

The platform targets the Ku field, part of Pemex’s Ku-Maloob-Zap shallow water complex, which supplied about 37% of Mexico’s total production prior to the accident.

Oil production from Ku averaged 48,341 b/d in August, down from 53,975 b/d in...