NGI The Weekly Gas Market Report | E&P | Earnings | LNG | LNG Insight | NGI All News Access

ExxonMobil Sees Positives in LNG Segment but Balancing Global Supply/Demand to Take Time

ExxonMobil’s gambit to increase capital spending to backfill the global natural gas and oil portfolio ran smack dab into bruising commodity prices during the final three months of 2019, but the company is playing the long game, with less focus on short-term commodity cycles, CEO Darren Woods said Friday.

The oversupply of natural gas and oil that rushed into the markets last year, much of it from U.S. shores, is clobbering the markets. The global gas and oil supply will take time to balance, but during a conference call to discuss the quarterly and year-end results, Woods assured investors that it would.

The market is dealing with “slightly different dynamics” between domestic natural gas and liquefied natural gas (LNG) exports, Woods said.

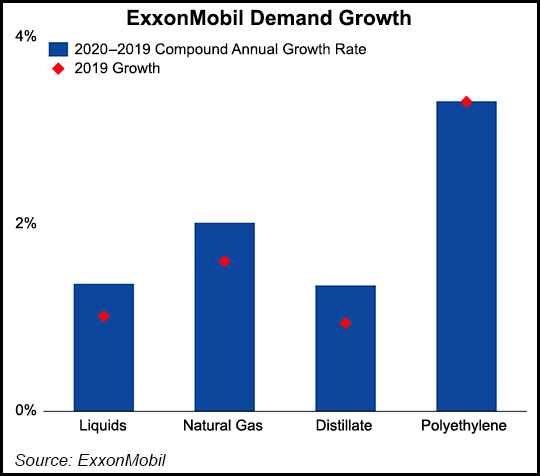

“Overall, we continue to see very good growth in the gas business,” with a projected 4% growth expected this year in the LNG segment alone. “I think both stories, both domestic and LNG, are very similar to discussions that we’re having in the downstream and chemicals” segments, which fared poorly in the final quarter.

There’s “fairly solid and good growth,” for global gas demand, but “we’re seeing short-term oversupply, and therefore lower margins. Our expectation is that demand will continue to grow, in part driven by concerns of climate change, replacing coal for gas, but also as the economies grow, as people’s standards of living grow, and as more power is used in gas…

“I think that dynamic is going to continue to happen. I think the LNG oversupply over time will work itself out, and I think investments in that space will probably slow and eventually the demand will catch up to the supply and things will improve…”

As capital-intensive, long-cycle investments come onto the market, it takes some time to find the balance, Woods said.

ExxonMobil has its hand in several big LNG projects worldwide, including in Papua New Guinea and Mozambique. The Golden Pass LNG project planned on the Texas coast with Qatar is underway.

The company has no control over the “short-term price environment,” but it does have control over the fundamentals, Woods said.

“There’s no doubt that 2019 was a challenging year for a number of our businesses.” The company coped with “near or at 10-year lows on price and margins” for the gas, downstream and chemicals segments. However, “the product demand underpinned in our investments in each of these sectors remains solid.”

Oil-equivalent production worldwide was nearly flat year/year at 4 million boe/d in 4Q2019. A 4% increase in liquids was offset by a 5% decline in natural gas. Excluding entitlement effects and divestments, liquids production increased 2%, driven by a 54% increase in Permian Basin growth, while gas volumes decreased 4%.

Woods offered an economics lesson about supply and demand to explain his optimism. Depressed margins are driven by “excess capacity, which will be a short-term impact, particularly as industry pulls investments back significantly, which, by the way, we’re beginning to see.”

However, demand is going to continue to grow from population increases, economic growth and higher standard of living, he said. In turn, “excess capacity will shrink, typically faster than people think, and margins will rise. Then, new capacity will be needed.” It’s a “classic price cycle” for capital-intensive industries.

ExxonMobil works to capture the cycle upswing, “a win-win, resulting in higher margins and a lower cost.”

The downside, of course, is the draw on cash, “which we’re seeing and responding to,” by looking for opportunities to optimize and cut costs.

Fourth quarter earnings fell to $5.7 billion ($1.33/share) from $6.0 billion ($1.41), while profits for the year slumped 31% to $14.34 billion ($3.36/share). The earnings results would have been worse if not for a one-time $3.7 billion gain on the sale of assets in Norway.

Slammed by low gas prices, the U.S. upstream arm’s profits took a nosedive in the final period to $68 million from $265 million in 4Q2018, but profits were $31 million higher sequentially. For the year, U.S. upstream profits declined to $536 million from $1.74 billion.

Capital and exploration expenditures in the final quarter totaled $8.5 billion, including key investments in the Permian. Capital spend for 2019 was around 20% higher than in 2018 at $31 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |