E&P | NGI All News Access | NGI The Weekly Gas Market Report

ExxonMobil Boosts Dividend, Posts Profit, While Chevron Swings to Another Loss

ExxonMobil Corp., which posted a higher quarterly profit than expected on Friday, raised its quarterly dividend and is keeping its long-term forecast for rising natural gas and oil demand, the investor relations chief said Friday. Meanwhile, Chevron Corp. reported its second straight quarterly loss.

The world’s largest publicly held producer’s earnings in 1Q2016 fell to their lowest level since 1999, to $1.81 billion (43 cents/share) from $4.94 billion ($1.17). The earnings haven’t been as low since 1999 when the predecessor company merged with Mobil Corp. (see Daily GPI, May 28, 1999). Still, the Irving, TX-based operator beat Wall Street per-share forecasts that averaged around 30 cents. Revenue declined by 28% to $48.71 billion.

And in a noticeable difference from other energy companies, the board in late April voted to raise the quarterly payout to shareholders by nearly 3% to 75 cents/share, which will cost about $3.1 billion total when it is paid in June. Standard & Poor’s Ratings Services reduced ExxonMobil’s 66-year-old “AAA” credit rating by one notch a few days ago, citing low prices, high investment requirements and large dividend payouts (see Daily GPI, April 26).

The credit rating is important, said ExxonMobil investor relations chief Jeff Woodbury, who helmed a conference call to discuss results. However, it’s all about the long term. “We are focused on creating value through the cycle,” using “self-help initiatives, driving down costs, increasing efficiencies and improving reliability…” Regardless of where gas and oil prices are today, ExxonMobil continues to see “demand growth” worldwide. The demand trend line for gas and oil continues up and to the right.

“It’s what we expect…We are seeing in excess of 10-year demand growth, and there is a good indication of a healthy demand increase, which is very consistent with our outlook for energy, with oil growth of about 0.6% a year and gas of about 1.6% a year.” ExxonMobil is forecasting gas to gain market share through 2040 (see Daily GPI, Jan. 25).

From a macro perspective, ExxonMobil “remains constructive” on energy demand, which means the capital allocation approach won’t change.

“We built this business to be durable even in a low-cost environment, whether in the top or the bottom,” Woodbury said. “The return on capital employed continues to be a strong focus for us.”

The company made a “strategic decision years back to…invest in a number of upstream projects” to capture value “that no one else could capture like ExxonMobil.” Prices are a “burden for a period of time…But rest assured, all those investments add accretive value…”

As to when ExxonMobil may begin ramping up development of all of those valuable projects is a question Woodbury could not answer. There’s not a “price trigger,” he said, but an accounting of all the relevant factors “to ensure that we’re maintaining our prudent financial management…We’re spending $23 billion this year, and that represents a lot of investment activity.”

ExxonMobil could not escape the gravitational pull of low commodity prices. Upstream earnings declined $2.9 billion from a year ago to a loss of $76 million, with lower liquids and natural gas realizations reducing profits by $2.6 billion. Sales mix effects decreased earnings by $100 million. The U.S. upstream operations posted a loss of $832 million, versus a year-ago loss of $52 million.

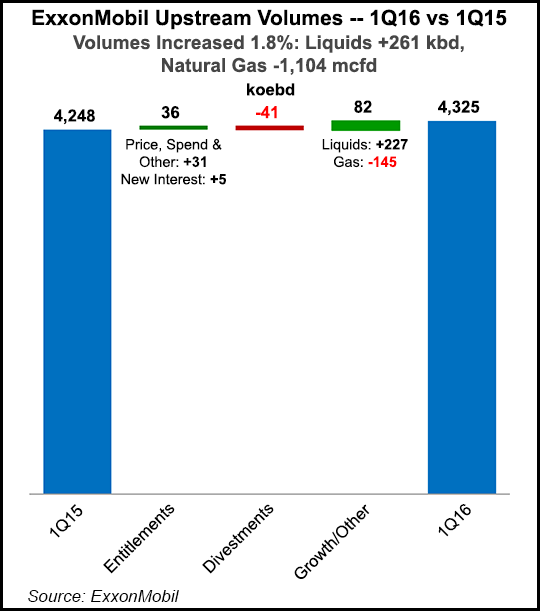

Capital efficiencies were striking, however. Global project capacity additions over the past year drove liquids production up 11.5% to 261,000 b/d, with total upstream volumes at 4.3 million boe/d. At the same time, capital expenditures (capex) fell 33% from a year ago to $5.1 billion. Upstream capex declined to $3.98 billion from $6.42 billion, with U.S. upstream spend falling almost by half to $1.076 billion from $2.12 billion.

Production increased worldwide by 1.8% year/year to 4.325 million boe/d, with liquids rising 11.5%, while gas output declined 9.3% to 10.7 MMcf/d. In the United States, gas production fell slightly to 3.15 MMcf/d from 3.22 MMcf/d.

Sharply lower commodity prices and weaker refining margins were offset in part by a 38% jump in chemical segment profits, increased partly because of lower gas prices.”The business is capturing increased specialty and commodity product demand, along with significant cost benefits from both gas and liquids cracking advantages at our integrated sites,” Woodbury said of the chemicals unit. The global downstream segment also saw a profit as gasoline demand remained relatively strong.

Chevron Workforce Continues to Decline

San Ramon, CA-based Chevron, the No. 2 U.S.-based producer, posted its first quarterly loss for 4Q1015 in 14 years — and it repeated with another loss in the first quarter. Net losses totaled $725 million (minus 39 cents/share), higher than in the fourth quarter when it lost $588 million (minus 31 cents). In 1Q2015, Chevron earned $2.567 billion ($1.38/share). Wall Street had forecast a 1Q2016 loss, only not that high, at an average of 20 cents/share.

Revenue fell to $23.55 billion from a year ago when it was $34.558 and from the fourth quarter when it was $29.247 billion. The debt-to-capital ratio reached 22%, the highest since 2004.

The producer was done in by the commodity price rout and weaker refining margins, and it wasn’t able to right the ship with higher production or cost efficiencies.

Net production fell 15,000 boe/d to 2.67 million boe/d, with the blame put on a shut down at a Middle Eastern venture. The Gorgon liquefied natural gas export facility in Australia, which launched to fanfare in March, reached a production rate of 90,000 boe/d but was shut down within a couple of weeks of startup. Gorgon isn’t expected to restart before sometime in May.

Executive Vice President Joe Geagea, who runs technology, projects and services, discussed the quarterly results with CFO Pat Yarrington. Geagea cited operational efficiencies that he expects will define the company this year.

“The key for us is to exercise things in our control, that drive costs down, that improve efficiencies,” he said. For instance, one bright spot, the legacy Permian Basin operations, “are now in full horizontal mode,” with well costs down by about 40% year/year “and about 4,000 well locations that offer a 10% rate of return at $40 West Texas Intermediate.

“The key for us is to remain competitive,” he said. Since the end of 2014, Chevron has laid off 4,000 people. Another 4,000 are expected to be laid off by the end of this year, he said. The company also is “on target” to cut the contractors “by about 6,500 from 2014 levels.”

The reduction in spending will have “momentum,” Yarrington said.

Over the past four quarter, capital outlay is down by about 19%, with operating expenses declining by 6%, she said. Costs began to “turn south” in 2015. “There are some transitional costs, such as severance, rig termination fees, that are incurred as we work to compete in a lower price environment…Once we transition through the costs, we expect to see continued improvement toward a lower sustainable cost structure…continuing through 2016 and 2017 as the full run-rate is recognized.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |