Permian Basin | NGI All News Access | NGI The Weekly Gas Market Report

ExxonMobil Bolts On More Permian Acreage in Texas

ExxonMobil Corp. has secured more development rights in its most prolific liquids play in the U.S. onshore, the Permian Basin.

Two agreements announced Thursday provide the largest U.S. producer with horizontal development rights in 48,000 acres of the Midland subbasin. Neither the sellers nor financial details were disclosed. One deal is an acquisition and the other is a farm-in, both of which adjoin an existing position in the Texas portion of the Permian in Martin and Midland counties.

XTO Energy Inc., ExxonMobil’s North American exploration and production unit, would operate the acreage.

“We are continuing to grow our position in a prolific area of the Permian Basin,” said XTO President Randy Cleveland. “The recent emergence of strong Lower Spraberry results, combined with the established Wolfcamp intervals, demonstrates the significant potential of the stacked pays in the Midland Basin core.”

ExxonMobil has executed five agreements in the Midland play since January 2014, providing the company with more than 135,000 operated net acres in the subbasin. Two Permian transactions last year were completed with Linn Energy LLC and one was with Endeavor Energy Resources LP (see Shale Daily, Sept. 19, 2014; May 22, 2014; Feb. 3, 2014).

“We are encouraged by the horizontal well productivity and cost reductions we have achieved to date,” Cleveland said. “We expect to drive continued improvements in productivity and cost as we develop our substantial inventory of wells across the multiple stacked pays.”

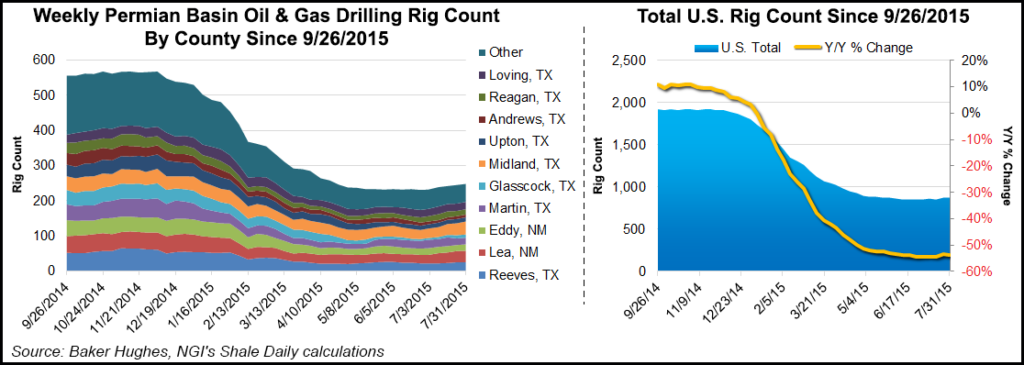

XTO currently is operating 11 horizontal and four vertical rigs across its Permian Basin leasehold of more than 1.5 million net acres, with net oil-equivalent production exceeding 115,000 b/d. Permian production during 2Q2015 was about half of the company’s total U.S. onshore crude oil output (see Daily GPI, July 31). Last October, investor relations chief Jeff Woodbury said ExxonMobil was continuing to look for more Permian bolt-ons (see Shale Daily, Oct. 31, 2014).

During the company’s annual investor day in March, CEO Rex Tillerson had said the company could make money in the Permian, Ardmore and Williston basins at an oil price of $55.00/bbl (see Shale Daily, March 5). He also said at the time the company planned to double output from the three plays through 2017.

“Our U.S. onshore portfolio is resilient. The high quality and scale of our resources in these core plays deliver attractive returns through the cycle, including in the current price environment,” Tillerson told investors. “We have the financial strength to develop these plays through the cycle, which provides the opportunity to capture significant cost savings in this changing market.”

Exploration and production companies working in Martin and Midland counties include Callon Petroleum Co., Devon Energy Corp., Encana Corp., Energen Corp., LRR Energy LP, Parsley Energy Inc., Pioneer Natural Resources Co., Resolute Energy Corp. and RSP Permian Inc.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |