E&P | NGI All News Access | NGI The Weekly Gas Market Report

Except in Permian, Matador Pulling Back, Considering Sales in South Texas, Haynesville

Because of the “changing financial circumstances” brought about by volatile oil prices, Dallas-based independent Matador Resources Co. said Wednesday it will reduce its drilling program in the Eagle Ford Shale and consider selling some assets, including in South Texas and the Haynesville Shale.

Not on the chopping block, however, are assets in the Permian Basin’s Delaware formation, where activity continues to expand. However, a South Texas rig is to be released in mid-February. Matador also may sell select assets and mineral, royalty and midstream stakes to narrow any potential 2019 spending gap.

“During 2019, we plan to continue our focus of executing on the highest rate of return opportunities across our Delaware properties and midstream operations, which served us well in 2018, while still continuing to be mindful of our balance sheet as we have always done,” CEO Joseph Wm. Foran said. “With this in mind, Matador plans to reduce activity and has built considerable flexibility into its operated drilling program, with several rigs on short-term contracts for six months or less, enabling us to further reduce our drilling activity quickly in 2019 should economic circumstances dictate.”

Management is “confident it has more than sufficient liquidity to accomplish its 2019 financial and operating plans but still is very appreciative of the consistent support our bank group has shown — during these challenging times — by increasing our borrowing base during the fourth quarter of 2018 from $725 million to $850 million,” Foran noted.

“Matador has often made some of its most significant strides during uncertain times by protecting its balance sheet and continuing to seek operational progress at a measured, profitable pace, and we anticipate that 2019 will be no different.”

The company is implementing practices to improve capital efficiency in its operations, including potential reductions in service costs, additional multi-well pad drilling, increasing the number of longer laterals by more than one mile and increased use of in-basin sand in its fracturing operations.

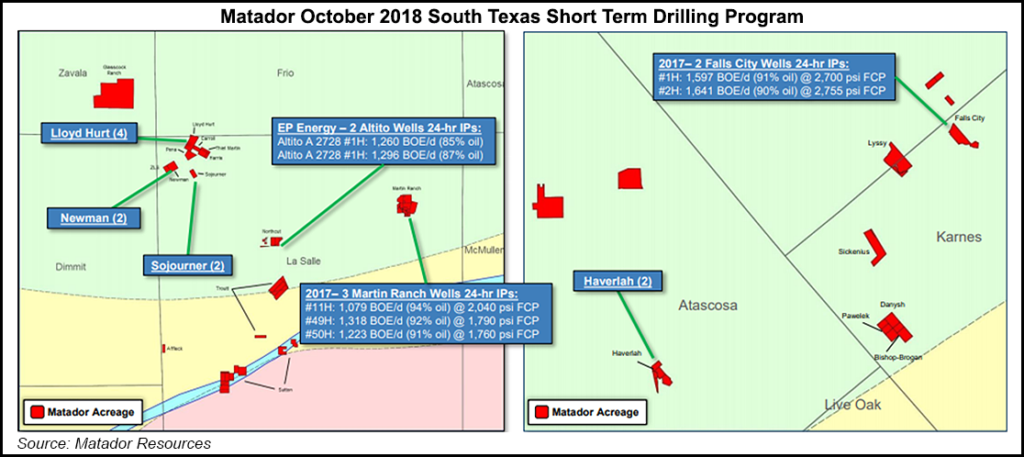

When oil and gas prices were higher last October, Matador began a short-term drilling program in South Texas to drill up to 10 wells, primarily in the Eagle Ford, and to conduct at least one test of the Austin Chalk formation.

The South Texas program was a follow-on to a 2017 five-well Eagle Ford program, which included three of the top six oil producing wells Matador has drilled to date in the play. As of Wednesday (Jan. 30), Matador had completed drilling operations on seven of the newly drilled wells, including six Eagle Ford wells and one Austin Chalk well. Two additional Eagle Ford wells are planned before the South Texas program is concluded in mid-February.

As part of the operational update, Matador said it operated six drilling rigs in the Delaware during 4Q2018, with one rig drilling a sixth saltwater disposal well in the Rustler Breaks area in Eddy County, NM, on behalf of midstream joint venture affiliate San Mateo Midstream LLC. Drilling continued into January.

“Assuming no significant change to oil and natural gas prices from current levels, Matador expects to keep these six drilling rigs in the Delaware Basin for the remainder of 2019,” management said.

The formal 2019 operating plans and guidance are to be issued when Matador issues its quarterly and 2018 results in late February.

As of Jan. 1, Matador said it had slightly more than 5.0 million bbl of its anticipated 2019 oil production hedged at a weighted average floor price of about $55/bbl and a weighted average ceiling price of $75. It also had 7.2 Bcf of anticipated natural gas production hedged at a weighted average floor price of $2.50/MMBtu and a weighted average ceiling price of $3.30.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |