LNG | LNG Insight | Natural Gas Prices | NGI All News Access

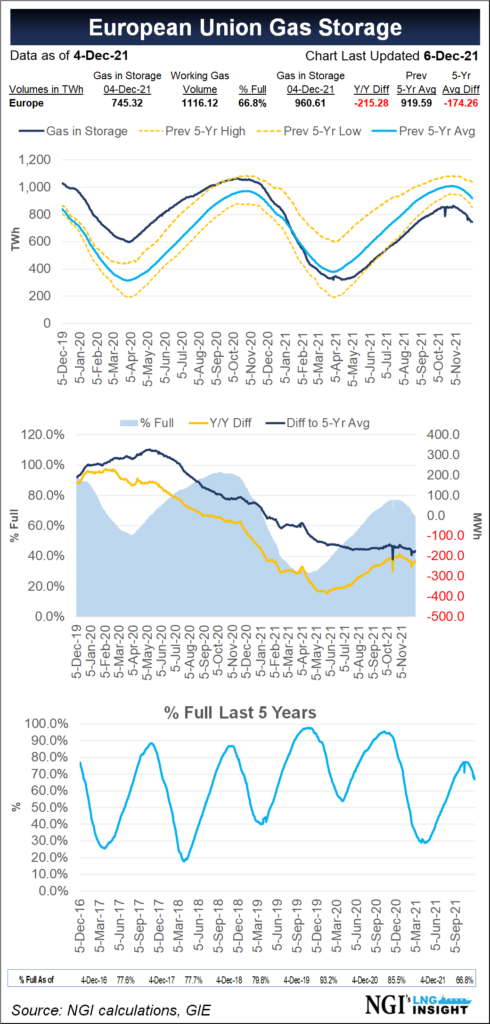

European Natural Gas Inventories Decline as First Cold Snap of Winter Arrives — LNG Recap

Markets

West Texas Clawing Back as Volatile Week Ends with Natural Gas Prices Still Lower; Futures Slip

Struggles defined the weekly natural gas cash market as prices bounced between gains and losses amid seasonal factors including fickle weather and maintenance activity. NGI’s Weekly Spot Gas National Avg. for the April 15-19 period ultimately lost 7.5 cents to $1.135/MMBtu. Meanwhile, the May Nymex futures contract jumped early in the week after reports of…

April 19, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.